Purchasing Power Parity PPP is a theory which suggests that exchange rates are in equilibrium when they have the same purchasing power in different countries.

Purchasing power parity will involve looking at a basket of goods to determine effective living costs. The purchasing power parity is determined by dividing a basket of goods in one country, by the cost of basket of goods in another.

A simple example of purchasing power parity

Suppose a Big Mac costs £2 in the UK and $4 in the US. The correct exchange rate according to purchasing power parity would by £1 equals $2. This would leave a customer indifferent to buying the good in the UK and buying it in the US.

Purchasing power and differences in prices

- Suppose the Pound/Dollar exchange rate is £1 to $2.

- If an Apple Mac costs £1,000 in the UK and $1000 in the US.

- If a UK citizen was able to travel to US, he would only need £500 to convert into a $1,000. This suggests that it is much cheaper to buy the Mac in America. In this case, the current exchange rate is not reflecting the true living costs.

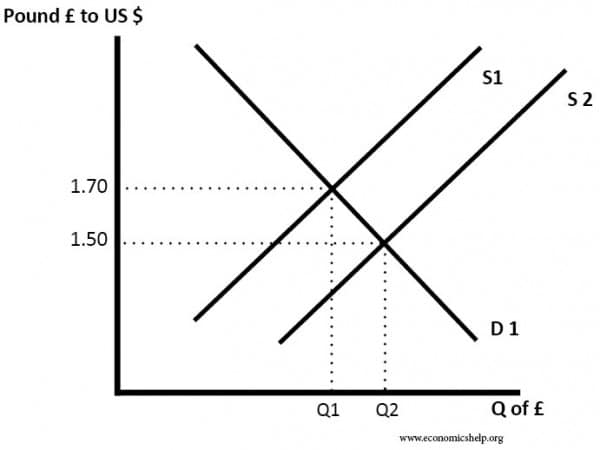

- Therefore, UK citizens will want to import the good from America, this will involve selling pounds and buying dollars causing the Pound to depreciate.

Why can exchange rates differ from purchasing power parity?

Exchange rates often diverge from purchasing power parity for long periods of time. This reflects other factors such as the risk and stability of investing in a certain country.

- If a country is seen as a safe haven, then investors will seek to save money in those assets. For example, investors are often keen to save in Swiss banks – causing the Swiss Franc to appreciate in value and make Swiss goods appear expensive. Conversely, if a country is seen as risky due to high inflation or debt default, this will cause the exchange rate to be undervalued as investors are reluctant to hold that currency.

- If interest rates are much higher in the US than the UK, then this will cause hot money flows into the US as investors want to save in countries with higher interest rates.

- Tax rates. Some visible prices may differ because of different tax rates. In Europe, VAT is often 20%, in the US, some state sales taxes are much lower.

- Transport costs. Electronic goods in the US will tend to be cheaper because average transport costs are quite low. US retail firms benefit from economies of scale and being close to major ports. However, if you sold the same good, in say Bhutan, the good would have much higher transport costs, and so exchange rates will differ from the purchasing power parity.

- Tariffs. Some countries may impose higher import tariffs (or non-tariff barriers) on goods, raising price beyond exchange rates

- Living costs. Looking at the Big Mac index some of the cheapest places to buy a Big Mac are in the developing world or places with cheap rent. Big Macs are cheap, by international standards, but they are likely to be a big percentage of workers income because wages are low. Low wages enable firms to produce Big Macs at lower costs.

According to purchasing power parity which countries are overvalued?

The Euro and Yen look overvalued on purchasing power.

The Pound was overvalued in the dollar when it was at $2 to £1. This over-valuation was one reason why the Pound has consistently devalued in the past 15 years.

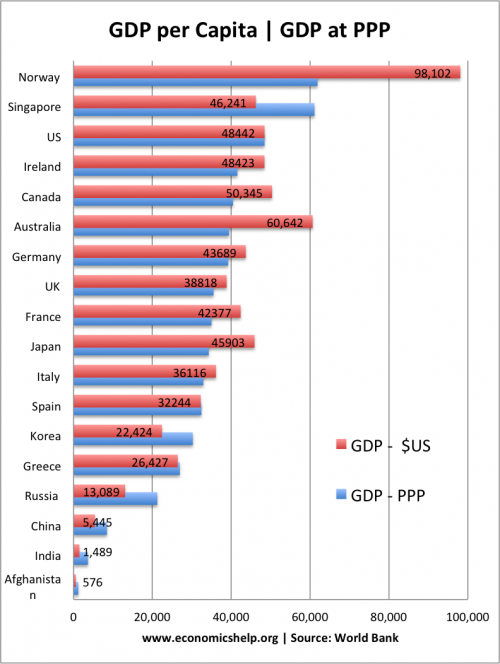

GDP per capita and GDP at PPP

Comparing GDP per capita at $US to PPP

Norway’s GDP per capita is $98,000, but when adjusted for PPP it falls to $62,000. This reflects the fact that wages are very high, but then living costs are also high. PPP gives a better indication of what you can actually buy in different countries.

India’s GDP per capita is $1,489, but because living costs are very low. The PPP is considerably higher.

Big Mac Index

A simple way to understand Purchasing power parity is to use one good. One of the most widely available goods is the McDonalds Big Mac. The Big Mac index looks at the US dollar price of a Big Mac (which in theory uses similar ingredients).

The US dollar price of a Big Mac varies, indicating that nominal exchange rates do not reflect the purchasing power parity of a currency. For example, in India a Big Mac is $1.62, but in Norway it is $6.79.

Source: CC BY-SA 3.0

Source: CC BY-SA 3.0

Related

I dont think that PPP is always an accurate measure of relative currency strength. It often doesnt take into account things like wages or inputs, which can affect overall currencies. Here is an interesting article on why PPP isn’t always accurate: http://www.mindreign.com/en/mindshare/Global-Economics/PPP-perfect-3f/sl35291137bp327cpp10pn1.html