It is not a good time to be a saver in the UK. Interest rates are 0.5% and inflation has been above 2% for a high proportion of the previous five years. Because inflation is higher than nominal interest rates, we are seeing negative real interest rates. This means many savers are seeing a decline in the real value of their savings. Pensioners who are relying on interest payments as income, are seeing a decline in their income.

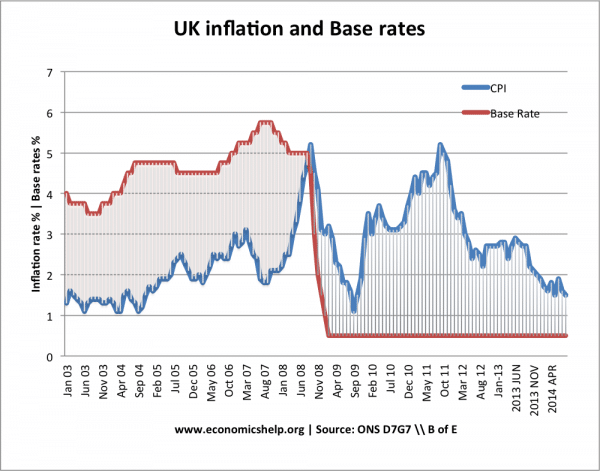

Inflation and interest rates

In most of the post-war period we have seen positive real interest rates – Base rates above the headline inflation. This means that savers are protected from the effects of inflation.

H0wever, 2008 marks a sharp contrast, with Bank of England base rates falling to 0.5% and inflation reaching above 5%.

In recent months, inflation has fallen to below 2%, but that is still higher than base rates of 0.5%

Effectively, you are getting 0.5% return on your saving, but prices are going up 2%, so the real value of your savings is falling by 1.5%.

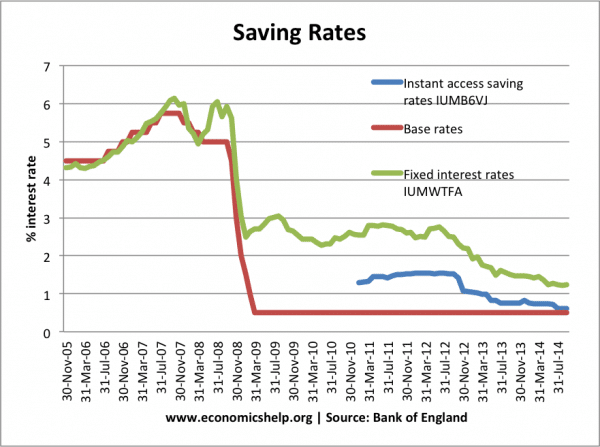

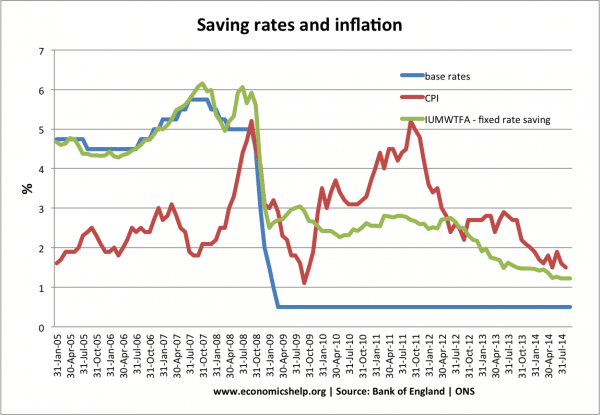

Base rates and bank rates

The contrast between base rates and inflation looks very high. But, actually bank savings rates have not fallen as much as base rates. This is because banks were short of money in the credit crunch and were keener to attract deposits than lend money. Therefore, when the Bank of England cut interest rates to 0.5%, commercial banks were not so keen to reduce their own interest rates by as much. Usually commercial bank rates closely follow base rates, but after 2008 we see a break in this correlation.

Source: Bank of England. Series IUMB6VJ | IUMWTFA

In 2008/09, base rates are cut from 5% to 0.5%, but fixed interest rates (series IUMWTFA) only fall to 2.5 / 3%. Interestingly since mid 2012, fixed interest rates have continued to fall closer to 1%. This suggests the banks are less desperate to attract saving deposits and so can reduce interest rates.

It is a similar story with instant access saving rates (series IUMB6VJ) Since mid 2012, rates have fallen from 1.6% to 0.6%. This suggest the financial sector is in better health, but it means a poorer return for savers.

However, if you look around, you can still see higher fixed rates for those willing to ‘lock their money away’

It also depends how much money you can save. For example, according to ‘Money Saving Expert‘ you could get 3.25% if you can put £25,000 away for 5 years. – hardly a great deal, but you would just about get a positive real interest rate.

Should the Bank of England do more for savers?

In the past few years, many groups representing savers have felt they have been ignored – and the government / Bank of England should have done more to give a better rate of return for savers.

However, the past five years have seen declining living standards for most groups of people – real wages have fallen. Unemployment has been very high. The cost of renting has been very high. Given the general economic decline, savers have not been alone in seeing falling living standards. It is complicated by the fact that people with high levels of saving are more likely to be household owners. Homeowners have seen record low mortgage interest payments and rising house prices, which, to some extent, have offset the fall in the return on savings.

Young people without savings, but paying rent, have seen a bigger squeeze on their living standards.

However, someone who is relying on their savings to pay rent, is definitely in a bind.

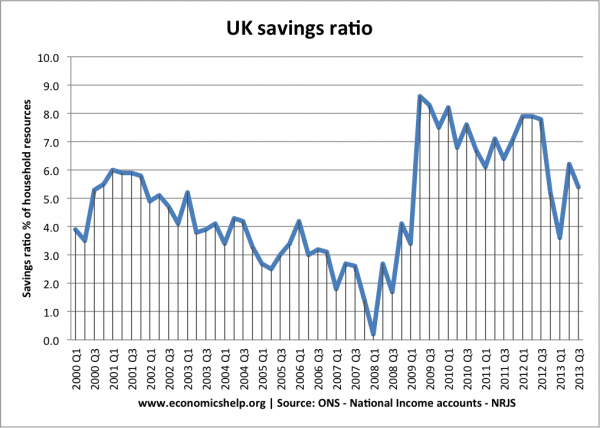

Paradox of saving rates and interest rates

A paradox of saving in the UK, is that when interest rates were cut from 5% to 0.5%, we saw a rapid rise in the savings ratio.

I.e. even though interest rates fell, more people wanted to save because of the recession. More on the paradox of saving

Target of the Bank of England

The primary objective of the Bank of England is to attain low inflation and economic prosperity. Given the depth of the recent recession, the Bank of England have primarily been concerned with promoting economic growth. The side effect of promoting economic growth through low interest rates has been to cause a boom in house prices and reduce the return for savers. However, it would not make sense to do anything else. The Bank of England has to consider the whole economy and not just a particular section like savers or the housing market.

In the long-term it is important for everyone that the economy escape from recession and return to normal economic growth. This will enable a return to normal interest rates and rising tax revenues. If we had set high interest rates to protect the value of savers, this would have prolonged the recession and placed even more strain on government finances. This would not have helped anyone – including savers.

Sometimes, economic policy makers are faced with unwelcome choices. In a period of stagflation – cost push inflation and negative growth – there are a strong set of bad trade-offs. It’s impossible to make everyone better off. Sometimes it is a case of limiting the worst economic problems.

If the economic recovery becomes sustained and more balanced, then we can see a return to normal interest rates and savers will start to see better returns. But, to reach escape velocity – we may need a long period of loose monetary policy. A premature rise in interest rates could be counter-productive for everyone, including savers

Related

Economics around the world are in a constant battle to maintain the country’s well being while on the other hand imposing polices that restrict citizens from spending beyond the tagged bounds .whether we spent or save this will always has an advise affect on the economy,the government cannot control some illegal trade and therefore its enough only strength so far.the presence of inflation will always be a shadow that follows spending and some argue it is very important as it shows sighs of grown In an economy