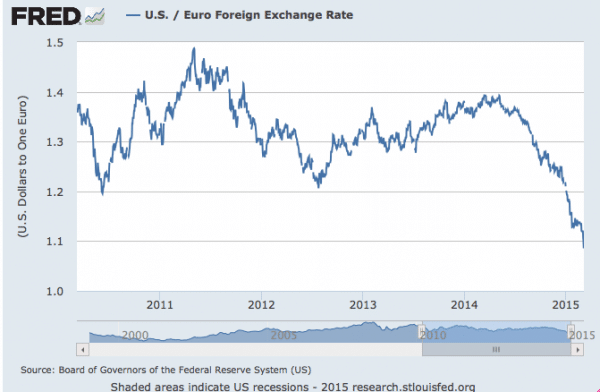

Recently, the Euro has fallen from 1.5 Dollars to 1 Euro in 2011 to near parity in March 2015.

The fall in the value of the Euro has been very steep in the last six months.

This is a very significant depreciation in the Euro, and primarily reflects the greater economic weakness in the Eurozone. Related to the economic weakness, is the decision of the Eurozone to recently begin expansionary monetary policy (quantitative easing).

Why the Euro is falling

1. The ECB are embarking on Quantitative easing – the creation of money to purchase government bonds. Quantatitive easing tends to reduce the value of a currency because:

- This increase in the money supply tends to reduce the value of the currency (greater supply tends to reduce price.)

- Q.E raises expectations of higher inflation – higher inflation tends to reduce the value of a currency because it will become less attractive to buy EU goods.

- Also purchasing government bonds will reduce bond yields in Europe, making it less attractive for private investors to save money in the Eurozone – you get a lower return on Eurozone assets. Investors would rather save in US assets, where interest rates are more likely to rise and you will get a better rate of return.

2. General weakness of the Eurozone economy. Some analysts believe that EU’s quantitative easing maybe a case of too little too late; they believe Q.E. in Europe may actually have a quite limited effect. This is due to two factors:

- In Europe (compared to US) Firms rely on banks more than bond market, and do not benefit as much from falling government and corporate bonds – an aim of Q.E.

- Low inflation expectations are very strong in the Eurozone, and it may be difficult for the ECB to really increase inflation and nominal economic growth.

- There is still strong opposition to Q.E. from Germany so the size of Q.E. in the EU maybe insufficient.

This long term weakness of the Eurozone is having a big impact on the value of the Euro. People don’t want to hold Euros if we expect several years of low growth, low interest rates and rising debt to GDP ratios. The long-term weakness of the Eurozone is making investors less likely to save in Euros. The fall in the Euro is greater than the fall in Pound or dollar, when the UK and US embarked on Q.E. which suggests there are more underlying effects, than just Q.E.

Interest rates. An important factor in the determination of the exchange rates are real interest rates. If interest rates are relatively lower in the Eurozone than elsewhere, there will be less demand for saving in the Eurozone and the Euro will fall. Because the economic recovery is much stronger in the US and elsewhere, analysts expect interest rates to increase in the US quite soon. By comparison, interest rates in Europe are expected to remain at zero for a considerable time. (Real interest rates on German 10 year bonds are negative -0.9%)

Other factors that might influence exchange rates (theory)

Low inflation. EU has lower inflation than elsewhere with a current rate of -0.2% – this should in theory make EU goods relatively more competitive and increase the value of the Euro, but it is currently outweighed by the other factors.

Impact of falling Euro

A falling Euro will help EU goods become relatively cheaper, providing a boost to EU tourism, manufacturing and exports. We should expect a bigger European current account surplus, which provides an injection into the Eurozone economy This should help the EU recovery – this is particularly important given the current limited domestic demand and deflationary pressures in the Eurozone.

A stronger dollar will mute the US recovery. The strength of the dollar will make US exports more expensive and reduce demand.

In a way the floating exchange rate is helping to equalising demand between US and Europe. One of the main reasons the Euro is falling against the dollar is the greater economic weakness of Europe compared to the US. But, the fall in the Euro, will lead to this gap being reduced.

Inflation in Europe? The falling Euro may help to solve deflation /very low inflation in Europe. Firstly the cost of imports will rise, creating some cost-push inflation. But, also the rising demand for exports, may contribute to a small amount of demand-push inflation. Given the current state of Eurozone economy, the impact on inflation is likely to be very limited. But, it if helps avoid outright deflation, this may be beneficial.

Related

It says:

Interest rates. An important factor in the determination of the exchange rates are real interest rates.

It should say:

Interest rates. An important factor in the determination of the nominal exchange rates are nominal interest rates adjusted by risks (both sovereign and exchange rate risk). A risk neutral american investor cares about the (risk-adjusted) nominal interest rates in japan, not the real interest rates because he/she does not consume in japan.