There are various economic costs associated with inflation – uncertainty, decline in investment, redistribution from savers to borrowers – but although there are costs with inflation, is zero inflation actually desirable?

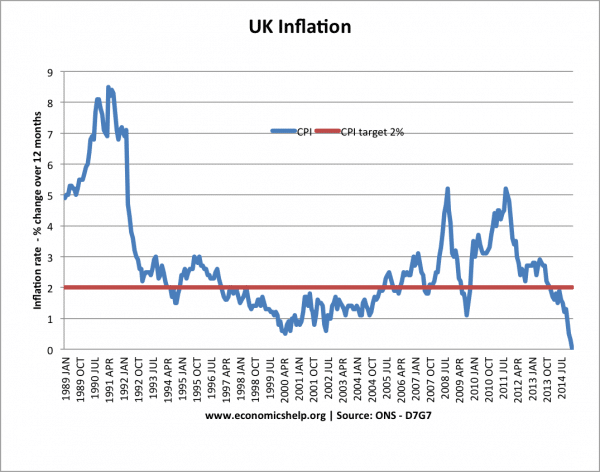

Governments usually set an inflation target of around 2%. (UK CPI target is 2% +/-1) There are reasons for targetting inflation of 2% – rather than inflation of 0%. The fear is that to achieve inflation of 0% may require lower economic growth and cause problems associated with deflation (falling prices)

Potential problems of deflation/low inflation

- Rising real value of debt. With low inflation, it becomes harder than expected for people to pay back their debts – they have to spend a higher % of income on debt repayments leaving less income for other spending.

- Rising real interest rates. The fall in inflation increases real interest rates, whether we like it or not. Rising real interest rates make it less attractive to borrow and invest; it encourages consumers to save. If the economy is depressed, this rise in real interest rates can make monetary policy less effective in encouraging growth.

- Delay purchasing. Falling prices can encourage people to delay buying expensive luxury goods – they feel they need to wait a year because prices will be lower.

- Low inflation is an indication of low growth. A normal period of economic growth would typically give a moderate rate of inflation (2%). If inflation has fallen to 0%, it suggests that there is intense price pressure to encourage spending and the recovery is very fragile.

- Harder for prices and wages to adjust. When inflation is 2%, it is easier for relative prices and wages to adjust because firms can freeze wages and prices – and effectively it is a cut in real terms of 2%. However, if inflation is zero, then a firm would have to cut nominal wages by 2% – cutting nominal wages is much harder psychologically – people resist cuts in wages more than they accept a nominal freeze. If firms are unable to adjust wages – it can lead to real wage unemployment.

- More details here ‘About the problems of deflation‘.

Evaluation

We have to look at the reason why inflation is zero.

Reasons for zero inflation. In 2015, the fall in UK inflation was due to temporary short-term factors, such as falling oil and petrol prices. These temporary factors are unlikely to continue and were reversed. It is more important to look at underlying inflationary pressures – core inflation, which excludes volatile prices of food and oil. For example, other measures of inflation like – RPI was 1% (even though RPI is not the same as core inflation.) In that case, the fall in inflation has occurred during a partial economic recovery. Inflation has fallen, but the economy is not slipping into recession. In fact the opposite.

In 2012-15 several southern Eurozone economies had inflation close to zero, but this was a result of depressed demand, austerity and attempts to restore competitiveness – this caused lower rates of economic growth and higher unemployment.

Depends on the type of deflation. Falling prices could boost real incomes. One of the fears of deflation is that it depresses consumer spending. However, with a fall in the price of basic necessities like petrol and food, consumers find their discretionary income/spending power has increased, this could actually lead to higher spending in the short-term.

Real wages. A feature of the past few years has been falling real wages – inflation higher than nominal wage growth. With nominal wage growth still low, the fall in inflation will make people relatively better off and could encourage spending. Ending the fall in real wages is important for economic growth.

Long-term expectations. Some economists feel the drop in UK inflation is primarily due to temporary factors, but others fear that the ultra-low inflation could feed into permanently low inflation expectations, which results in zero wage growth and persistent deflationary pressures. This is the big concern over 0% inflation.

Do we know how to tackle deflation? There is an assumption that we can overcome any deflation/disinflation. But, experience from Japan suggests deflation can be surprisingly difficult to shift once established. Reducing inflation above target is relatively easy – solving deflation is more of an unknown quantity.

Government finances. The fall in inflation is good for the government in the short-term. Benefits which are index-linked will be rising than less than expected, making the UK government benefit bill less. This could save the government a lot of spending, improving deficit and leaving money for pre-election tax cuts.

On the other hand, very low inflation could also lead to lower government tax revenues. e.g. VAT (%) of goods will not rise by as much as expected. Low-wage growth will also limit income tax receipts.

Conclusion

Zero inflation is often welcomed by average consumers. They will benefit from cheaper prices and the feeling of more disposable income. This ‘feel good’ factor may encourage stronger confidence – investment, spending and growth. In the current climate, low inflation could be a blessing in disguise.

However, there is also a real danger that if we get stuck in a period of ultra-low inflation/deflation, then all the problems of deflation will become more prominent and start to hold back normal economic growth.

Related

why is zero inflation not set as target?

https://www.economicshelp.org/blog/13272/inflation/is-zero-inflation-a-good-thing/

I really like to visit here amazing post thanks a lot.

This sounds very good for everyone

Still not seeing why 0 inflation is a bad thing. 2% robbery is still 2% robbery. The stability of knowing the dollar will buy today what it will buy tomorrow is called “STABILITY” and does not take a pHD to figure out tomorrows retirement dollars. Peg the dollar to gold and keep inflation at 0%. Limit trade with other countries. Ahhh… sweet isolation.

Yep… I’ll trade incremental growth for stability any day.

“Zero inflation is often welcomed by average consumers. They will benefit from cheaper prices and the feeling of more disposable income. This ‘feel good’ factor may encourage stronger confidence – investment, spending and growth. In the current climate, low inflation could be a blessing in disguise.” My guess is that is why it’s not going to happen.