Readers Question: I only recently discovered your site, which is spectacular, and have been reading every article since then. However, I found that two of your articles are contradicting. In your article “Problems of Deflation” you state that the current monetary policy of the EU is tight due to 0.5% inflation and interest rates.

In your article about tight monetary policy though, you state that tight monetary policy could include open market operations and rising interest rates.

It is a good question. Firstly tightening of monetary policy implies that the Central Bank is trying to reduce demand for money – and reduce the rate of economic growth. Tight monetary policy implies high real interest rates. Tightening of monetary policy usually involves higher real interest rates.

The most simple example of tight monetary policy would involve increasing interest rates.

- Higher interest rates increase the cost of borrowing, increase the cost of mortgage payments and reduce disposable income – this leads to lower consumer spending and lower economic growth

- Alternatively in theory, the Central Bank could try and reduce the money supply. For example, printing less money, or sell long dated government bonds to banking sector. This is very roughly the opposite of quantitative easing. Though open market operations haven’t been used in practise for quite a while.

How can you have tight monetary policy with low interest rates?

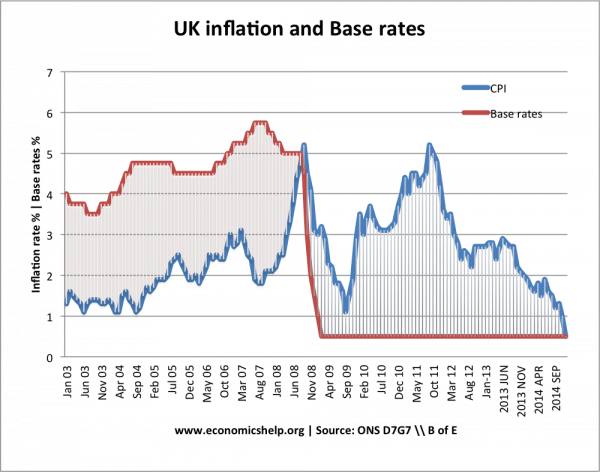

A potential confusion is why do economists talk about tight monetary policy when interest rates are 0.5% or zero – like in the current climate?

If you have a quick glance of an economics textbook, zero interest rates imply loose monetary policy – low interest rates make borrowing cheap, mortgages cheap, and in theory should encourage spending and a higher rate of economic growth.

- If we had a normal period of economic growth, and a typical inflation rate of 2%, then ultra-low interest rates should be expansionary – they would help to increase demand.

- If interest rates are 0 and inflation is 2%. Then real interest rates are -2. This means if you save money, the real value of money will fall – therefore there is an incentive to spend rather than save. If you borrow money, it becomes easier to pay your debts back, because interest rates are low and inflation reduces the value of your debt. This should encourage borrowing and spending.

- But, suppose, we have a fall in the inflation rate from 2% to 0%. Then real interest rates fall. Real interest rates were -2%. But, after the fall in inflation, real interest rates are now 0%. In effect, the fall in inflation has caused a tightening of monetary policy.

- With inflation falling, it now becomes more attractive to save money. It becomes less attractive to borrow and spend. This fall in inflation is effectively increasing real interest rates.

- If the inflation rate fell further to -3%, then real interest rates would increase. It would be 0 – (-3). Real interest rates would rise to 3%. With an inflation rate of -3% (deflation), then consumers would likely reduce spending further. Saving increases the real value of money. Negative inflation rate would make borrowing more expensive.

Tight monetary policy and negative real interest rates

A further complication is that monetary policy can be seen as ‘relatively’ tight – even with negative real interest rates. For a time EU interest rates are 0.5%, and inflation say 1.5%. This is a negative real interest rate of -1% – which in normal circumstances you would expect to be expansionary. But, the past few years haven’t been normal.

- Fiscal policy has been tight (deflationary)

- Wages have been falling or stagnant

- Confidence has been very low

- Bank rates haven’t fallen as much as base interest rates set by Central Bank.

Therefore, despite theoretical negative real interest rates, the economic climate has discouraged spending. In a liquidity trap – cutting interest rates are ineffective in boosting demand and some economists you need unconventional monetary policy like quantitative easing.

What can cause a tightening of monetary policy?

- Higher interest rates.

- Fall in inflation rate, with interest rates staying the same.

- Fall in the money supply.

Related