A reader on twitter asked – How has government borrowing helped me recently?

I’m tempted to paraphrase as – What has borrowing ever done for me? – just so that I can make a reference to Monty Python and the Life of Brian? – And what have the Romans ever done for us? – apart from education, sewers, wine, roads, peace, law and order … (youtube)

I’ve answered this question several times before:

But, I frequently get asked it, so here’s a few more ideas.

Why do we need to be in debt at all?

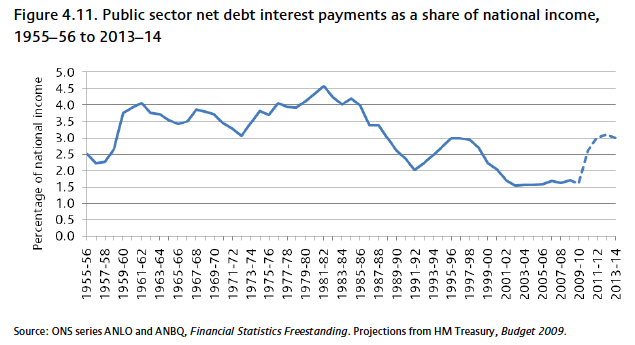

Surely all the money in interest (some £50bn pa?) would be better spent on ourselves as a country?

It is true that the government spends around £50bn a year on interest payments. (and forecast to rise) But, those interest payments enable higher government spending now.

We could reduce the amount of interest payments by raising taxes / cutting spending. But, it wouldn’t make us better off. It would just change how we finance current spending.

Also, who do those interest payments go to – primarily UK individuals/UK pension funds. You can think of it as a transfer payment to people within a country.

You could argue that it is a transfer payment from the average taxpayer to people with pension funds / city financiers – who are likely to be better off. But, more people with private pensions may benefit from government interest payments than they realise.

Interest rates are also very low, which means interest payments on government debt are quite a small percentage of GDP. (3%)

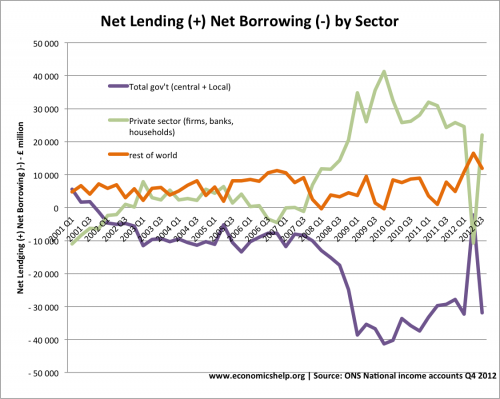

Use of private sector saving

In the great recession, there was a rapid rise in private sector saving. This was money not used, but just saved and unproductive.

If the government borrowed nothing, these resources would remain idle, aggregate demand would be lower and the recession deeper. Through government borrowing, we made use of this surplus savings and helped to stabilise the economy. (recession not as deep)

Borrow in recession

A firm will often have to borrow in a recession, because of a temporary fall in revenue leads to temporary loss of profitability. It is the same for the government. In a recession, tax revenues fall and benefit spending rises – and these automatic fiscal stabilisers help to prevent the economy sliding deeper into recession.

Alternative of no government borrowing

Suppose we had a fiscal rule that the government is not allowed to borrow? What would have happened in the great recession?

As the recession hit, the government would have to slash spending and raise taxes. But, in a recession, cutting spending and raising taxes would make the recession worse. It would cause a rise in unemployment and further reduce tax revenues.

Greece has been trying for several years to reduce debt by increasing taxes and cutting spending. But, the negative effect on the economy is so deep, that the austerity is proving to be self-defeating.

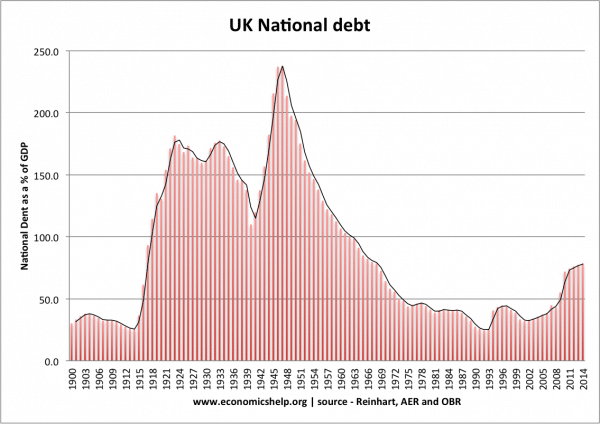

Future generations

I often hear that government borrowing is unfair on future generations. But, are we disadvantaged because past governments in the 1950s and 60s, borrowed money? No. It might have been much worse, if they had insisted on reducing debt and not investing in building roads and education.

Debt interest payments as a % of GDP are fairly stable at 2-3% of GDP.

Is borrowing really bad?

Another way of thinking about it is does a firm ever borrow? Does a household ever borrow?

If a homeowner wanted to stop paying mortgage payments on debt, they could sell house and rent instead, but it doesn’t make them better off.

A firm often borrrows to invest for the future. The aim of most firms is not to have no interest payment, but to increase capacity for future expansion.

It is the same with the government. The UK has failings in transport, education and health care. Higher government spending could lead to improved infrastructure, which helps economic growth in the long-run. If we borrow to finance this investment, then we are getting a better rate of return than the cost of interest payments – which are currently low.

You could argue that a government is different to a firm. A government spending is liable to government failure – a higher risk of inefficiency and wasted spending. But, a government can also help to tackle inequality and deal with market failure.

Does that not mean that running a surplus would eventually get us out of the red and into the black? I understand that this is a naive way of looking at the economy, but surely long term this would be achievable. Why

Running a surplus would eventually reduce national debt. But, would it be advisable for the government to run up savings and hold on to money that could be better used in the economy?

Also, even if you run a persistent budget deficit, you can still reduce the ratio of debt to GDP. In 1950, debt to GDP was close to 200% of GDP. This fell to 40% of GDP by 2007 – yet we nearly always had budget deficits in this period (1945-02007). The reason is that if growth is higher than government borrowing, the proportion of debt falls. This is what happened?

What did borrowing ever do for us?

- It enabled the post-war economic expansion of 1950s and 1960s.

- It enables investment in countries infrastructure

- It can prevent a great depression style collapse in the economy.

Related