Readers Question: What is the difference between a recession and deflation?

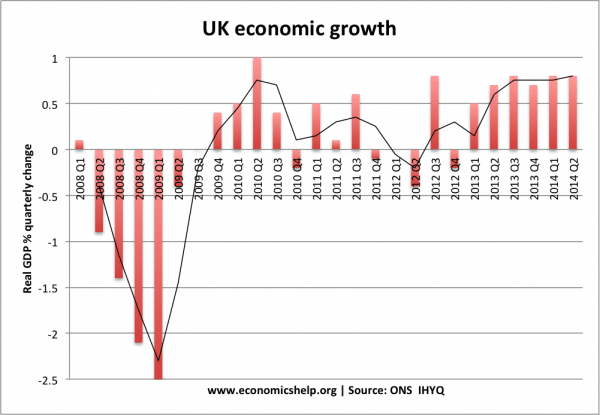

A recession is a period of negative economic growth. The official definition is a decline in output (Real GDP) for two consecutive quarters.

Usually, in a recession, you will get a fall in the inflation rate.

From 2010, there is a fall in the rate of inflation. Prices are still rising – but they are rising at a slower rate.

Deflation

Deflation is when we get a negative inflation rate i.e. falling prices.

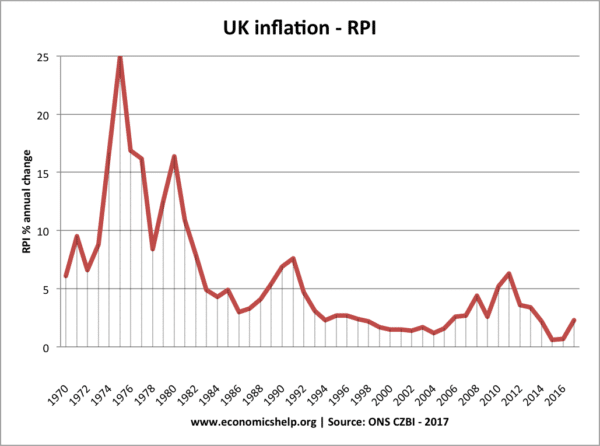

Since the second world war, recessions have generally not led to deflation – just a lower inflation rate. The two recessions of 1980 and 1991 were caused by attempts to reduce a high inflation rate.

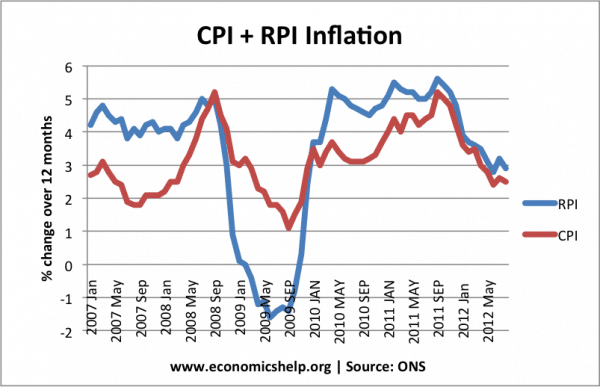

In 2009, there was a brief period of deflation (using RPI method)

For a short-time in May 2008, the RPI (which includes the cost of interest payments) became negative – deflation. But, this deflation did not last very long.

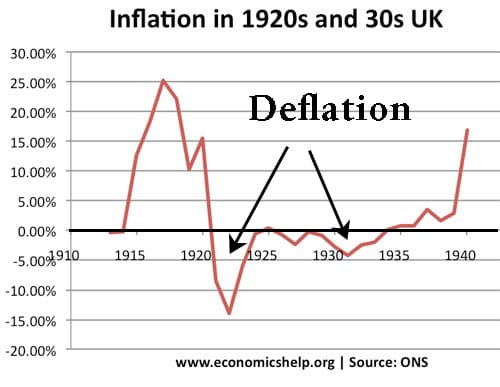

In the 1920s and 30s the UK experienced a considerable period of deflation (falling prices) This was due to

- Low economic growth

- Tight monetary policy – high real interest rates

- Overvalued Pound – Gold Standard caused imports to be cheaper but exports less competitive

Difference between Recession and Depression

Interestingly many see deflation as a sign that the economy is experiencing depression rather than just recession. (Other features of depression include a much bigger and longer fall in GDP)

- Definition of depression

- Definition of recession

- Deflation definition

I have a slight quibble with the above definition of deflation. Any definition should include the point that the word “deflationary” does not necessarily apply to a scenario where prices are falling. “Deflationary” is often used to refer to a policy or event which dampens or reduces economic activity (but not necessarily to the extent to causing prices to fall).

What’s your basis for stating that ‘The last two recessions were caused by attempts to reduce a high inflation rate’ ? I’ve not seen any suggestion that this was the case in 2008.

I should specify I meant 1980 and 1991 (not 2008 – as you say there was no major effort to reduce inflation (though we did get 5% cost-push inflation because of oil price)