Readers Question: Why do the Government often fail to achieve its main objectives of high economic growth, price stability, and a surplus on the balance of payments.

Other objectives worth adding are low unemployment, low government borrowing and maybe stable exchange rate.

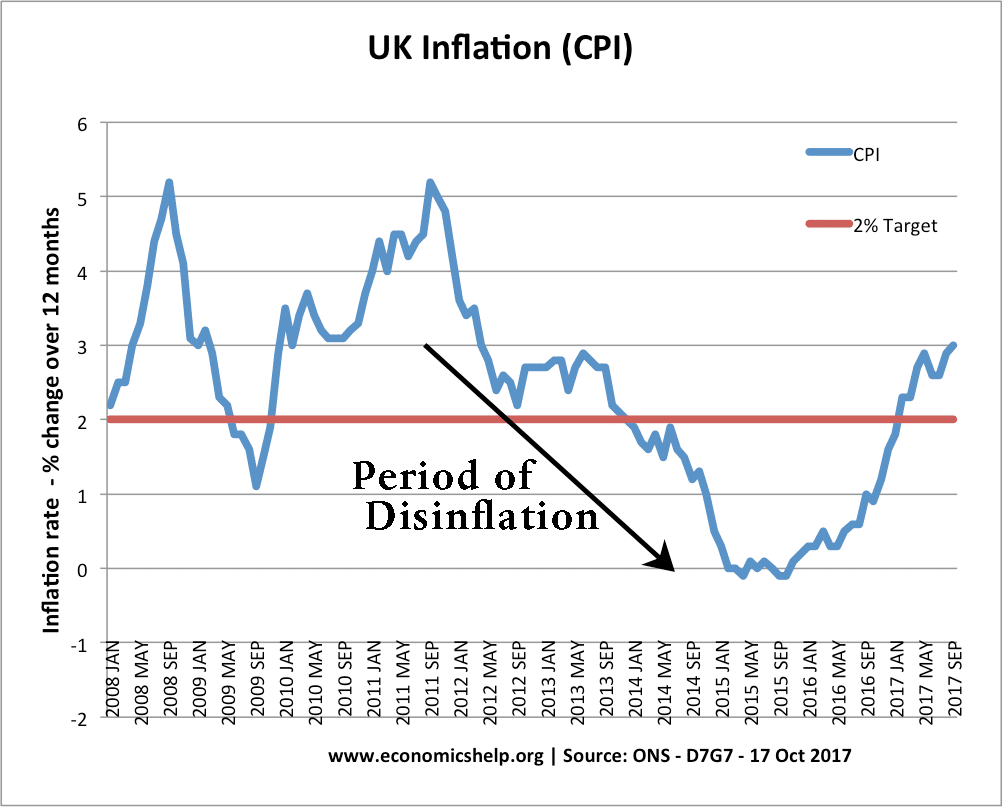

Looking at the current climate of the UK economy, the government is only meeting one target – low inflation. CPI is close to target of 2%. (Although there is a fear CPI inflation could fall below 1% and could soon lead to deflation. That would mean the government is meeting none of its main targets.

Why Do Governments Fail to Meet Objectives

Trade off between Economic Growth and Inflation / Balance of Payments

In normal times a period of high economic growth, especially when growth is above the long run trend rate, often causes inflation. A good example of this is the Lawson Boom in the 1980s. Also as growth increases, consumers buy more imports and this leads to a deterioration in the current account. The UK had many periods of boom and bust like this in the post war period. Arguably it is difficult for the government to manage Aggregate Demand so that growth remains stable and non-inflationary.

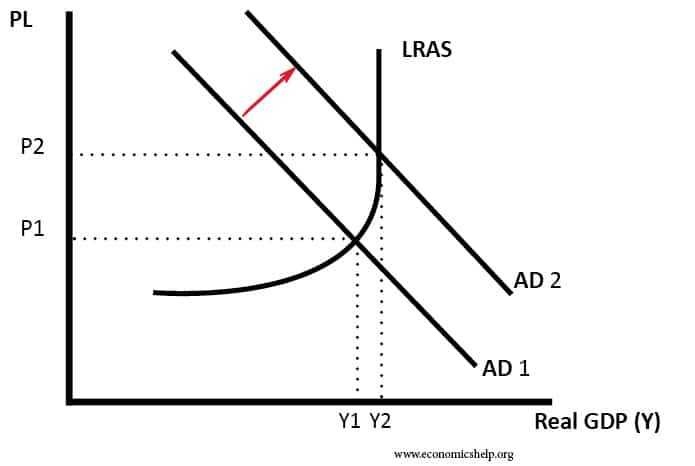

Simple Trade off between growth and inflation

- However, it is possible to have stable economic growth without inflation. Economies like Germany had long periods of low inflationary growth in the post-war period. Up until late 2007, the UK government had also felt it had done away with the boom and bust cycle. Up until 2008, we had achieved 15 years of continuous growth.

Factors Beyond the Governments Control

To some extent, we can blame the government for the current recession. e.g. they did not do enough to prevent a boom in housing prices, and a boom in mortgage lending which later proved unsustainable. But, elements of this recession were beyond their control.

Oil Price Shock of 2008. Rising oil prices make it difficult to meet government objectives because it causes cost-push inflation which gives a worse trade-off.

Global Credit Crunch. Losses on subprime lending in the US filtered through the whole global finance system causing more banks to go under. This led to lower investment and growth.

Global Downturn. Even countries like Germany and Japan, who didn’t experience booming housing markets and pursued more conservative fiscal policies, have been adversely affected by global slowdown. Germany and Japan both rely on export demand and the collapse in the global economy has had a powerful effect on their economy.

Related