Definition of Foreign Direct Investment (FDI).

- FDI is the net transfer of funds to purchase and acquire physical capital, such as factories and machines, e.g. Nissan, a Japanese firm, building a car factory in the UK.

- In recent years, foreign direct investment has also widened to include the purchase of assets and shares which give investors a management interest in a firm.

- The World Bank defines foreign direct investment as:

“Foreign direct investment are the net inflows of investment to acquire a lasting management interest (10 percent or more of voting stock) in an enterprise operating in an economy other than that of the investor. It is the sum of equity capital, reinvestment of earnings, other long-term capital, and short-term capital as shown in the balance of payments. ” (World Bank)

- Foreign Direct Investment should be distinguished from portfolio transfers (e.g. moving financial capital to foreign bank accounts) this is known as indirect investment. (However, to complicate things, if there are portfolio transfers which leads to a foreign investor controlling a management share in the company, then this may be considered Foreign Direct Investment because of the transfer of ownership.)

FDI net inflows/outflows

FDI net inflows are the value of inward direct investment made by non-resident investors in the reporting economy. This is usually reported for a given year

Inward investment stock

This is the total accumulated level of foreign direct investment in a country. For example, in 2014, the value of accumulated FDI in the UK – exceeded £1 trillion level for the first time. (Gov.uk)

Reasons firms engage in FDI

Most foreign direct investment is undertaken by firms and multinational corporations, who hope to benefit from some of these advantages:

- Take advantage of lower labour costs in other countries (e.g. India is one of biggest recipients of FDI, where labour costs are much lower than in the OECD.

- Take advantage of proximity to raw materials rather than transport them around the world.

- Avoid tariff barriers and other non-tariff barriers to trade.

- Reduce transport costs. For example, by producing cars in the UK, Nissan has lower transport costs for selling to the UK market.

- Opportunities for using local knowledge to help tap into domestic markets. For example, by investing in a foreign country and working with local workers, a multinational can gain a better insight into what works well for local markets.

Advantages of Foreign Direct Investment (FDI)

- Capital inflows create higher output and jobs.

- Capital inflows can help finance a current account deficit.

- Long-term capital inflows are more sustainable than short-term portfolio inflows. e.g. in a credit crunch, banks can easily withdraw portfolio investment, but capital investment is less prone to sudden withdrawals.

- Recipient country can benefit from improved knowledge and expertise of foreign multinational.

- Investment from abroad could lead to higher wages and improved working conditions, especially if the MNCs are conscious of their public image of working conditions in developing economies.

Potential Problems of Foreign Direct Investment

- Gives multinationals controlling rights within foreign countries. Critics argue powerful MNCs can use their financial clout to influence local politics to gain favourable laws and regulations.

- FDI may be a convenient way to bypass local environmental laws. Developing countries may be tempted to compete on reducing environmental regulation to attract the necessary FDI.

- FDI does not always benefit recipient countries as it enables foreign multinationals to gain from ownership of raw materials, with little evidence of wealth being distributed throughout society.

- Multinationals have been criticised for poor working conditions in foreign factories (e.g. Apple’s factories in China)

Evaluation of FDI

- Firstly foreign direct investment is a relatively small % of AD. The biggest component of AD is domestic consumption. The impact of the foreign direct investment may not really be felt beyond the local region where it occurs.

- Also, it depends on other factors in the economy. For example, if FDI increased during the current recession, it would probably be insufficient to create positive economic growth because other factors are reducing AD and these are more powerful.

- The impact of FDI may also depend on the extent to which there is a multiplier effect. E.g. does the investment stimulate the creation of new industries to support the new factory?

Importance of foreign direct investment

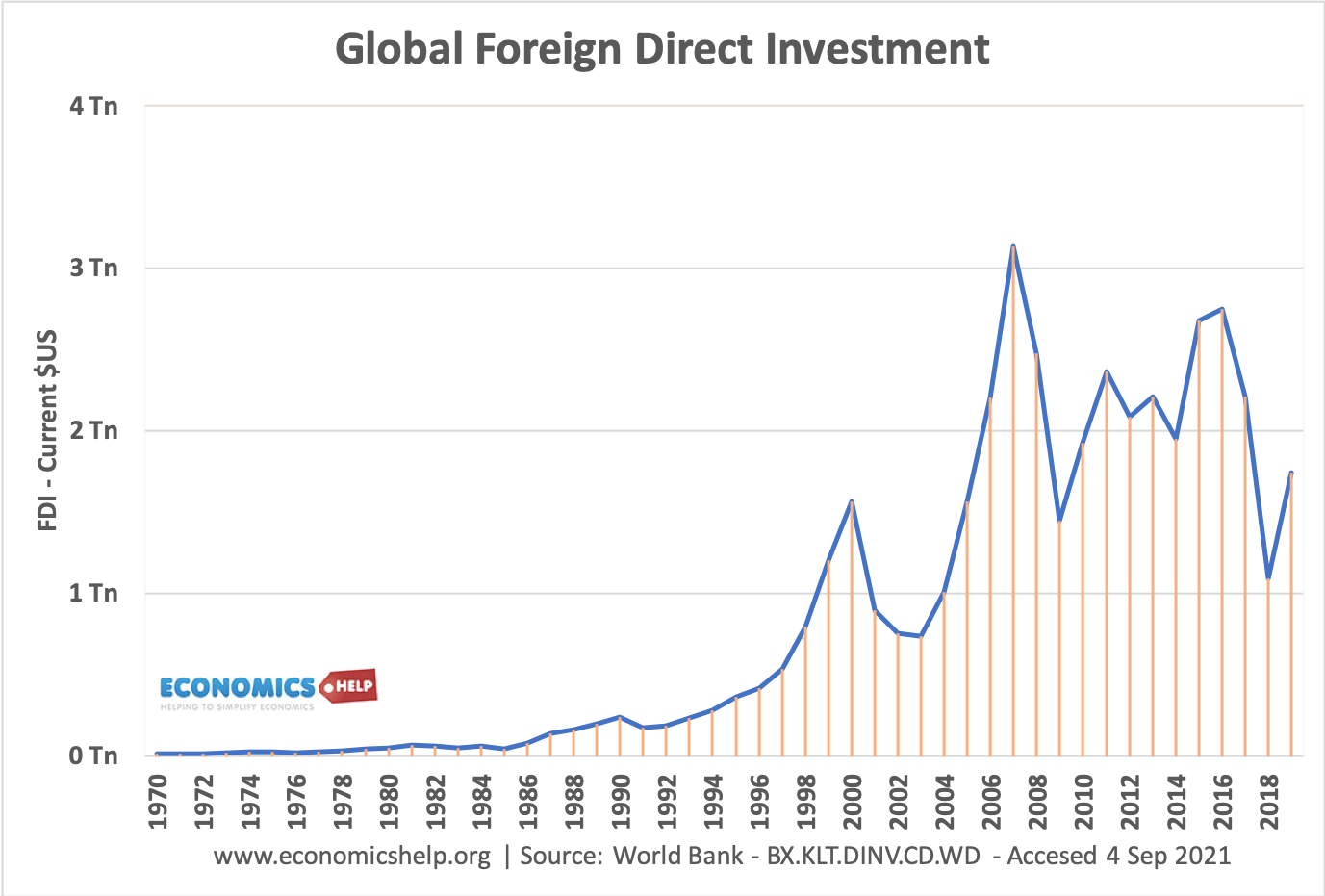

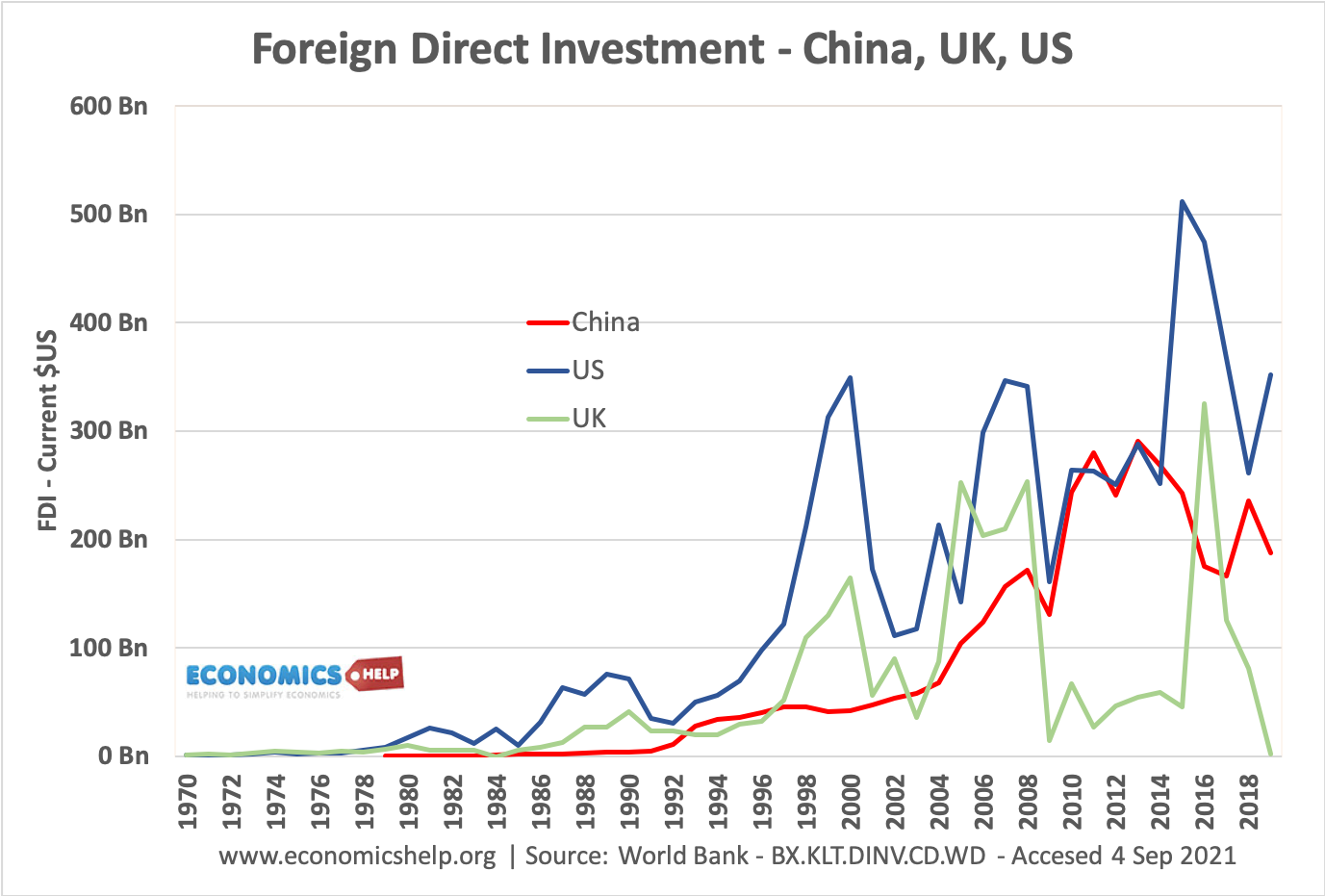

Foreign Direct Investment has increased significantly in past few decades. This is because:

- Lower transport costs

- Improved technology which has helped increase low capital intensive startups

- Increased global trade and lower tariff costs

- Statistics of FDI at World Bank

Global Foreign Direct Investment

Related

Cheers:)

i missed a week of school and this just saved me a load of work:)

what sort of graphs could you include for essay questions?