Abstract. A look at the economic effects of Britain leaving the European Union.

Summary. The UK has been a member of the European Union since 1973. The European Union gives many economic benefits to member countries. These include free trade, inward investment from European companies, free movement of labour, harmonisation of regulations and qualifications and the stability of being in world’s largest trade block. However, critics argue that the European Union imposes unnecessary costs on business and hampers the UK ability to grow. Leaving the EU could enable the UK to have the economic benefits of a Single Market but without unnecessary costs and bureaucracy.

Economic effects of leaving the EU

1. Less free trade with EU The UK currently has free trade with all 28 European countries, enabling a range of imports and exports. In 2014, trade with the EU accounted for 44.6% of UK exports of goods and services, and 53.2% of UK imports of goods and service (ONS). When the UK leaves, it may not be able to negotiate replacement free trade deals with all 27 countries. This could lead to trade diversion and a negative impact on the UK export industry.

- However, if the UK leaves, it may be able to lower EU external tariffs. The EU has free trade within member countries but imposes significant external tariffs on goods, such as agriculture. This raises the price of some food imports. If the UK left the EU it may be able to negotiate better free trade deals without the EU’s external tariffs.

- Another factor is that the EU’s share of world trade is declining in relative terms due to the growth of emerging economies like China and India.

2. Inward investment

The European Union is an important source and target for inward investment. Many European companies have invested in the UK and the UK earns revenue from investment in the EU. If the UK leaves the EU, this investment may be less attractive causing foreign firms to return to within the EU border. Companies like BMW has already warned workers of potential job losses in the case of a Brexit (1)

in 2013, 43.2% of UK overseas assets were held in the EU, whereas 46.4% of assets held in the UK by overseas residents and businesses were attributable to the EU. (ONS)

However, if the UK can negotiate successful post-leaving treaties, investment may not be under threat. Non-EU countries like Iceland, Norway and Lichtenstein make up the European Economic Area (EEA) and in theory, this could be a satisfactory alternative for the UK economy.

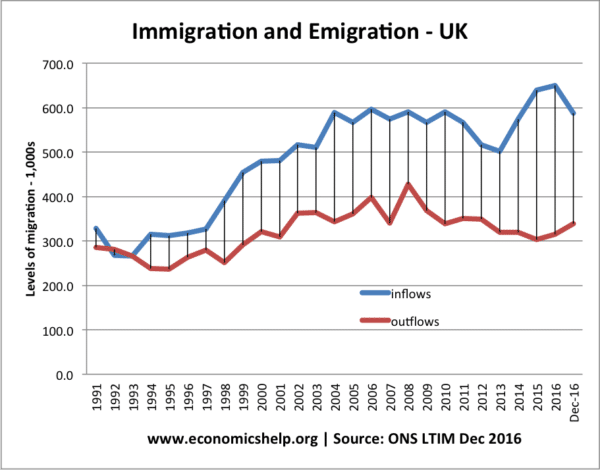

3. Free movement of labour

A big political issue is the net migration of mostly Eastern European workers into the UK. This has created stress on housing, infrastructure and population pressures. From an economic perspective, the impact of net immigration is mostly positive – migrants tend to be of working age, net contributors to the budget and help fill labour market shortages in areas, such as plumbing, nursing, cleaning and teaching. If the UK left the EU, labour markets will become less flexible. Since 2016, there have been firms reporting labour shortages – especially in areas like agriculture, retail and construction.

If the UK left, it would have greater freedom to be able to restrict net immigration. However, it would also make it harder for UK nationals to work abroad. There are currently 2 million Britons working in EU (Guardian)

4. Short term costs of leaving

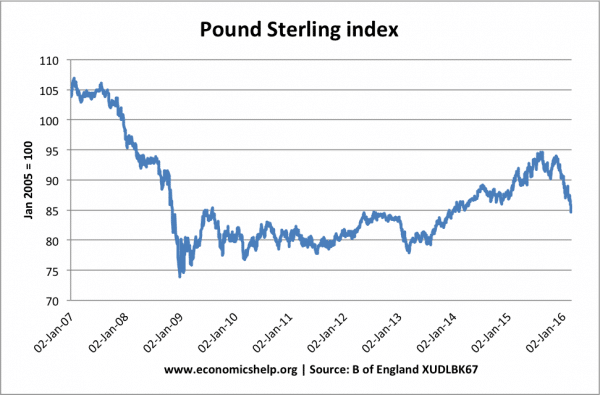

Since the referendum, the value of the Pound has fallen 10-15% reflecting markets more pessimistic view about the long-term economic prospects for the UK.

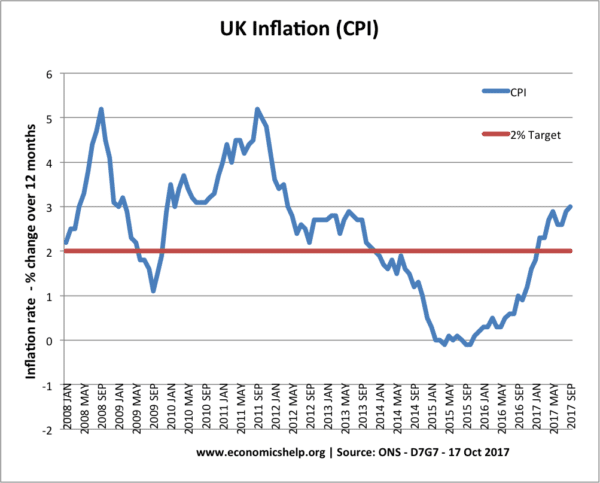

The devaluation in the Pound has led to a rise in cost-push inflation, which has reduced living standards – this is particularly problematic because of low nominal wage growth.

A particular economic concern for the UK leaving the EU is a decline in inward investment from the EU. With a current account deficit of 4.5% of GDP, the UK requires capital flows to finance the deficit. If the UK receives less inward investment, the Pound will have to fall.

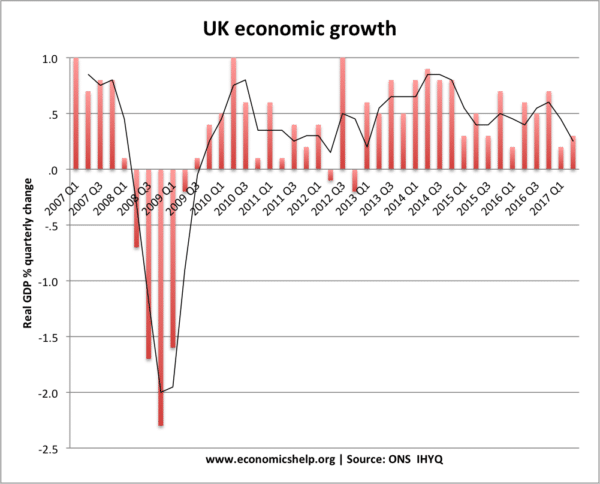

If the UK did leave the EU, the uncertainty and political wrangling over a new deal could cause a fall in investor confidence and (in worse case scenario) trigger an economic downturn.

Since the vote in June 2016, there has been a fall in the rate of economic growth. In the first half of 2017, the economy has grown by just 0.5% (annualised growth of 1%) – real wages have started falling again due to rise in inflation.

Others argue the markets are exaggerating the impact of leaving and that once the vote is known, stability will return. In the long run, Britain could adjust to the new reality.

5. Costs of EU Membership

In 2014, the UK paid £17bn to the European Union (approx. 0.06% of GDP) (1). However, the UK also received a CAP rebate and also is a recipient of EU funds from social and regional programmes. If the UK leaves the EU, it would still have to pay to be able to benefit from the single market. The EU would not allow the UK to have benefits of Single Market without paying into it. As a percentage of GDP, the cost of membership including money coming back to the UK is 0.4%. The net contribution of UK to EU is £7.1bn according to EC. See more on cost of EU

6. Inefficient policies

Despite years of reform, the EU still spend a high percentage of its budget on agriculture (43% in 2013). Arguably these agricultural policies have also encouraged inefficiency and a waste of resources. Leaving the EU will enable the UK to pursue its own agricultural policy and not be subject to EU policy.

However, there still needs to be some kind of deal with other European countries other cross-border issues, such as fishing, environment and pollution.

7. EU regulations

A big criticism of the EU is burdensome regulations. Some of these regulations are myths (e.g. the myth of banning the bendy banana). Leaving the EU would enable the UK to cut these EU regulations from its law. However, if we want to trade with the European Union, companies will still need to meet EU standards on environmental, health e.t.c. Some argue the biggest cost to EU business is not from EU regulations but the UK’s own planning regulations.

Also, it should be remembered that regulations can have beneficial social effects – e.g. better safety standards and reducing excess energy use.

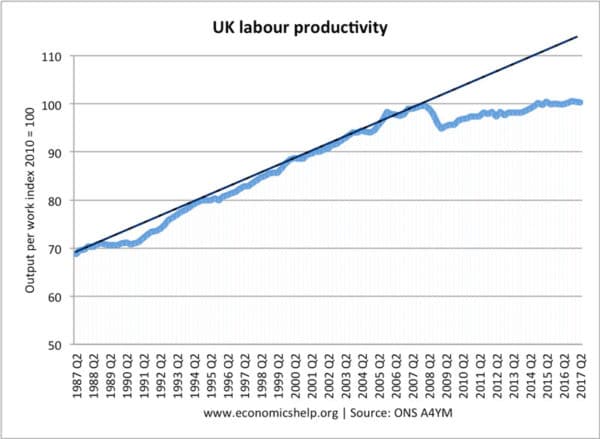

8. Effect on productivity and investment

A concern about the UK economy is the very poor performance in productivity since 2008. Productivity is a key determinant of economic growth and therefore tax revenues. Since 2009, productivity growth has been poor. This can be blamed on different factors

- Global fall in productivity (though UK fall is more severe)

- Low investment in new technology and robots

- Effects of fiscal austerity and low wage growth

- Uncertainty over Brexit. Whilst Brexit is not wholly to blame for the continued poor performance of productivity, the uncertainty over future trading arrangements is discouraging investment when the UK needs more investment.

Conclusion

The impact of Brexit will impact the economy for many years. It also depends on the type of deal and new trading arrangements made. In the immediate aftermath of the vote, the economy was relatively resilient, but the devaluation has begun reducing living standards. Combined with poor productivity growth, growth forecasts have been downgraded causing a deterioration in public finances.

Related

Interesting to see … thank you it’s well done 🙂

I AGREE!!! WOULD LOVE TO MEET UP FOR A COFFEE AND SHARE MY VIEWS WITH U

Many of the people we spoke to were in agreement with us, that Theresa May should not give the EU any more money and we should leave immediately.

The vast majority of people in Manchester told us they wanted to completely leave the EU, no ifs and no buts – they want us out of the EU and all of its institutions.

This is untrue. Manchester voted to remain, as all major metropolitan areas did. Look at the figures. People with relatives outside the EU are however motivated by Brexit as it may be easier for non EU citizens to be allowed to settle in the UK.

If you recognise that when things become scarce then they usually also become more expensive, then consider the impact on food prices in the U.K. if there are long delays at Dover & Folkestone. Over 40% of the food we eat comes from overseas and without a “frictionless ” boarder the price of home produced food will increase too. It’s simple supply and demand.

Brexit is the biggest “Own Goal ” in history !

At the moment, as full members of the EU, the United Kingdom can engage in trade with 41 countries that currently already have trade deals with them. Leaving the EU wont just restrict trade between the EU 28 , being part of the EU “Club” allows access to the others with whom the EU has already negotiated trade deals. Those countries (e.g Canada ) are definitely not going to offer better terms to The UK as a sole trading nation outside of The EU.

Imagine if your biggest and most important customer found out that you were giving one of your smaller customers better terms. You would quickly demand the same, right ?

Brexit is the biggest “Own Goal” in history !

There is one thing that’s is really worrying me at the moment as the prospect of leaving the EU without an agreement about the free movement of goods looks likely. Some influential newspapers (e.g.The Daily Telegraph ) are seeking to reassure the public that there is no cause for concern as “Quite simply World Trade Rules will come into place. ”

My worry is that although The UK Government may have contingencies in place to ensure that goods can move into The UK according to World Trade Rules and without delay how can these well informed journalists be sure that similar arrangements will be in place in Calais or Rotterdam so that our exports can move the other way ?

Interesting to see the head of H.M. Customs and Excise appearing before The House of Commons Select Committee to update them on preparation for “No Deal”. They confirmed that although an additional four thousand staff have been recruited the computer systems are not in place to cope with the expected 50 fold increase in vehicles that would be required to clear customs at The Port of Dover. The Port itself will need to be re-designed and additional terminals constructed.

At Dover, as a last resort, Customs Officers would just wave vehicle through and forego the collection of import duties. They were unable to say what would happen when vehicles travelling the other way reach Calais.

EU is the biggest point of trade for UK so UK may sort out the problem they are facing for the EU.yeah its definitely a good way to leave EU.

UK exit from the EU at the moment, the issue is solved. You have an interesting analysis and infographics. Thanks for sharing!