Readers Question: Explain what is meant by a balance of payments disequilibrium?

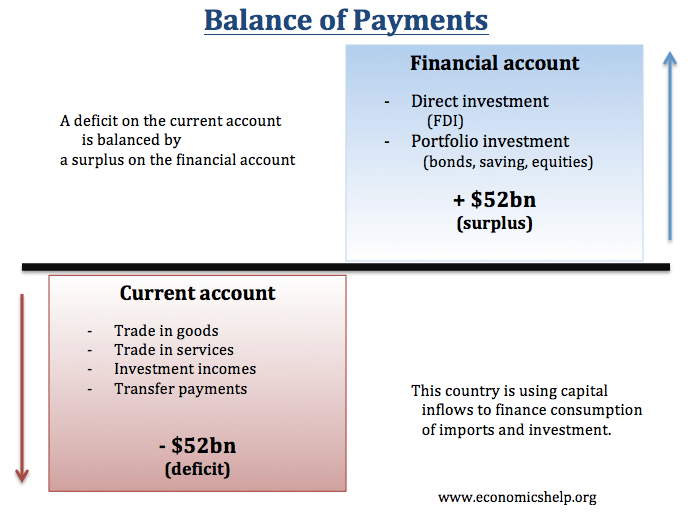

The Balance of Payments is comprised of two main components:

- The Current Account (trade in goods, services + transfer payments and investment incomes)

- The Financial Account (used to be called capital account; this is capital flows such as foreign direct investment)

If the UK imports more goods and services than we export – then we have a deficit on the current account. A significant deficit on the current account is generally referred to as disequilibrium. It will be matched by a surplus on the financial account.

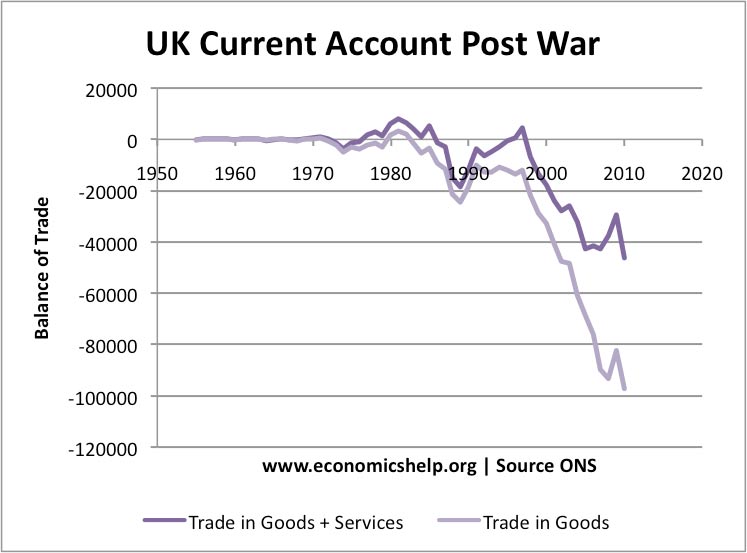

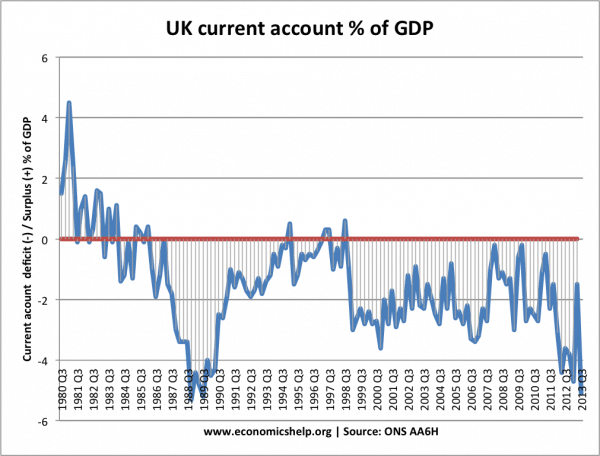

In the post-war period, the UK has usually had a current account deficit, apart from a brief surplus in the early 1980s and 2000s. The UK currently has a deficit on the current account.

Deficit in current account as % of GDP

See also ONS – balance of payments

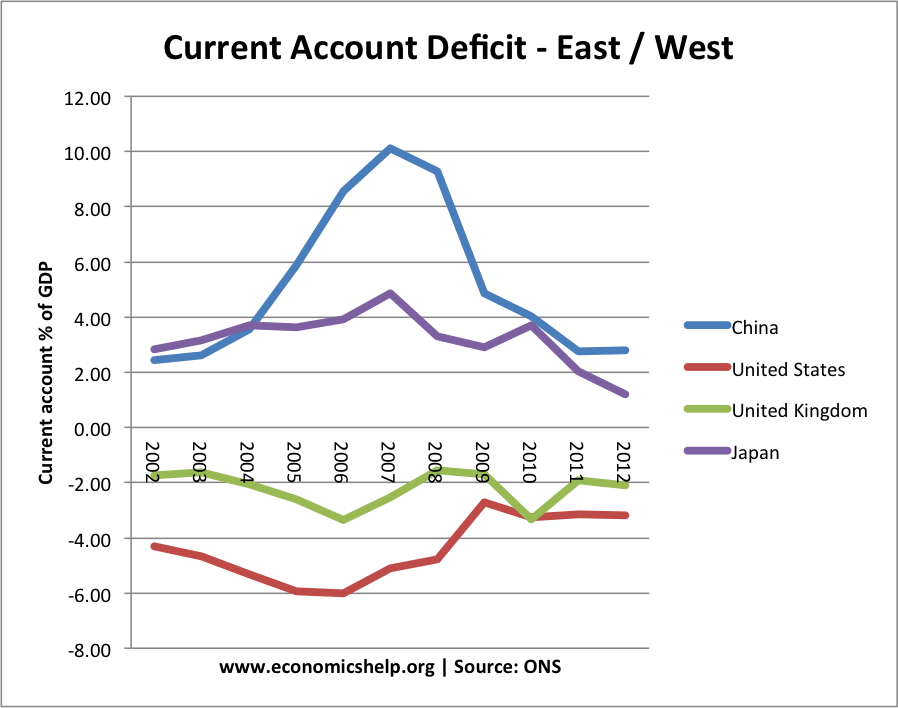

Note a large surplus on the current account would also be seen as a disequilibrium. – e.g. Japan or China have large current account surplus – current account surplus

Germany’s large current account surplus was seen as an imbalance within the Eurozone – see: German current account surplus.

Note, how if one country has a large surplus on the current account (Germany). Another country will have a similar deficit. Since 2006, the US deficit with China has narrowed. Similarly, China’s surplus has fallen too.

Current account deficit suggests wider disequilibrium in the Economy

- A large current account deficit may be an indication that the economy is too much geared towards spending (e.g. spending on imports) and too little on exports. A current account deficit can occur when the saving ratio falls and domestic consumers spend more on imports.

- A current account deficit may also be a sign of underlying inflationary pressures. As domestic goods increase in price, people buy imports instead. A current account deficit often occurs towards the end of a boom – when domestic demand is rising faster than domestic supply.

- It may also be an indication the country is losing competitiveness. This is especially important in a fixed exchange rates. Southern European countries experienced record current account deficits in 2008-10 due to becoming uncompetitive within the fixed exchange rate – the Euro.

- A deficit may also be a reflection that saving is less than investment and investment is being financed by capital inflows from abroad.

Overall Equilibrium in Balance of Payments

In a floating exchange rate, the two components of the Balance of Payments should balance each other out. If the UK has a deficit on the current account of £52bn. Then in a floating exchange rate, the financial account should have a surplus of £52bn. This is because financial outflows must be matched by financial inflows.

Example, if we buy more imported goods than exported goods, then we need financial flows (e.g. hot money, long-term capital investment to finance the purchase of imports)

Balance of Payments Disequilibrium and Fixed Exchange Rates

When a country has a fixed exchange rate, there is more likely to be a balance of payments problem. For example, in 2011, several Euro countries were relatively uncompetitive. However, because they are in the Euro, it is not possible to devalue against other European countries. Therefore, they are stuck with exports which are too expensive. Therefore, we tend to see a large current account deficit.

Portugal and Greece both have a serious balance of payments disequilibrium caused by a decline in competitiveness.

Global Imbalances

A balance of payments disequilibrium can be causes of global imbalances e.g. Large flow of capital from China to the US.

Some argue this was a factor in the credit crunch of 2008. Large flows of capital from China to the US kept yields on securities and bonds artificially low, creating a bubble in certain risky assets. See: Global imbalances

The current account can also be seen as an imbalance between domestic savings and domestic investment. If domestic saving is lower than domestic investment, then we will see a current account deficit. The excess domestic investment will be financed by capital inflows from abroad. See: Current account = Saving – investment

Related

why should economics always be based on assumptions, why should we run from the true facts.

The essence of assumptions in economics is to simplify real world situation in order to ease understanding. Being a social science, we cannot rule out unforeseen contingencies which we call stochastic errors that can invalidate the outcome of our prediction. We can only predict accurately under ceteris paribus assumption.

what causes capital accounts crisis within balance of payment especially in developing countries and the policies to prevent and cope with these crisis.

more information please

please give me details of how price adjustment machanism will remove the balance of payment disequilibruim with the help of diagram

whoud or shoud be asked on balance of payment withans

actully why the disequilibrium requires in balance of payment required without it it cannot manage y

plsease i need material on the balance of payment disequilibrium and the performance of nigerian economy.project work

Very well written as compared to others but very brief. I’d really like some more information.

What is disequilibrium in balance of payments? Also explain the correcting mechanism to solve

this problem.

——-Plz send me the answer to my Mail..——

Though the credit and debit are written balanced in the balance of payment account, it may not remain balanced always. Very often, debit exceeds credit or the credit exceeds debit causing an imbalance in the balance of payment account. Such an imbalance is called the disequilibrium. Disequilibrium may take place either in the form of deficit or in the form of surplus.

Disequilibrium in Balance of Payment

Image Credits © Anita Anand.

Disequilibrium of Deficit arises when our receipts from the foreigners fall below our payment to foreigners. It arises when the effective demand for foreign exchange of the country exceeds its supply at a given rate of exchange. This is called an ‘unfavourable balance’.

Disequilibrium of Surplus arises when the receipts of the country exceed its payments. Such a situation arises when the effective demand for foreign exchange is less than its supply. Such a surplus disequilibrium is termed as ‘favourable balance’.

Economics is commerce you are supposed to take risks and make assumptions for the future that is the reason why it doesn’t come under science.

You’re really helpings me alots inorder to excel in my studies in South Sudan, Starford International University College-Juba, so saying thanks you will not be enough, May God bless you abundantly n gives you more lives n knowledge to continue to helps people who eagerly wants to be somebodies in the future and contribute to their nation’s development n greater world.