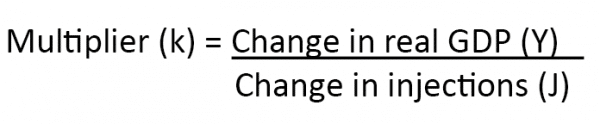

The fiscal multiplier effect occurs when an initial injection into the economy causes a bigger final increase in national income.

For example, if the government increased spending by £1 billion but this caused real GDP to increase by a total of £1.7 billion, then the multiplier would have a value of 1.7.

Example of how the multiplier effect works

- If the government spent an extra £3 billion on the NHS this would cause salaries/wage to increase by £3 billion; therefore National Income will increase by £3 billion.

- However, with this extra income, workers will spend, at least part of it, in other areas of the economy.

- For example, if they spent 50% of the extra income there would be another £1 billion injected into the economy. e.g. shopkeepers would earn money from increased sales.

- This extra spending would cause an increase in output. Therefore firms would employ more workers and pay higher salaries.

- Therefore these workers will also increase their spending. This will lead to another injection into the economy, causing higher Real GDP

- In other words, if you increase salaries in the NHS, it isn’t just NHS workers who benefit from higher incomes. It is also related industries and service industries who see some benefits.

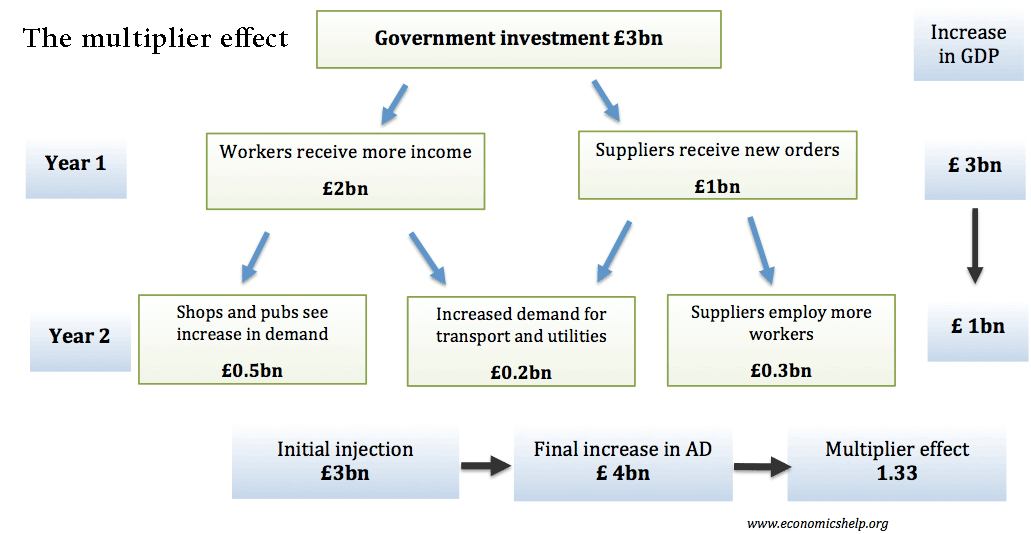

Example of multiplier effect from government investment

- In this case, the government spend £3bn on building roads. This involves employing workers (previously unemployed) and paying suppliers for raw materials. Initially, GDP rises £3bn

- In the next period, workers spend part of this extra income – in shops and for transport. The suppliers also employ more workers – creating more employment.

- This creates an additional economic output of £1bn.

- Therefore the final increase in GDP is £4bn – from the initial injection of £3bn.

- In this case, the multiplier effect is 1.33

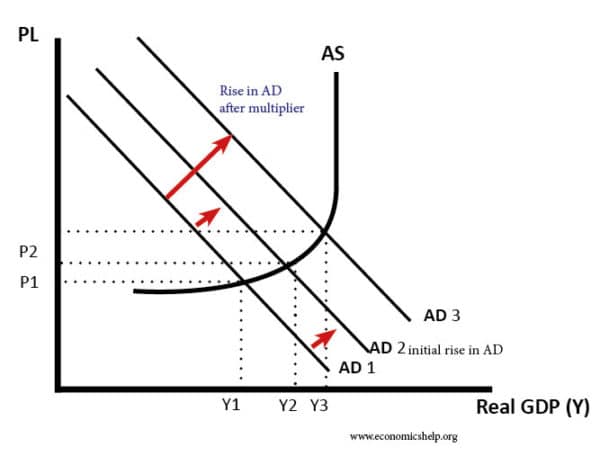

Multiplier effect using AD/AS diagram

Injections can include:

- Investment (I)

- Government Spending (G)

- Exports (X)

Negative multiplier effect

The multiplier effect can also work in reverse. If the government cut spending, some public sector workers may lose their jobs. This will cause an initial fall in national income. However, with higher unemployment, the unemployed workers will also spend less leading to lower demand elsewhere in the economy. See more on negative multiplier effect.

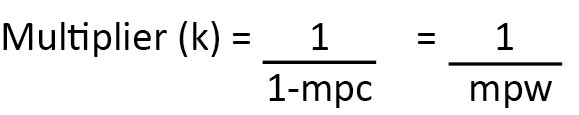

Determining the size of the multiplier

The value of the multiplier depends upon the percentage of extra money that is spent on the domestic economy.

- If people spend a high % of any extra income (a high mpc), then there will be a big multiplier effect.

- However, if any extra money is withdrawn from the circular flow the multiplier effect will be very small.

- Marginal Propensity to Consume (mpc). This is a persons willingness to spend money – if a worker saved all his money there wouldn’t be an increase in GDP

- Marginal Propensity to Withdraw (mpw). This is when money is withdrawn from the circular flow it includes mpt + mpm + mps

- The Marginal Propensity to Tax (mpt)

- The Marginal Propensity to Import (mpm)

- The Marginal Propensity to save (mps)

The multiplier will also be affected by the amount of spare capacity if the economy is close to full capacity an increase in injections will only cause inflation.

Example of the size of multiplier

- If mpt = 0.4, mpm =0.3 and mps = 0.1

- Then mpw = 0.8. The marginal propensity to consume is 0.2

- Therefore, the multiplier effect will be 1/0.8 = 1.25

The multiplier effect of a tax cut

A tax cut has no effect on government spending, but, will affect consumer spending (C) and investment (I)

For example, imagine the government cut VAT from 17.5% to 15%. This has two effects:

- Firstly, if consumers maintain the same spending habits, they will have more disposable income left over to buy more goods.

- Secondly, they may be encouraged to buy goods (especially expensive electrical goods) e.t.c because they are cheaper.

- Therefore, in theory, a tax cut should boost consumer spending and this leads to an overall rise in AD.

- This means firms will get an increase in orders and sell more goods. This increase in output will encourage some firms to hire more workers to meet higher demand. Therefore, these workers will now have higher incomes and they will spend more. This is why there is a multiplier effect. Extra spending benefits others in the economy.

Crowding out

Monetarists argue the fiscal multiplier will be limited by the crowding out effect. E.g. if the government increase aggregate demand through higher spending or tax cuts then this increases consumer spending. However, the rise in borrowing (and higher bond yields) leads to a decline in private sector investment. Therefore, there is no overall increase in AD.

See more at crowding out

Keynesian view on crowding out and multiplier

However, in a recession, Keynesians argue that the private sector typically has a glut of non-productive savings, therefore, the crowding out effect is limited and there will be a positive multiplier effect.

Related

Thanks for that – clears up some questions. You raise that M should increase as well – in representing the effect of the multiplier, I’m thinking that C and I should increase by enough to cancel out the increase in M, whilst maintaining the correct ratio of each propensity (to consume, to invest, to import)? Hope that makes sense.

M (imports) will rise as C (consumption) rises. Typically M may account for say 0.4 of any rise in C.

So if you get an extra £10, £4 goes on imports, £3 on taxes leaving an increase in C of £3.

Thanks to [https://www.economicshelp.org] because i was looking for effects of multiplier, and this article is absolutely matches with my requirement… thanksss alotttttttttttttt 🙂

good materials and notes provided….

does the multiplier effect makes increased in government expenditure and tax reduction

There would be a decrease in the tax on imports (M) so they would increase