“Maintaining and expanding a nation’s stock of capital requires saving.” Evaluate and explain. Is the assumption of full employment of any relevance?

Capital Stock is the level of productive capacity in the economy.

Saving and Investment

- There is an important economic idea that Savings = Investment. The logic is that without bank deposits, banks are not in a position to lend money for investment.

- An economy with a low savings ratio has little funds to finance investment because it is all being used to finance current consumer spending.

However, higher levels of saving do not necessarily lead to more investment. The extra saving may not encourage people to invest more. E.g. In the great depression, individual savings did not encourage investment. Keynes called this the paradox of thrift

Keynes said that an important factor in determining investment was, not so much levels of savings, but peoples attitude to the future of the economy.

This is perhaps why full employment is important. In a recession, extra savings may just be saved and not used to finance resources. However, when the economy is close to full employment, extra savings are important for financing extra investment.

Another factor is financing investment from abroad. E.g. the UK has a current account deficit but, the UK has also been able to attract capital investment from abroad e.g. Japanese firms investing in the UK.

Does Saving influence the Growth Rate?

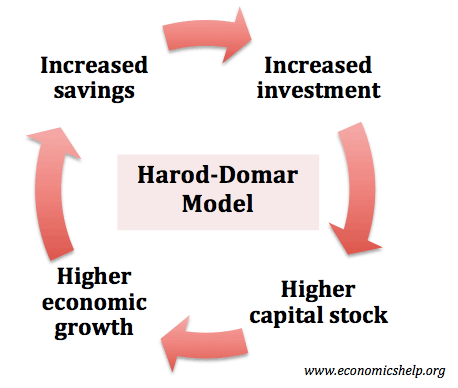

Some economic models suggest that low saving rates will imply a low long-term rate of economic growth. If savings are low, then this will hamper long-term investment and the capital stock will increase at a lower rate.

e.g. Harrod Domar rate of economic growth.

Saving, Investment and Current Account

The Current account measures the net value of exports + net investment incomes from abroad. For accounting purposes, the current account also equals = domestic saving – domestic investment.

If domestic investment is substantially higher than domestic saving, then it needs to be financed by capital inflows from abroad ( A surplus on the financial / capital account and a deficit on the current account.

If the savings of individuals and that of investors are made available for the expansion of a nation’s capital stock, the idea is to produce more goods and services. This also has the effect that people are employed, which, in turn, leads to improvement in the standard of living of the population. When the volume of investments increases the possiblity for further investment expands and this ultimately increases the economy’s capacity for growth in terms of an increase in goods and services. This can help improve the standard of living, provide more job opportunities and greater prosperity, which is investigative of an enhanced economic growth.

When supply for loanable funds is greater then demand for loanable funds , the extra or excess saving landed to abroad ,because these extra saving required to foreigner ,Because we are export more good and services then we are imported such situations current account is surplus.