Economists attempt to make forecasts for leading economic variables such as

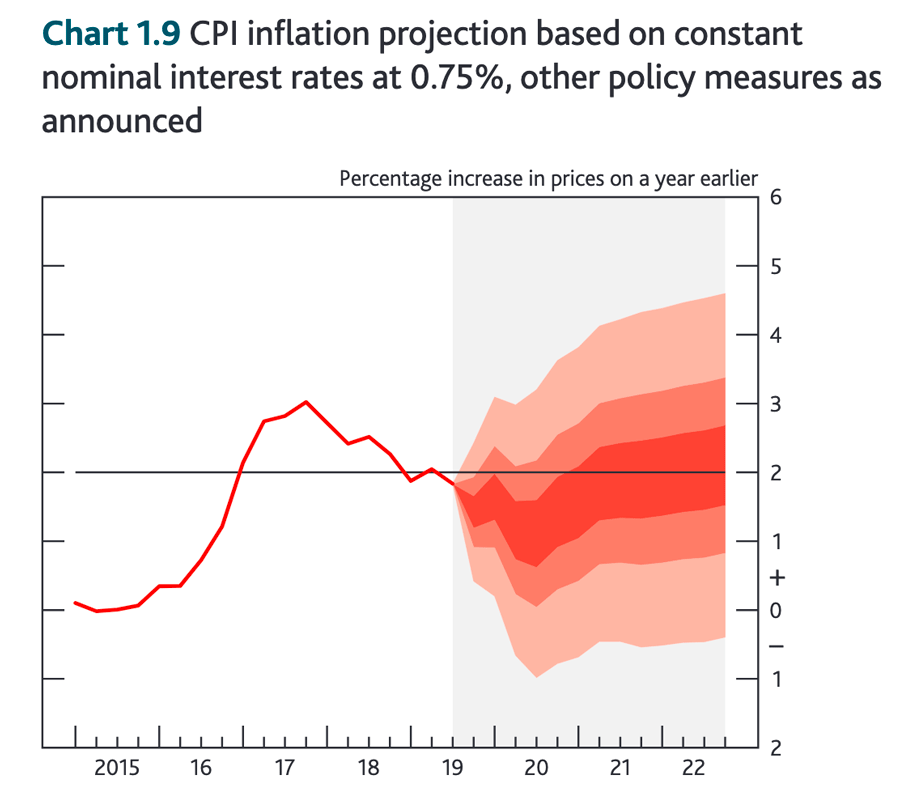

- Inflation

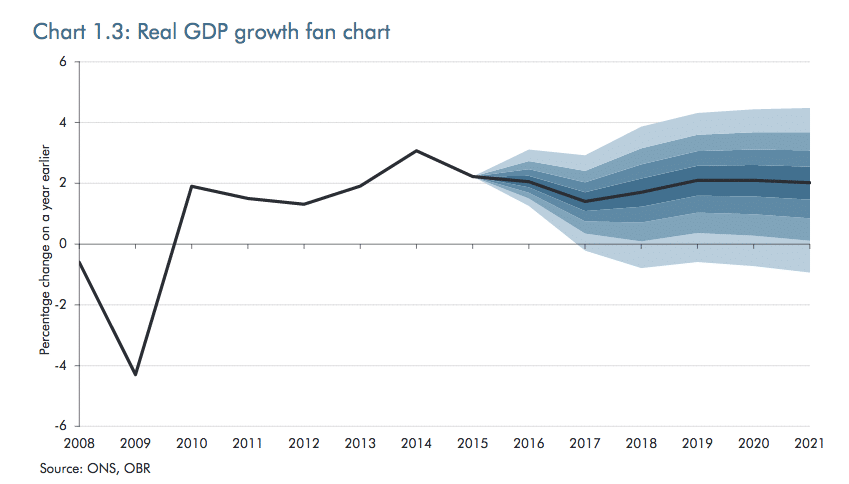

- Economic growth

- House prices

- Exchange rates

- Population growth

The main importance of economic forecasts is to help policymakers make better decisions. For example, if the economy was forecast to enter into a recession, the government could consider implementing expansionary fiscal policy (higher spending financed by borrowing) to maintain demand in the economy and prevent a sharp downturn in the economy.

Forecasts are important because policy changes take time. If you wish to increase demand in the economy. There could be a time lag of up to 1 or 2 years for the change to have the full effect. If you wait until after the event, the policy will be delayed and it will take up to two years to have an effect.

Importance of Forecasts for Monetary Policy

Economic forecasts are very important for determining monetary policy / fiscal policy. If the economy is really expected to recover, then inflation may pick up and the Bank may need to raise interest rates. If the economy is likely to continue to shrink, the Bank may need to pursue further quantitative easing.

Another issue for the Bank of England is that interest rate changes can take up to 18 months to have an effect. Therefore when the Bank change interest rates, they are trying to set the optimal rates for the future economic situation. See: How Bank of England set interest rates

Importance of Exchange Rate Forecasts

For firms trading with other countries, movements in the exchange rate can be very important. A sharp appreciation in sterling could reduce demand for exports. Firms may need to plan ahead by hedging exchange rate movements or seeking to sell to domestic markets.

Importance of population growth and demographic changes

If an economy is facing population growth, it will face rising demand for housing and infrastructure.

Many western economies are facing an ageing population. This has a different effect. An ageing population could.

- Lead to increased demand for health care spending and pensions

- May require higher taxes to deal with the greater entitlement spending.

- Shift demand for goods and services, e.g. greater demand for long-term health care.

Population forecasts are generally more reliable than economic forecasts on inflation and economic growth.

Forecasting of house prices

A reader was asking how the credit crunch may have been different if banks had correctly forecasted falls in house prices.

Certainly, if banks knew house prices were going to fall 20-25%, they would (presumably) never have lent the raft of unconventional mortgages which had little chance of repayment. (This was particularly a problem in the US)

The credit crunch was caused by many other factors, and not just a failure to predict house price falls. But, better forecasting or more realistic forecasting would definitely have helped minimise the problem.

Difficulty of Forecasting

It is very difficult to predict economic data such as house prices.

- At the end of the last crash in 1995, how many would have predicted a near tripling of house prices in the next decade?

- Some were predicting house price collapses in 2007. But, many of these commentators had started predicting house price falls as early as 2003.

- Not many predicted the rise in house prices we saw in 2009

But, it is important to retain a sense of perspective and try and avoid any irrational exuberance which can lead people to ignore possibilities such as house price falls.

Related

As I understand it, some banks did forcast the house price crash: they were betting large sums on the crash at the same time as offering NINJA mortages (No Income No Assets).

This is similar to the way in which one of the Rothchilds allegedly turned up at the London stock exchange looking glum and making it look as though he was selling shares, when all along he knew we had won the Battle of Waterloo and was buying on the side. Obviously he cleaned up.

If my above point about banks is correct, then the banks concerned were engaged in fraud: either that or I don’t understand the meaning of the word fraud. Seems to me that some underwater house owner could do a class action case against one of these banks.

this a valuable note on eco. forecasts