Will the UK’s decision to leave the EU cause recession?

Factors which could cause Brexit recession

- Loss of confidence. Many foreign investors may be deterred from investing in the UK because of uncertainties that they may have higher costs for accessing the Single Market. This decline in investment could lead to fall in aggregate demand.

- Decline in consumer confidence and spending. The uncertainty over Brexit may encourage consumers to increase their savings ratio and reduce spending. Consumers may also be hit by higher prices from a devaluation in the Pound. A fall in house prices may also cause a negative wealth effect. Consumer spending is often the key to the UK economy, accounting for roughly 66-70% of AD; what happens to consumer spending will have a big impact on UK economy.

- Bank losses. The turmoil in the financial markets may encourage banks to hold back on lending, leading to a decline in credit making it harder for firms to invest.

- Expectations of higher tariffs could discourage investment. If the UK leave the Single Market, tariffs on exports to Europe are likely to rise, this will discourage from firms investing in export capacity to the rest of the world.

- Rest of world economy is weak. Brexit fears could spill other into other weak economies like the Eurozone. If China’s economy also goes into a downturn, this will magnify any decline in UK economic growth.

- Higher taxes and continued fiscal austerity. Brexit is likely to hit UK public finances, with lower growth leading to lower tax receipts. Also, the UK has a rapidly ageing population. Net migration helped public finances because young migrants were net contributors to public finances. If migration is cut, this will negatively affect both economic growth and public finances, leading to likelihood of higher taxes / lower spending. This additional fiscal contraction will hold back UK aggregate demand.

- Fall in house prices. Some predict falls in house prices, especially London. Falling house prices cause a negative wealth effect and in the past, this has often co-incided with a fall in consumer spending. For example, in the recession of 1992 and 2008, house prices fell significantly. On the other hand, London house prices have become over-inflated, and falling house prices and falling rents could help young renters.

- Fall in stock markets. Stock markets have fallen since the Brexit vote, this will negatively impact on business and investor confidence. Combined with other shocks and loss of confidence, it could lead to fall in spending and investment. However, stock markets often fall with no noticeable impact on consumer spending and the ‘real economy.

Factors which may help to avoid Brexit recession

- Devaluation should boost domestic demand. A depreciation in the value of the Pound Sterling will make exports cheaper and imports more expensive. This will increase domestic demand. If manufacturers are able to benefit from cheaper exports. This may offset the impact of any possible higher tariffs.

- The Bank of England is committed to providing liquidity. The Bank of England states that banks have much better liquidity and capitalisation than in 2008 credit crisis. The Bank of England is also willing to provide extra liquidity (£250bn) if required. The Bank of England could even try cut interest rates from 0.5% to 0%. (BBC link)

- Desire to maintain trade links. Post Brexit, European and world trading partners may be keen to keep good trade deals for the mutual benefit of countries and so in the long-run trade may not be adversely affected as much as some fear.

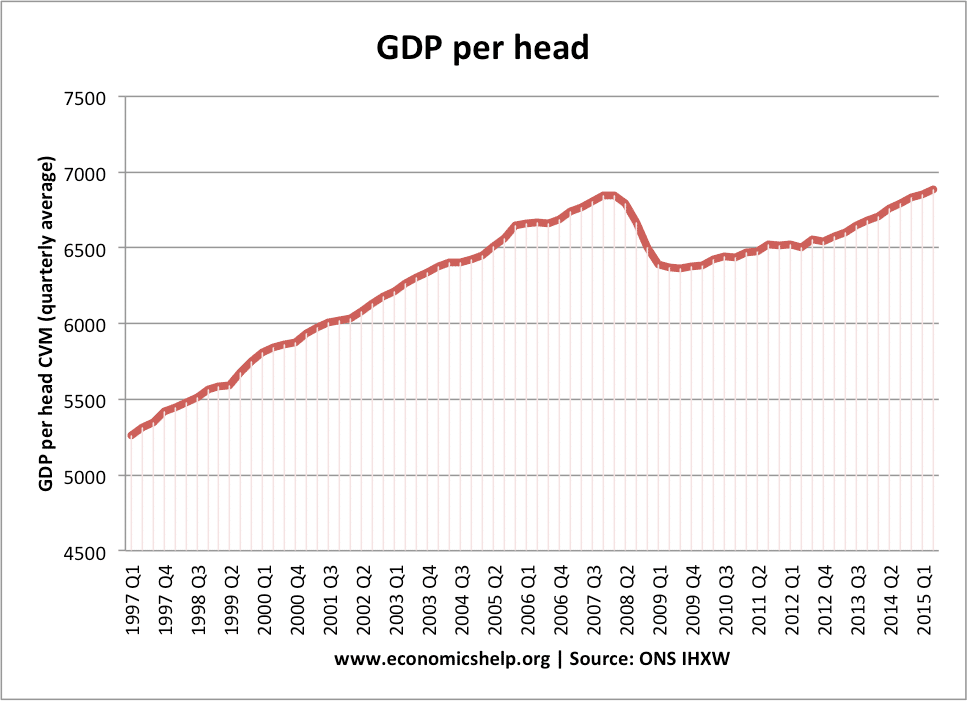

- Stage of economic cycle. At this stage of the economic cycle, you should be expecting high rates of economic growth to catch up with all the missed output from the last recession.

- The UK government doesn’t have to pursue fiscal contraction. With bond yields very low, the government could delay the time when it has to balance the budget. They could even provide a fiscal boost, though this is unlikely from a political perspective.

- Economies are resilient. There may be a short term demand side shock, but economies have pulled through worse events. For example, the 1987 stock market crash had no effect on the real economy.

- The Pound may stabilise in time due to growth in exports.

Evaluation

There are many factors which could cause a recession. In particular fears over general downturn in China and weak growth in Europe, mean news of Brexit makes economies more sensitive than usual. However, economies can be surprisingly resilient, after the initial shock, pragmatism may encourage business and Europe to find a solution which reassures markets.

Also, there are some self-correcting mechanisms. For example, the devaluation in the Pound could in theory boost domestic demand. Though it may be less than some hope, due to inelastic demand and weak growth abroad.

In the long-term it is uncertain how much UK outside Single Market will discourage inward investment into the UK. It is also uncertain what kind of trade deals the UK will be able to gain. There will be a tension between wanting to maintain good trading relations, but also a desire by Europe to show the costs to their own electorate from going down the Brexit route.

Related

- Causes of recession

- Can you talk yourself into a recession?