After the UK’s decision to leave the EU, what economic problems will it face?

Summary of problems

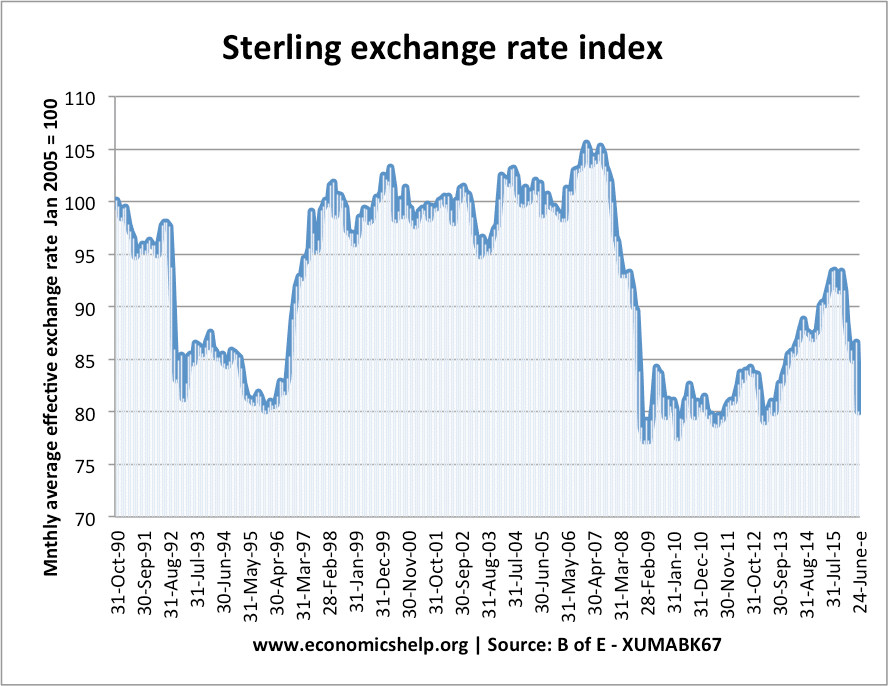

- Devaluation of Pound Sterling, increasing price of imported goods, such as food, oil, manufacturers and domestic inflation.

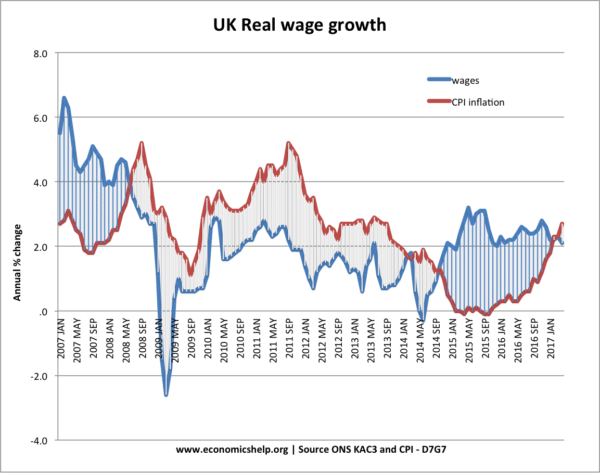

- This cost-push inflation is again putting pressure on real wages. WIth low nominal wage growth – inflation has led to falls in real wages.

- Decline in capital flows as the UK is seen as a more risky place to invest and save.

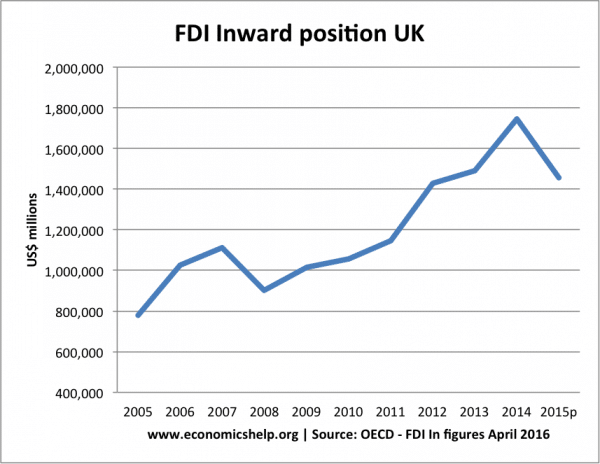

- Decline in inward investment. The UK is currently 3rd largest destination for inward investment in the world, but this may fall when it is outside the EU.

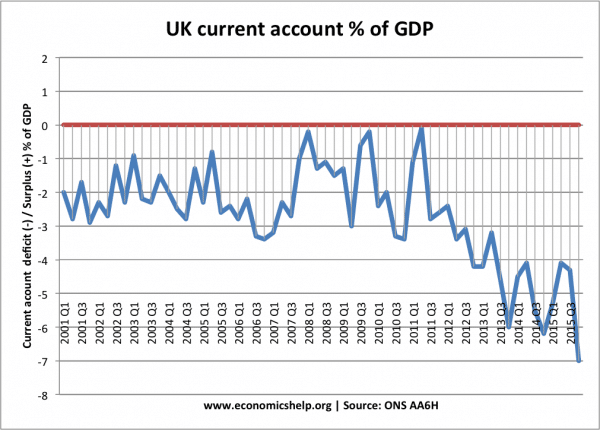

- UK’s large current account deficit, which will put further downward pressure on Sterling

- Decline in business and consumer confidence. Uncertainty will delay investment decisions.

- Limited room for monetary easing with interest rates already 0.5%.

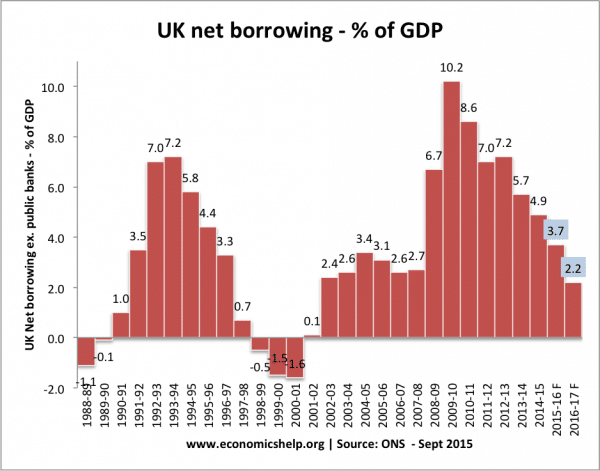

- UK Budget deficit likely to be adversely affected. This will limit the role of fiscal policy and possibly leading to higher taxes and / or lower spending in the long-term.

- Firms relocating to within EU / Single Market, leading to job losses.

- Short-run economic growth forecasts have been downgraded, indicating the likelihood of slower rates of economic growth in 2017.

- Long run trend rate of economic growth likely to be adversely affected by new trade deals and less inward investment.

- Rise in unemployment due to decline in investment.

- Decline in immigration may lead to labour shortages in certain areas, making labour markets less flexible.

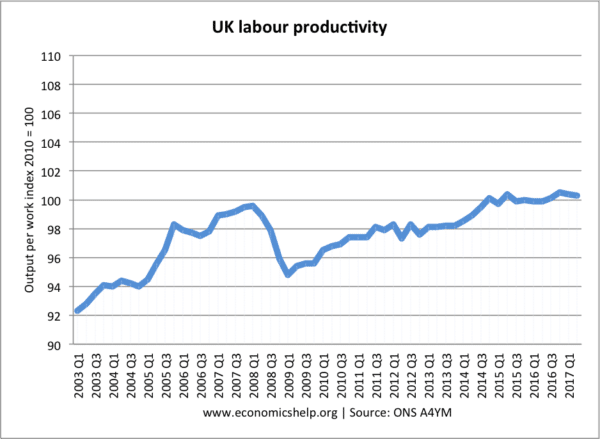

- Long-term decline in productivity growth could be exacerbated by Brexit uncertainty. Poor productivity is leading to downgrades of economic growth and this will hit future tax revenues.

- Difficulties of arranging new trade deal in a world which shows signs of greater protectionist sentiments.

Possible benefits to economy of Brexit

- Devaluation of Pound will provide a boost in competitiveness to manufacturing exporters.

- Devaluation necessary to reduce long-term current account deficit.

- Economies are resilient and recessions only temporary. Furthermore, consumer spending post-June referendum vote has proved more resilient than many forecasts.

- The decline in inward investment and trade may be less than feared as firms work hard to take a realistic view to look after their profitability.

- Others argue the UK will save on its £9.9bn of net contributions to EU mitigating impact of falling migration and lower growth.

- The whole process of leaving the EU will take time, so in theory, there should be no sudden major change in trading conditions.

- Supporters of hard Brexit (leaving Single Market and customs union) argue that outside the EU, it will be easier to negotiate proper free trade deals rather than current EU deals, which can involve high tariffs on imports of food.

Problems in more detail

1. Likely recession

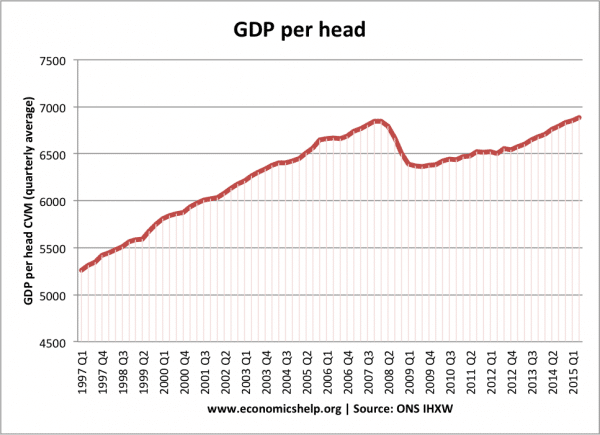

City forecasters have downgraded growth forecasts. For example, the OBR has cut UK GDP forecast for 2017 from growth of 2.3% to 1.4%. This growth downgrade is due to UK’s retreat from globalisation, likely decline in investment, uncertainty leading to projects and spending being put on hold, and firms relocating to within the EU.

The UK has still not caught up with the lost output from 2008 recession. In recent years, real GDP per capita growth has been low and the recovery tentative. Although consumer spending has been resilient in 2016, rising cost-push inflation in 2017 and weak wage growth, could see increased pressure on economic growth in 2017.

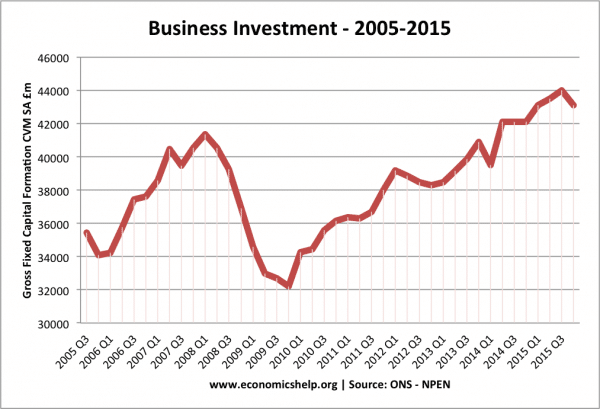

2. Fall in investment

Business investment is highly volatile. The uncertainty over leaving EU may be enough for business to ‘wait and see’ before committing to major investment projects. A fall in investment will reduce demand and limit economic growth.

The fall in inward investment is likely to be even greater as membership of the EU was a large attraction of investing in the UK. In recent years, inward investment has become very important for UK economy. See: Levels of UK Inward investment

Productivity

UK’s productivity has fallen behind the previous trend rate of growth.

Real Wages

Since June 2016, positive real wage growth has returned to negative real wage growth.

Firms relocating to EU

Already firms like Vodaphone have indicated they are likely to relocate to the EU. If a significant number of firms do actually move to EU, this will lead to job losses and lower economic growth in the UK. China has also indicated it sees the UK as a less attractive place to invest now UK is outside the EU. Though there is some debate about the extent to which investment will fall. Richard Branson has claimed thousands of jobs will be lost due to decline in investment (Guardian), though he did campaign strongly for Remain.

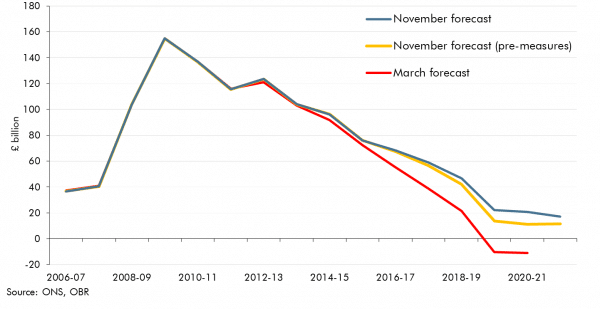

Budget deficit

Since the financial crisis, the UK has seen public sector debt rise to over 80% of GDP, and record peace-time budget deficits. With bond yields falling to record lows, there is actually a strong economic case for delaying further austerity – and even pursuing fiscal expansion to deal with fall in confidence. However, the current government have committed to very strict budget rules, which will see lower growth lead to tax rises and spending cuts. This fiscal contraction will adversely affect economic growth.

The governments budget is likely to be hit by Brexit because:

- Lower economic growth – reduces tax revenues and increases spending on benefits.

- Decline in net migration will also reduce tax revenues. Net migration has a positive impact on public finances (young workers more likely to pay taxes and not receive health care and pensions.)

Current account deficit

The UK has had a persistent current account deficit since the de-industrialisation of the 1980s. In recent years, the current account has deteriorated, partly due to relatively higher growth in the UK, but also long-term structural issues. This deficit is currently financed by capital flows – both financial and inward investment. The concern is outside the EU, these capital flows will dry up, leading to a prolonged fall in the Pound, which could be destabilising and reduce living standards due to higher prices. The current account deficit also shows the relative weakness of the UK exporting sector. A devaluation will provide a boost to competitiveness, though it may not be enough to deal with underlying structural weakness.

Devaluation of Pound Sterling

A devaluation in the Pound will lead to more expensive imports, reducing effective disposable income and possibly leading to lower consumer spending. The concern is how much the Pound will fall against the Dollar; declining capital flows combined with current account deficit will put strong downward pressure.

- Sometimes devaluations in the Pound can give a real boost to the economy because exports become cheaper. For example, the 1992 devaluation helped UK recovery. However, it may be different in 2016. In 1992, interest rates also fell dramatically as the Pound devalued. In 2016, interest rates are already 0.5%. Also, it depends on how Brexit and other factors like Chinese slowdown affect economic growth in Europe and US. It is likely there will be some negative confidence shock in Europe (which is already very fragile). Lower growth in Europe could see the depreciation in the value of the Pound have only a limited impact on increasing demand because of weak global export demand.

UK House prices

Uncertainty, lower growth and lower confidence could see a fall in demand for houses, leading to a fall in UK house prices. Falling house prices cause a negative wealth effect and traditionally have significant negative impact on UK economic growth. (e.g. 1990 and 2008)

On the other hand, house prices are very higher, lower prices may be good news for first-time buyers and renters. Also, the fundamental issue of demand greater than supply will not change post-Brexit, so the fall may be less than you would usually expect.

Rising in personal debt

Although consumer spending has been strong in 2016, this is partly due to households willingness to borrow more and run down savings. Household saving minus pension saving is forecast to fall below 0% by 2021. (Telegraph link)

Reasons to be less pessimistic

Economies are flexible and we have overcome serious recessions in the past. We have seen the decline of major industries, like steel, but new industries and replace them over time (even if service sector jobs have more insecurity than former full time manufacturing jobs). Even if there was an exodus of banks to Europe (and there is no guarantee this will happen), London’s economy would be resilient to overcome this structural change.

Low global tariffs. Even if the UK loses full access to the Single Market, WTO rules on trade mean tariffs are much lower than in the 1970s. There is a vested interest for Europe maintaining good trading relations with the UK (despite political pressures to make UK suffer to discourage more countries leaving EU) therefore, there is a case to say the UK will be able to continue good trading relations.

Inward investment will continue to some extent despite leaving Single Market.

Conclusion

The UK is not in a strong position. Even without Brexit, the economy was relatively weak, and unbalanced – relying too much on consumer spending and running a persistent trade deficit. With the UK likely to reject a full Single Market approach (to have controls on immigration) it is hard to see that not affecting the attractiveness of the UK as a place for inward investment. In the short term uncertainty as we debate best way forward will also have some kind of negative impact on investment, spending and economic growth. There is a possibility of a real negative multiplier effect with initial falls in spending causing knock-on effects in both UK and Europe.

However, on the other hand, it is important not to get carried away with worse case scenarios. The Bank of England has proved it is very willing to intervene and avoid the worse of any fall in demand. Economies are resilient and seemingly very bad situations have also provided new opportunities. But, the fundamental point is that no one fully knows. Brexit is a real step into the unknown and how it will play out is hard to predict with uncertainty. But, at the moment, it is really hard to see anything but some kind of economic shock in both short-term and medium term.

Is it right we cannot do free trade deals with Countries outside the EU if we don’t get an exit deal ?

I.e we have to deal on WTO terms as the default position both with the EU and with the rest of the world.

It’s argued by Brexit politicians that WTO tariffs are low but are they lower than the EU common external tariffs for member states importing from non-union Countries ?

Or would they have to be no higher than WTO tariffs for our imports ?

It wouldn’t seem right or fair to me that having left the EU, we couldn’t do bi-lateral deals on whatever terms suits us.

For those companies based in uk, they may even relocate to the EU in order to maintain competitive advantage in the world. For example Jaguar/Landrover may move their production to elsewhere in the EU or the world.