Readers Question: what are the benefits and costs of a tariff on consumers, producers, employment levels and the government?

The effect of tariffs on consumers

Tariffs increase the cost of imports, leading to higher prices (P1 to P2) for consumers and a decline in consumer surplus. For example, UK consumers have lost out from EU wide tariffs on agricultural products. Many agricultural goods are more expensive because of the high tariffs placed to protect EU farmers.

It is hard to think of any benefits from tariffs for consumers. Maybe in the long run consumers benefit from the protection of domestic industries if these industries use the tariffs to improve.

The effect of tariffs on producers

Domestic producers will benefit from the introduction of tariffs. This is because it makes their domestic production relatively more competitive compared to imports. Agricultural tariffs have benefited European farmers as they have been protected from cheaper competition.

However, it is argued that the restriction of competition encourages inefficient firms. Therefore, in the long run, domestic firms may not make the necessary improvements that they would have done without tariffs.

Also, the introduction of tariffs usually leads to retaliation. Therefore, other countries will place tariffs on UK exports. Therefore, some exporting firms will lose out and sell fewer exports.

The effect of tariffs on government

Tariffs will increase government revenue. However, it will be a small percentage of total tax revenue. If the tariff is too high then the UK may no longer import the good, so the government will not get any tariff revenue.

Also, there will be other effects. Tariffs lead to a decline in disposable income and a net loss of economic welfare – this will lead to less noticeable falls in tax revenue elsewhere in the economy.

Also, import tariffs may lead to retaliation, meaning UK export firms will face higher tariffs, and they could suffer falling demand. This will lead to lower corporation tax revenue.

The effect of tariffs on employment

It is often argued that tariffs can help protect jobs. If the US government place high tariffs on car imports, this can make US car industry more competitive – safeguarding jobs in US car industry.

However, whilst these jobs are quite obvious and visible. Less visible is the harmful effect on employment elsewhere in the economy.

- Consumers face higher prices for cars, leaving less disposable income for buying other goods. Therefore, other domestic industries may see a fall in demand – leading to less employment

- If the US place tariffs on car imports. Other countries – Japan, EU may retaliate and place tariffs on US exports – leading to less employment in export industries which are internationally competitive.

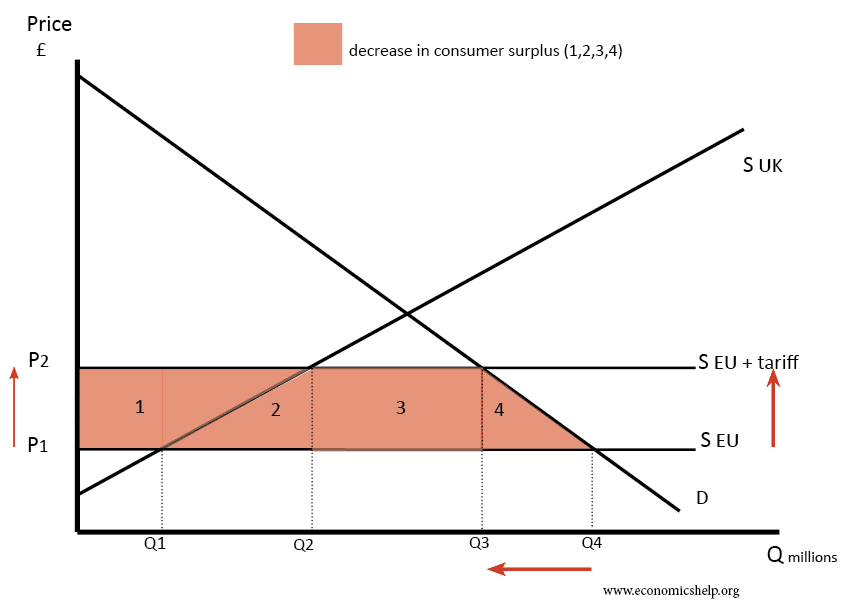

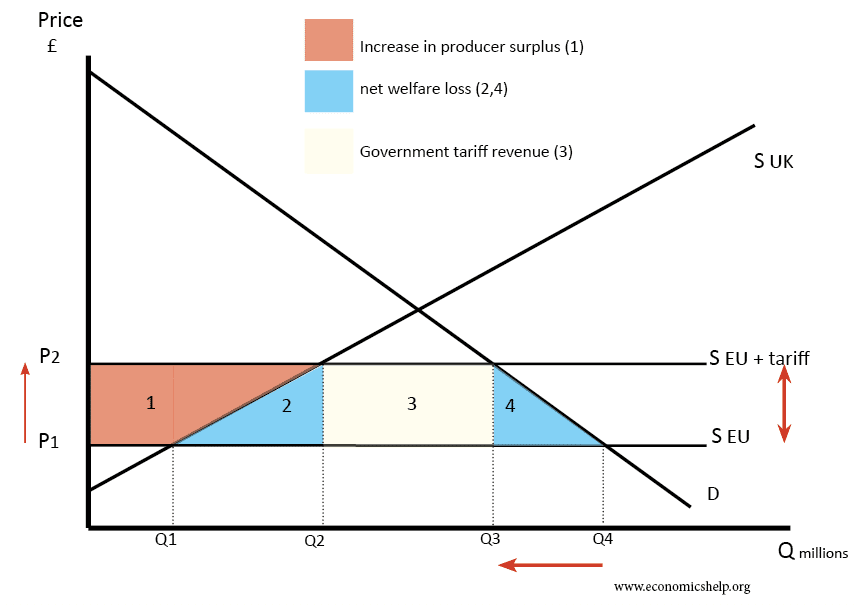

Diagram to show the effect of tariffs on consumers and producers

- The tariff equals P2-P1. This causes a higher price for consumers, and demand falls from Q4 to Q3. The net loss of consumer surplus is areas 1+2+3+4

- Domestic produces see sales rise from Q1 to Q2. Therefore, producer surplus rises by area 1

- The government receive tariff revenue of area 3.

- The net welfare gain is 1+3 – (1+2+3+4). So areas 2 + 4 are the net loss to the UK economy.

- However, we should remember foreign firms will also lose out from a decline in imports.

- Also, consumers will be relatively worse off so they will buy fewer goods elsewhere in the economy.

- Also, exporting firms may be hit by retaliatory tariffs.

Evaluation

- The effect of tariffs depends on the elasticity of demand. If demand is inelastic, there will be smaller welfare loss. If demand is price elastic, there will be a bigger decline in welfare and fall in consumer consumption of the good.

- There are other issues from economies of scale. Tariffs may cause production to shift to smaller firms with fewer economies of scale.

- There is also the issue of retaliation. If one country places tariffs on imports, then other countries are likely to retaliate – causing a decline in exports.

- Some jobs may be saved in domestic industry (industries protected by tariffs). But, other jobs in (export) industries will be lost.

- Also with less disposable income, consumer spending will fall and there will be some decline in output in other sectors.

See also:

1 thought on “Benefits and costs of tariffs”

Comments are closed.