Readers question: What is Austerity?

Simple definition of Austerity

- Austerity involves policies to reduce government spending (or higher taxes) in order to try and reduce government budget deficits – during a period of weak economic growth.

Austerity policies are often associated with higher unemployment and lower economic growth.

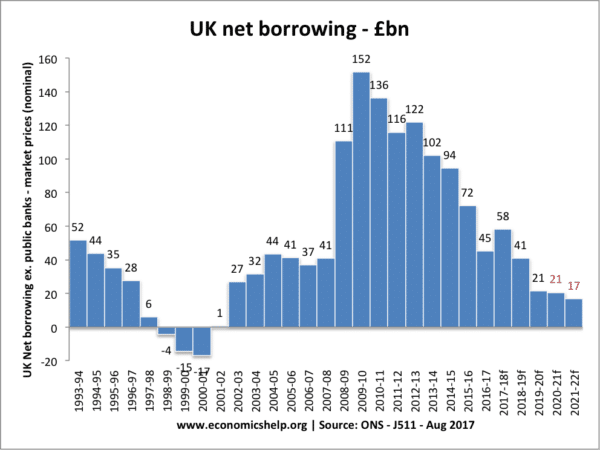

Austerity policies (and automatic stablisers) have reduced levels of government borrowing since 2010.

More complex points and definitions of austerity

The term austerity is more likely to be used when government spending cuts and higher taxes occur during a recession or period of very weak economic growth. Austerity implies that spending cuts and tax increases are highly likely to have an adverse impact on aggregate demand and economic growth. For example, if the government increased taxes during an economic boom, this would probably not be referred to as austerity. But, if the government cut spending during a period of negative growth, this would be referred to as austerity policies.

What constitutes actual austerity?

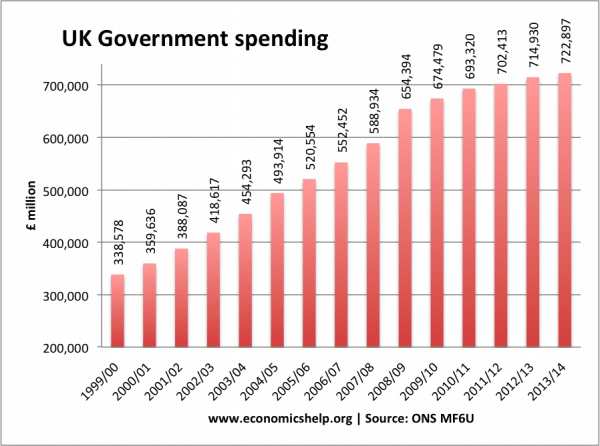

- A simple definition of austerity implies actual spending cuts. However, some may refer to austerity policies – even if there has just been a limit in the growth of government spending. For example, in the past 10 years, government spending may have increased on average by 3% in real terms. If the government now freezes public sector spending, this may be termed ‘austerity policies’ – because government spending is not increasing at the same rate as previously.

- Spending cuts – automatic stabilisers. Looking at the actual level of government spending could be misleading. In a recession, the government deficit will automatically increase – because of lower tax revenues and higher spending on unemployment benefits. If the government spend an extra £2bn on welfare benefits but cut public sector investment by £2bn, the overall impact on government spending would be zero – you could argue there is no actual austerity. However, because there has been a cut in spending on investment, this may be viewed as austerity. Another way to think about it is to look at the cyclically adjusted deficit. This is government borrowing adjusted for cyclical variations. If the cyclically adjusted deficit shrinks, this suggests austerity. (The Economist looks at structural budget deficits in Europe and argues there has been austerity in Europe)

- A failure to replace a fall in private sector spending. A Keynesian position might be that if there is a fall in private sector spending and a rise in the negative output gap, austerity are policies that fail to offset this drop in private sector spending and close the output gap. This is a very loose definition of austerity because it implies that austerity can occur – even if government spending increases but just fails to close the negative output gap.

- Failure to promote economic growth and close a negative output gap. Another way of looking at austerity is to examine the output gap. The government could be considered to be pursuing austerity when it fails to target higher growth and close the negative output gap. This is quite a vague definition of austerity.

- Austerity generally refers to fiscal policy – the government’s budget position. However, austerity implies policies which reduce aggregate demand and increase unemployment. In this case, tight monetary policy (high-interest rates) and an overvalued exchange rate (e.g. countries in Euro) could be seen as part of a general ‘austerity approach’ to the economy.

Reduced public services

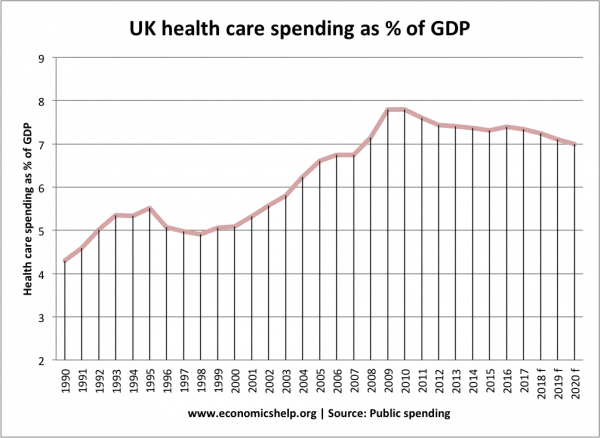

Austerity may refer to perceived cuts in public spending. For example, in the UK real spending on the NHS has increased. But, as a share of national income, it has fallen. Combined with increased demand for healthcare services (ageing population) users see increased pressure on health services and this is seen as an austerity policy.

Conclusion

There is no easy definition of austerity. A common feature of recent debates is for people to question the extent of austerity in Europe. For example, we could point to the fact that government spending hasn’t fallen in some countries – some economists ask – has there really been austerity? In the UK, the reduction in government spending is less than we might imagine (how much has spending been cut?). However, there are different degrees of austerity. Countries like Greece, Portugal and Spain have pursued very obvious austerity – let’s call it ‘Deep Austerity‘. In these countries, there has been a clear cut in real government spending and higher taxes in an attempt to reduce the structural deficit.

In other countries, there has been a less stringent form of austerity – let’s call it ‘austerity light’. Here government spending may not have fallen in real terms – or the fall may be very marginal. However, in these countries pursuing ‘austerity light’ – there has been an attempt to reduce spending government commitments; the net impact of the government’s fiscal position has been to reduce aggregate demand and limit the growth of real GDP. During austerity light, government spending may not fall across all departments, but usually, the changes in the government’s spending plans lead to a loss of public sector jobs and lower public sector investment. Importantly, this partial fiscal tightening has occurred during a depressed economy with a negative output gap.

Other Austerity Concepts

Self-defeating Austerity

The situation where austerity policies – spending cuts and higher taxes fail to reduce budget deficits. This is because spending cuts have a large negative impact on real GDP. Government spending cuts lead to lower aggregate demand and hence lower real GDP. The fall in real GDP causes tax revenues to fall and spending on welfare to increase. Therefore, despite spending cuts, there is no improvement in the budget situation because the spending cuts are outweighed by the increase in recession related borrowing.

Austerity and the Multiplier Effect

The impact of austerity depends on the multiplier effect. If government spending is cut by £1bn and real GDP falls by £2bn, we say there is a fiscal multiplier of two, and austerity is likely to cause a deeper recession. If government spending falls by £1bn and real GDP only falls £0.5bn, we say there is a fiscal multiplier of 0.5 and the impact of austerity policies is smaller.

See: fiscal multiplier and European austerity

Austerity Bomb

A rapid period of fiscal consolidation causing a sharp fall in real GDP. Austerity bomb

Definitions of austerity

In economics, austerity refers to a policy of deficit-cutting by lowering spending via a reduction in the amount of benefits and public services provided. Austerity policies are often used by governments to try to reduce their deficit spending and are sometimes coupled with increases in taxes to demonstrate long-term fiscal solvency to creditors. [wikipedia]

A state of reduced spending and increased frugality in the financial sector. Austerity measures generally refer to the measures taken by governments to reduce expenditures in an attempt to shrink their growing budget deficits. [Investopedia]

Could you come up with a better definition of austerity?

Which economists support austerity?

- Adam Smith warned of the dangers of Government Borrowing in Wealth of Nations (1776)

- David Ricardo suggested Ricardian Equivalence (also strengthened by Baro)

- “Treasury view” of 1929 – economists supporting balanced budget

- “expansionary austerity” (2010) Alberto Alesina, economist at Harvard

- Jean-Claude Trichet, President of the European Central Bank “The idea that austerity measures could trigger stagnation is incorrect,” (link to interview 2010)

- Economists supporting austerity are sometimes known as ‘Austerians’ According to Mark Thoma people say that budget cuts restore “confidence in the markets”

Evaluation of austerity

A key issue is the state of the economy which implements austerity and other policies which might be able to offset fiscal austerity. If we take Euro countries like Spain, Ireland, and Greece they cut government spending, but, they didn’t have the potential of loosening monetary policy, i.e. they have to cut government spending, but there is no interest rate cut, quantitative easing or depreciation in the exchange rate. They are relying on private investment and rise in exports. But given the size of budget cuts, the private sector is quite fragile.

- In the 1990s Canada cut spending and budget deficit but managed to enable high growth.

Related

External Links

- What is Austerity? – marginal revolution

- Europe’s Austerity madness – Krugman NY Times

3 thoughts on “What is Austerity?”

Comments are closed.