Readers Question: Does the level of real income grow as the economy grows? Can we say that real income grows as the economy grows? If yes, what factors surround it?

Summary

In a period of positive economic growth, usually, you would expect a rise in real wages and higher pay. However, it is not guaranteed. GDP measures wages, but also profit, interest and rent.

Therefore, it is possible for GDP to increase but average wages to stagnate and even decline. – e.g. if profit takes a bigger share of GDP.

- Economic growth means an increase in real GDP (Gross Domestic Product).

- GDP is a measure of National Income / National Output / National Expenditure.

National Income measure of GDP

- Wages and Salaries (compensation of employees)

- Rent

- Interest

- Profit

Economic growth and real GDP per capita

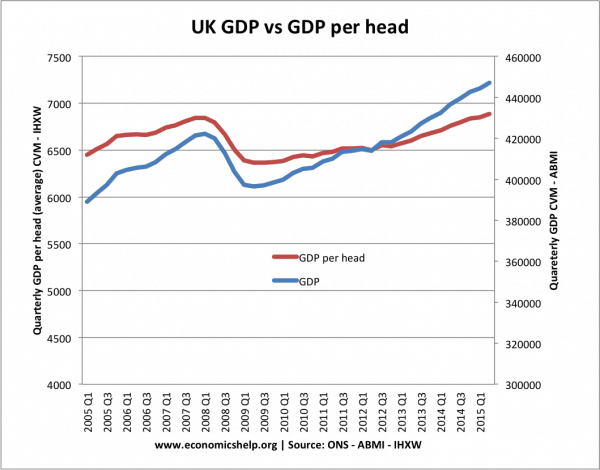

Another issue is that we could see a rise in real GDP caused by an increase in the population. If real GDP increases 2%, but the population increases 2%, then there will be no increase in GDP per capita and average real wages will stay the same.

Approx 33% of UK real GDP growth in past decade has been caused by population growth.

See: economic growth per capita

Rise in non-wage rewards

Another factor is that pay could be affected by non-wage rewards. Suppose firms became responsible for providing private health care insurance (like the US). Wages would be cut to enable healthcare payments. GDP would not be affected but workers would see lower pay. In recent years, UK firms have become more responsible for providing private pensions.

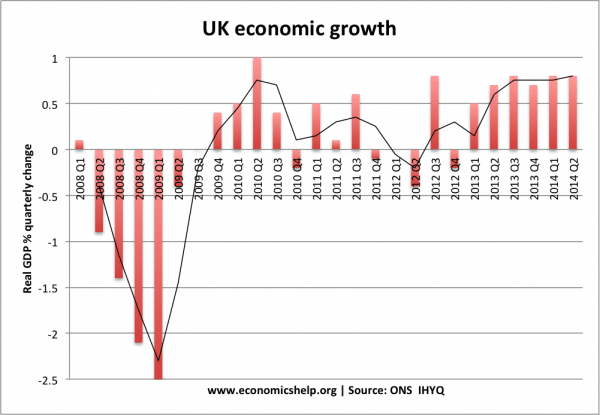

Economic growth but fall in average wages

It is possible economic growth could lead to a rise in company profit, but companies do not share this increase in profit with their employees.

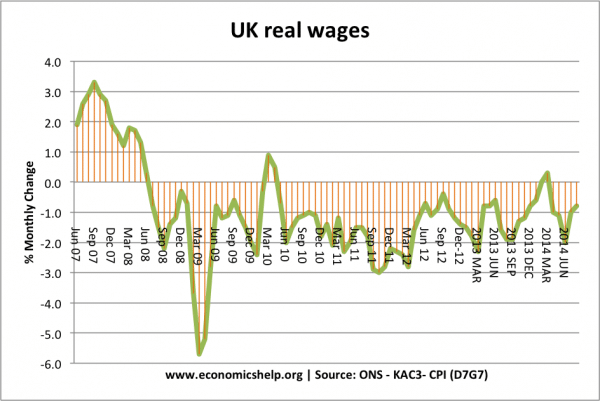

During the period 2010-2015, the UK experienced positive economic growth and rising real GDP, but average wages fell.

This was partly due to the nature of the labour market. Increased labour market flexibility and competitive pressures saw real wage growth decline. Company profit was taking bigger share of GDP.

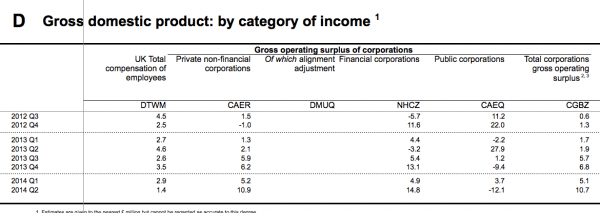

Evidence suggests that between 2012 and 2014 corporations were retaining more profit. The total corporations gross operating surplus increased over 10% in the 12 months to 2014 Q2. This suggests firms are increasing profitability but are reluctant to spend the increased profit

See: Economic growth with falling wages

Evaluation

- This experience of the UK – rising real GDP and falling wages is quite rare.In the post-war period, the UK’s economic growth led to rising real wages. Also, if you look at other economies with economic growth in this period, e.g France and Germany, wages are rising. (FT)

The UK paradox is explained by several factors:

- Population growth causing higher GDP, but not higher GDP per capita.

- Rising in the share of profit retained by firms.

- Flexible labour markets putting downward pressure on wages.

- Fall in unemployment but enabled by low wage jobs/part-time job.

- Low productivity growth. With low productivity, firms are keeping wages correspondingly low.

- Cost-push inflation reducing real wages.

- Rise in non-wage benefits (private pensions/healthcare)

GDP statistics only tell part of the story

This is an important development because GDP and economic growth is the primary economic statistic. The government can point to rising GDP in recent years. Yet, for many people, this rise in GDP may feel alien or not applicable to their situation. They don’t see the effects of this economic growth – they see stagnating real wages, rising prices and poor employment prospects.

Related

“This is an important development because GDP and economic growth is the primary economic statistic”

This comment, and the analysis behind it, begs very serious related questions for society:

1) What is the purpose of facilitating cooperative economic activity in a population?

2) In a democracy of real people, what is the overriding goal of government?

3) If the answer to 1) & 2) is to improve the general level of individual welfare of real people through the facilitating actions of government, and if GDP does not unequivocally function as a reliable KPI for the fulfilment of that mandate then how do the real people whom it is that government serves (not the legal persons, rentiers and market speculators) call them to account and force the adoption of relevant and appropriate management and governance practices?

I would suggest we start teaching methods of analysis based on modern developments of Smith and Ricardo’s cost+ pricing theorems, rather than J S Mills abdication (cf “.. Mills Reversion..” Y Shiozawa, Springer 2019) in that area. When he gave up and reverted to the wholly ‘out of this world’ assumptions of the simplistic and rentier-biased demand and supply fantasy, he endorsed with his considerable authority development of what became the neo-classical branch of economics and generations of similarly self-congatualtory bright people who went on to build their careers on defending the quicksand of their mutual appreciation of what was increasingly clearly nothing but a fairy tale. Useful like most are, as a morality story to a small section of society. That section’s vested interest was served by defending the ‘fake facts’ it produced, and they had control of the resources to ensure the defence succeeded. Even from the 1940’s onwards when challenges from Keynes (early days), Sraffa, Leontief, Hayek began to show how new mathematical tools could achieve what J S Mill had failed to do. Over the last 10 years those tools and many of the necessary theorems and their application to the ‘problem’ have begun to bear fruit (“Microfoundations of Evolutionary Economics” 2019 Y Shiozawa, Springer; ALSO: to be published 2020 “A new framework for analyzing technological change” Y Shiozawa).

succinctly.. “..the new theory of value… …explains how technological change leads to long-run improvement in real wage rates and income per capita. “. The key being that neo-classical and neo-liberal theory is totally unable to explain the “how” by which technological change comes about and how that leads directly to growth through the actions of firms. This is largely because equilibrium-seeking models of pricing cannot provide the necessary framework for incorporating ‘time’ as a necessary linear component of ‘growth’.