In terms of public spending, a deficit is the annual shortfall between spending and tax revenues. Debt is the total amount outstanding to holders of the government’s debt.

Definition of deficit and debt

- Deficit refers to the annual borrowing requirement of the government. (often referred to as budget deficit – or annual net borrowing)

- Debt related to the total level of public sector debt built over previous years. (often referred to as national debt/public sector debt)

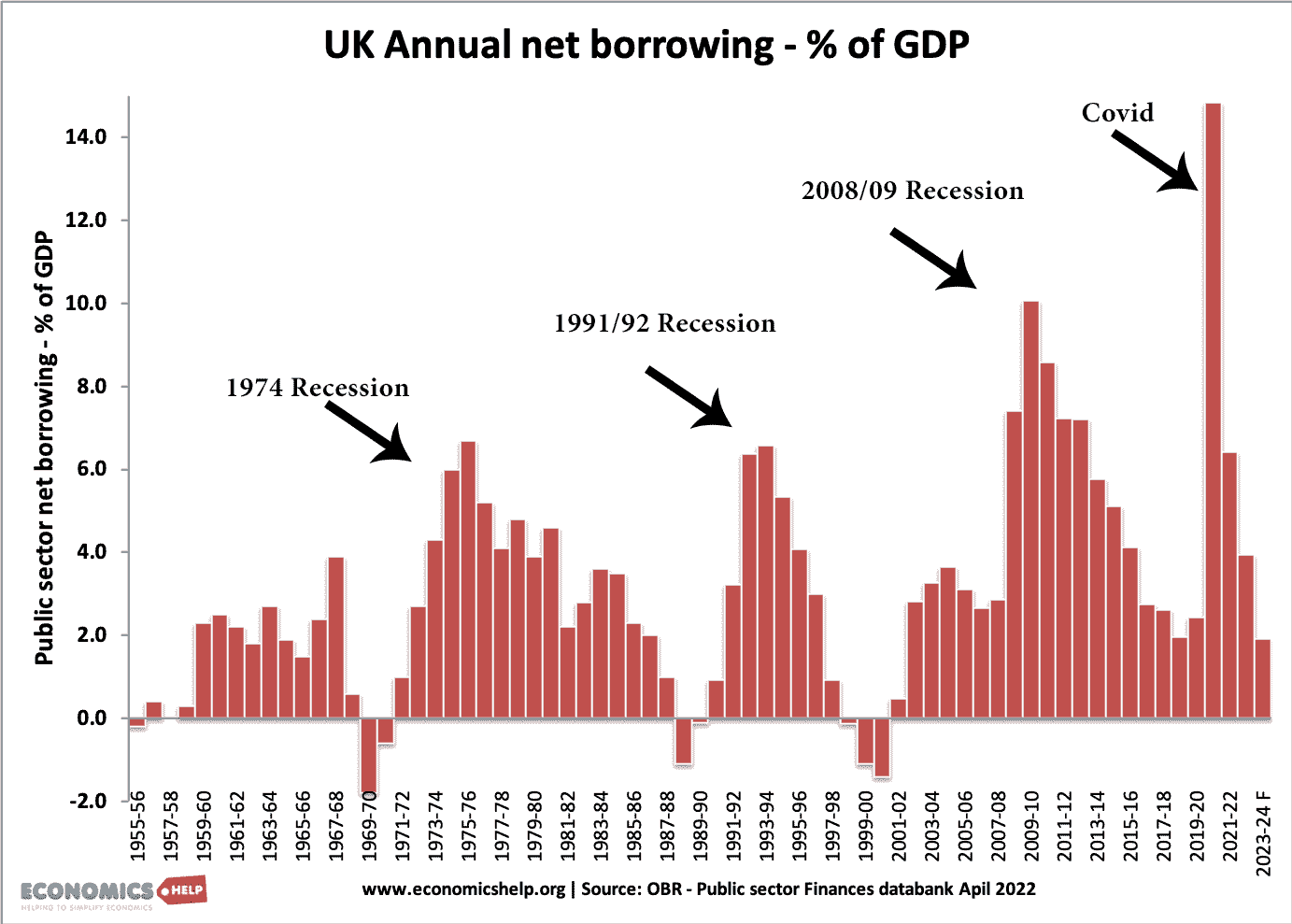

Budget deficit – net borrowing

This graph shows the annual amount the government have to borrow. In recessions, there is a sharp rise in the annual deficit.

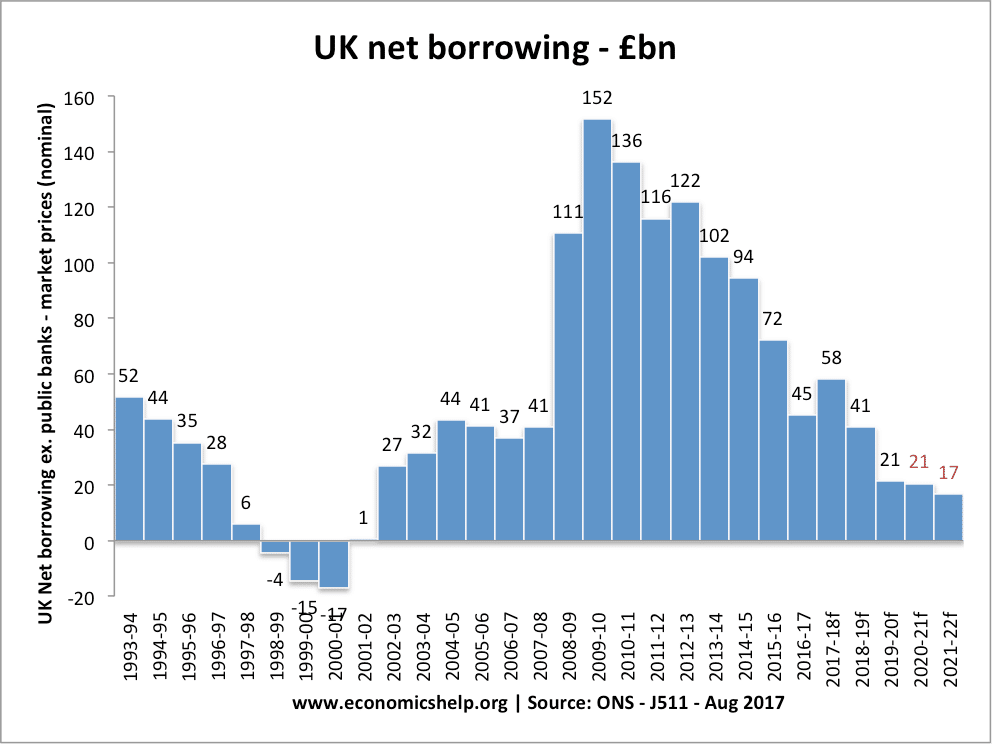

This is the deficit expressed in monetary terms, e.g. in 2008/09, the budget deficit was £152bn.

- Public sector net borrowing (PSND) – annual borrowing requirement

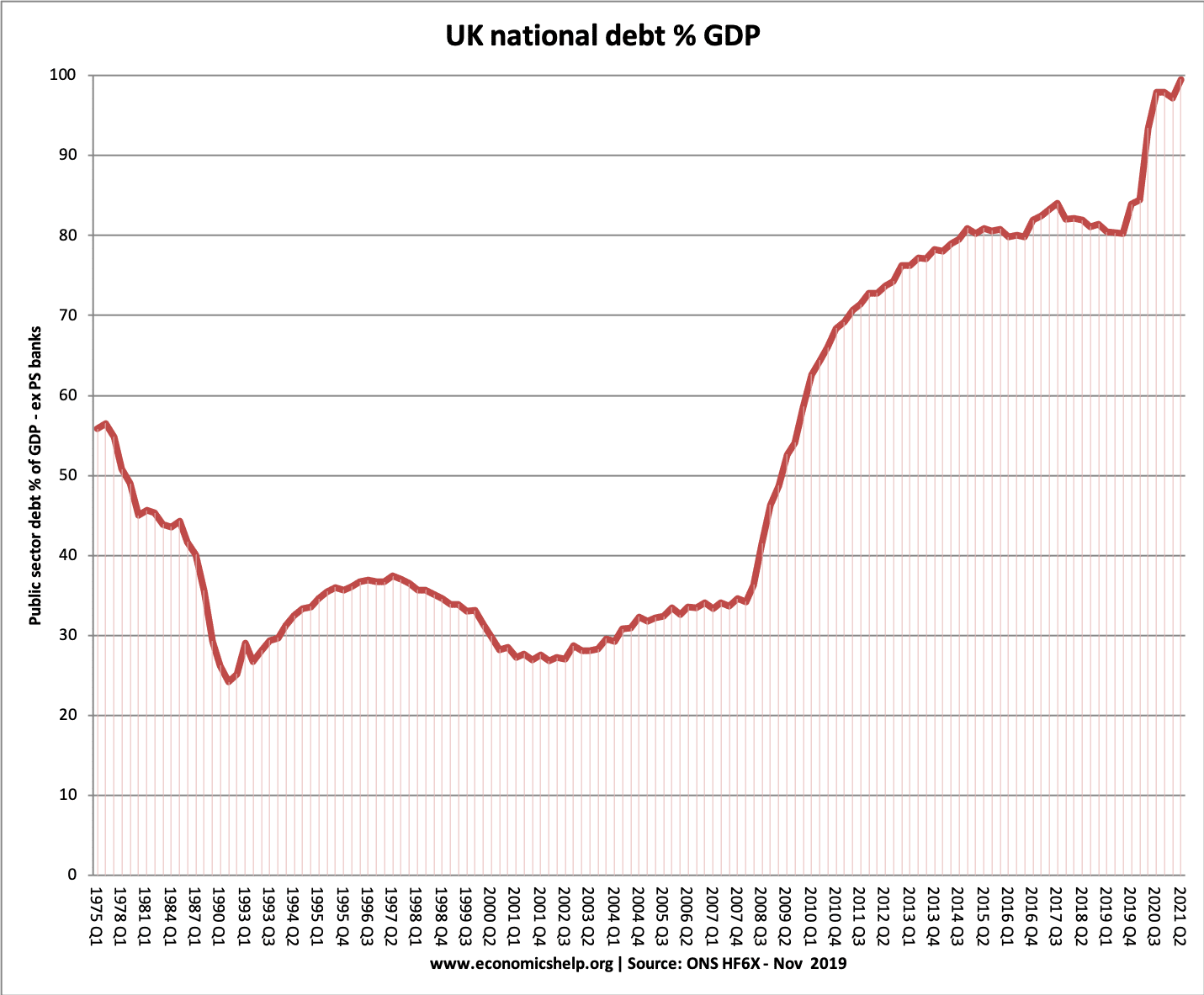

Net debt

This is net public sector debt as a % of GDP since 1975. Note. Even with a budget deficit, total debt can fall because of economic growth and rising GDP.

Deficit falling but debt rising

It is possible for the annual deficit to fall, but debt to continue to rise.

In 2012/13, the UK deficit was £122bn. In 2013/14 this fell to £102bn. So the deficit was lower, but the debt still increased by £102bn.

Which is most important?

Both are important. Markets will look at both annual deficits and total public sector debt in determining the creditworthiness of a government

- A high public sector borrowing requirement means there will be a rapid increase in total debt. Markets may feel this rapid increase in debt means the government may struggle to keep up and meet interest payments.

- However, a low public sector debt gives a government more room for manoeuvre.

Markets will also look at:

- The average maturity of government bonds – how soon do the government have to refinance debt?

- How much debt is funded by oversees?

- What are forecasts for economic growth and future tax revenues?

Another potential confusion is between a budget deficit (government spending greater than tax revenues) and the trade deficit (imports greater than exports) See: Government debt and trade deficit

Related

- UK National Debt

- Public Sector finances at ONS

- Many EU countries have higher levels of public sector debts. See: List of national debt by country

I was interested in the difference between overall budget deficit, primary deficit and sovereign debt level In addition to current account deficit