Definition of crowding out – when government spending fails to increase overall aggregate demand because higher government spending causes an equivalent fall in private sector spending and investment.

Question: Why does an increase in public sector spending by the government decrease the amount the private sector can spend?

If government spending increases, it can finance this higher spending by:

- Increasing tax

- Increasing borrowing

Impact of higher government spending on aggregate demand

- Increasing tax. If the government increases tax on the private sector, e.g. higher income tax, higher corporation tax, then this will reduce the discretionary income of consumers and firms. Ceteris paribus, increasing tax on consumers will lead to lower consumer spending. Therefore, higher government spending financed by higher tax should not increase overall AD because the rise in G (government spending) is offset by a fall in C (consumer spending).

- Increasing borrowing. If the government increases borrowing. It borrows from the private sector. To finance borrowing, the government sell bonds to the private sector. This could be private individuals, pension funds or investment trusts. If the private sector buys these government securities they will not be able to use this money to fund private sector investment. Therefore, government borrowing crowds out private sector investment.

Resource crowding out

The second type of crowding out is simply the fact that if the private sector lends money to the government they have less money to invest in private sector projects.

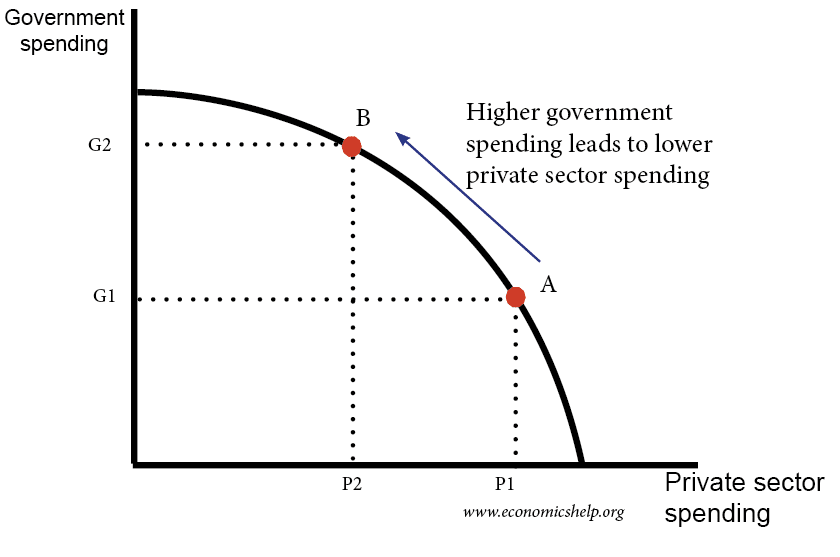

A production possibility frontier is useful for showing the idea of crowding out. If we are on the PPF curve at Point A and we increase government spending it leads to fall in private sector spending.

Furthermore, it is argued that the private sector investment tends to be more efficient than the public sector investment. Therefore, the economy is worse off for government borrowing.

Financial crowding out

This is the term used to describe how government borrowing can cause higher interest rates. If the government needs to sell more securities, it may have to increase interest rates on its bonds to attract people to buy. For example, in the EU, bond yields rose in 2011 because markets were worried about levels of EU debt. Therefore, the increased government borrowing was at the expense of higher interest rates on government debt. These higher interest rates on bonds lead to higher interest rates elsewhere in the economy and are likely to discourage private sector investment and spending.

Crowding out doesn’t always occur

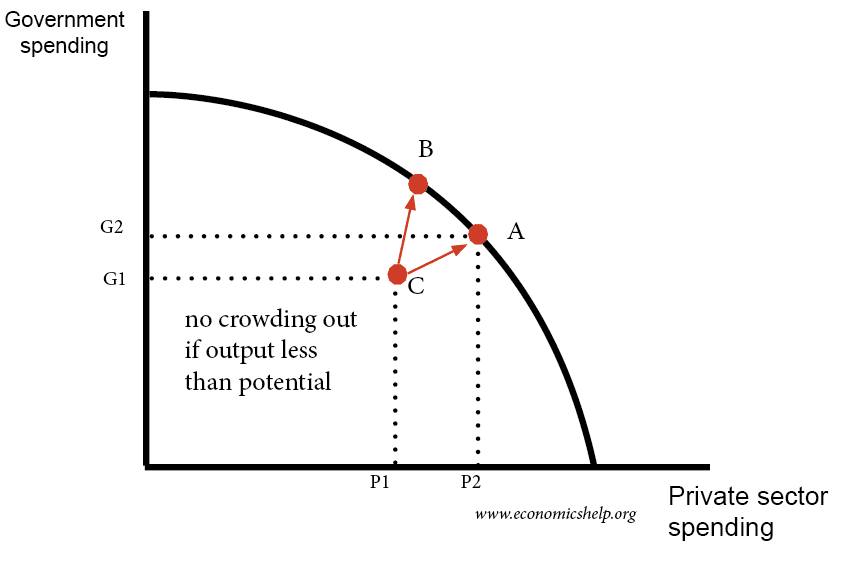

It is important to bear in mind crowding out doesn’t always occur – it depends on the state of the economy.

- If the economy is below full capacity, then we can have more government spending and more private sector spending.

Keynesians again argue that in a recession and liquidity trap, there is no crowding out because the government is merely spending unused resources. Keynesians argue that in a liquidity trap the LM curve is elastic. This means increased government spending doesn’t increase interest rates.

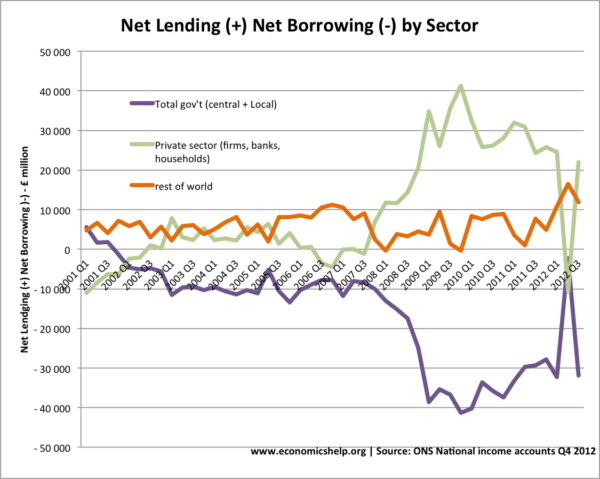

Another way of thinking about a recession is that the rise in government borrowing is merely to offset the rise in private sector saving.

This graph shows that in 2008-2012, there is a sharp rise in private sector saving. This is matched by an equivalent rise in government borrowing.

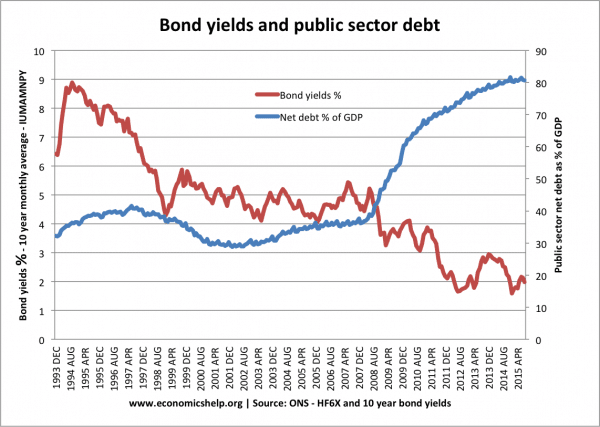

Crowding out and bond yields

In a recession, the government can often borrow more without interest rates rising. For example, in the UK 2009-13, despite higher borrowing – bond yields fell because people wanted to save money in bonds rather than invest. Therefore, there was no financial crowding out.

Also, as Keynes argued – in a recession – the private sector has idle resources (due to more saving). Therefore, government borrowing is effectively making use of these idle resources. Financial crowding out is more likely to occur when the economy is growing and is close to full capacity already.

Depends on the state of the economy

When the economy is growing strongly, the government will have more competition from other private sector investments. Therefore government bonds yields will have to rise to attract savings from other investment projects.

Economists who have suggested Crowding Out

Milton Friedman was generally dismissive of expansionary fiscal policy. He argued that, although there may be a temporary boost, in the long-term debt-financed government spending would cause crowding out. Milton Friedman noted that debt supported government spending leads to “a reduction in the physical volume of assets created because of lowered private productive investment.” (Crowding Out)

Frank Knight. Knight is credited with the theory that demand for investment is interest-elastic. Therefore, even a very small increase in interest rates (from financial crowding out) could cause a very large fall in private sector investment.

John M Keynes. In his General Theory, Keynes stated that if the economy was close to full capacity expansionary fiscal policy would cause crowding out.

Robert Baro. Baro is credited with developing the theory of Ricardian equivalence. The idea public debt issuance is equivalent to higher taxes – i.e. deficit spending is very limited in increasing real GDP.

Related

- How much can a government borrow?

- The multiplier effect

- Criticisms of fiscal policy

- Deficits and the Future – Paul Krugman – why crowding out won’t occur in a liquidity trap.

Crowding out is caused by the fact of the government – central bank machine borrowing in order to spend. Since no one seems to have the faintest idea how serious a problem crowding out is, there is a phenomenally simple solution to this “problem”: DONT BORROW !

In other words, since the the government – central bank machine can simply print money, why not just “print and spend” instead of “borrow and spend”. Problem solved !

Indeed, this is more or less what the UK authorities did in 2009. Trouble was that they handed too much of the money to the UK equivalent of Wall Street rather than the UK equivalent of Main Street.

How crowding out can be reduced?

Spending to sector or economic agents where is in deficit. They have more capacity to enhace demand. If this don´t happen, the spent Money will go to the superavit firms or household who cannot improve demand.

It helpful n each every details,thank you

Tejvan, your explanations are incredibly helpful. Thank you very much

Which one of the following is a reason the crowding-out effect could be mitigated?

a. deficit spending used for public investment

b. an increase in the saving rate

c. a decrease in tax revenues

d. an increase in consumer consumption

Crowdińg out might have a negative impact on goverment budget and infustructual development agencies ……Every attribution is entailed for the perspectives of Natural being and human health towards building a sustainable future for everyone without intervening with constitutionalized

rapid inflation rate propaganda.

how an increase in government spending may lead to a crowding out effect.