The UK national debt is the total amount of money the British government owes to the private sector and other purchasers of UK gilts (e.g. Bank of England).

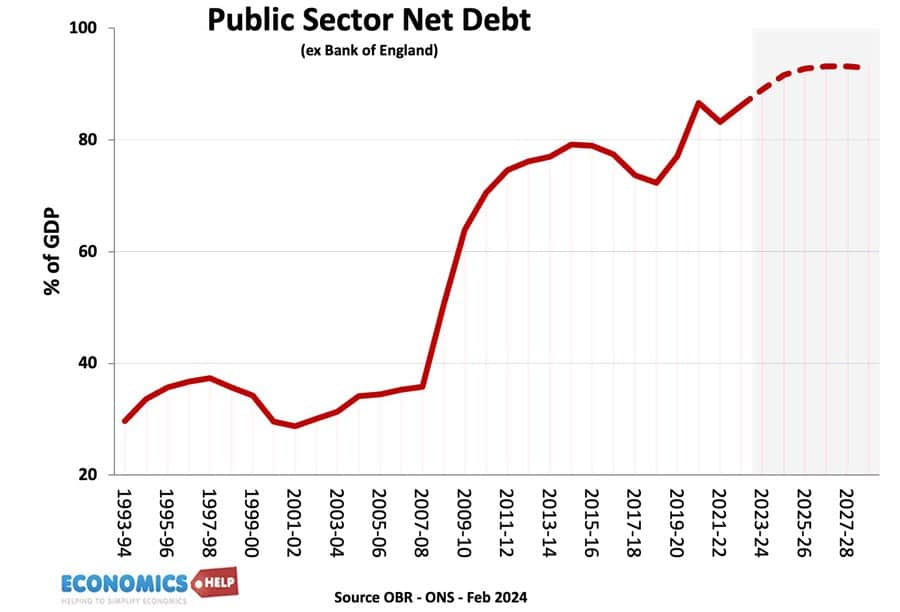

- In Jan 2024, UK public sector net debt was £2,685.6 billion or 97.7% of GDP

- This is the highest level of public sector debt since 1961.

- The OBR have forecast substantial rises in UK debt over the coming decade because of demographic factors, putting strain on UK spending.

- Source: [1. ONS public sector finances,- HF6X] (page updated 13 Feb 2024)

Source: ONS debt as % of GDP – HF6X | PUSF – public sector finances at ONS

Reasons for National debt

- Enables the government to spend more during periods of national crisis, e.g wars, pandemics, and recessions.

- In a recession, the government will automatically receive lower tax revenues (less VAT and income tax) and will have to spend more on benefits (e.g. more unemployment benefits) This causes a cyclical rise in debt.

- Extra government borrowing during a recession can help provide fiscal stimulus to promote economic recovery. By borrowing and then spending more, the government is injecting demand into the economy and this can help to reduce unemployment. This is known as fiscal policy and was advocated by J.M. Keynes.

- Strong market demand for government debt. Private investors buy gilts because they are seen as risk-free investments and there is also an annual dividend from the bond yield. Since 2009, there has been strong demand despite very low-interest rates, meaning the government can borrow very cheaply.

- Finance investment. The government could borrow to finance public investment projects that can lead to higher growth in the future.

- Political convenience. There is usually political pressure to cut taxes and increase government spending. Allowing debt to rise can be a way for the government to avoid difficult choices.

Forecast for the National debt?

Source: Fiscal risks and sustainability – OBR

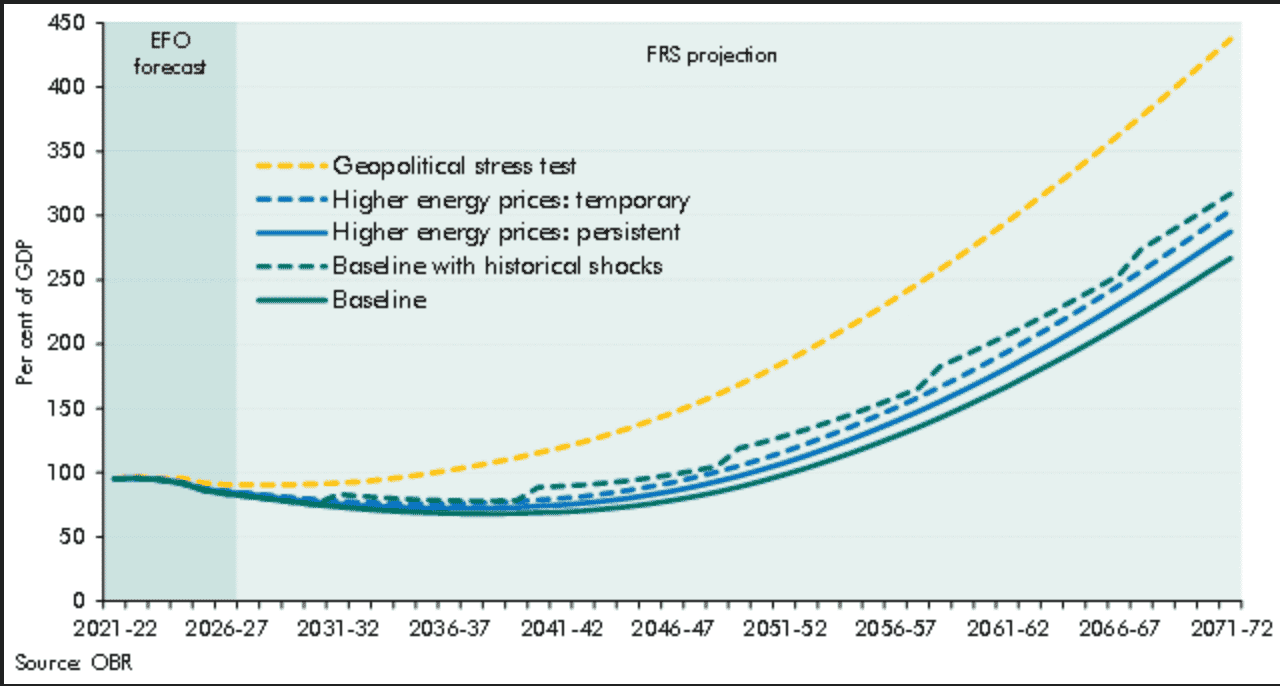

The OBR have forecast that, on our given trajectory, UK public sector debt could reach 350% of GDP within 50 years. The pessimistic outlook for national debt is made because

- An ageing population and demographic changes will put increased pressure on government spending, notably health care and pension spending.

- A smaller working population will limit UK’s productive capacity.

- Stress on finances from geopolitical events, such as frostier relations with China, Russia and the Middle East.

- Higher energy prices

- Costs of climate change.

- Declining tax revenues from petrol in a decarbonising economy.

- Low productivity growth of UK since the financial crash of 2009

- Recent boost to debt from the financial crisis and one-off cost of Coronovirus pandemic, which cut tax revenues and required government support for lockdown measures.

UK debt in context

Predicting debt for the next 50 years is difficult since we don’t know what kind of productivity improvements may come, e.g. continued gains in renewable energy may reduce the burden of higher oil and gas prices. Equally, the costs of environmental change could be worse.

History of the national debt

Main article: History of UK national debt

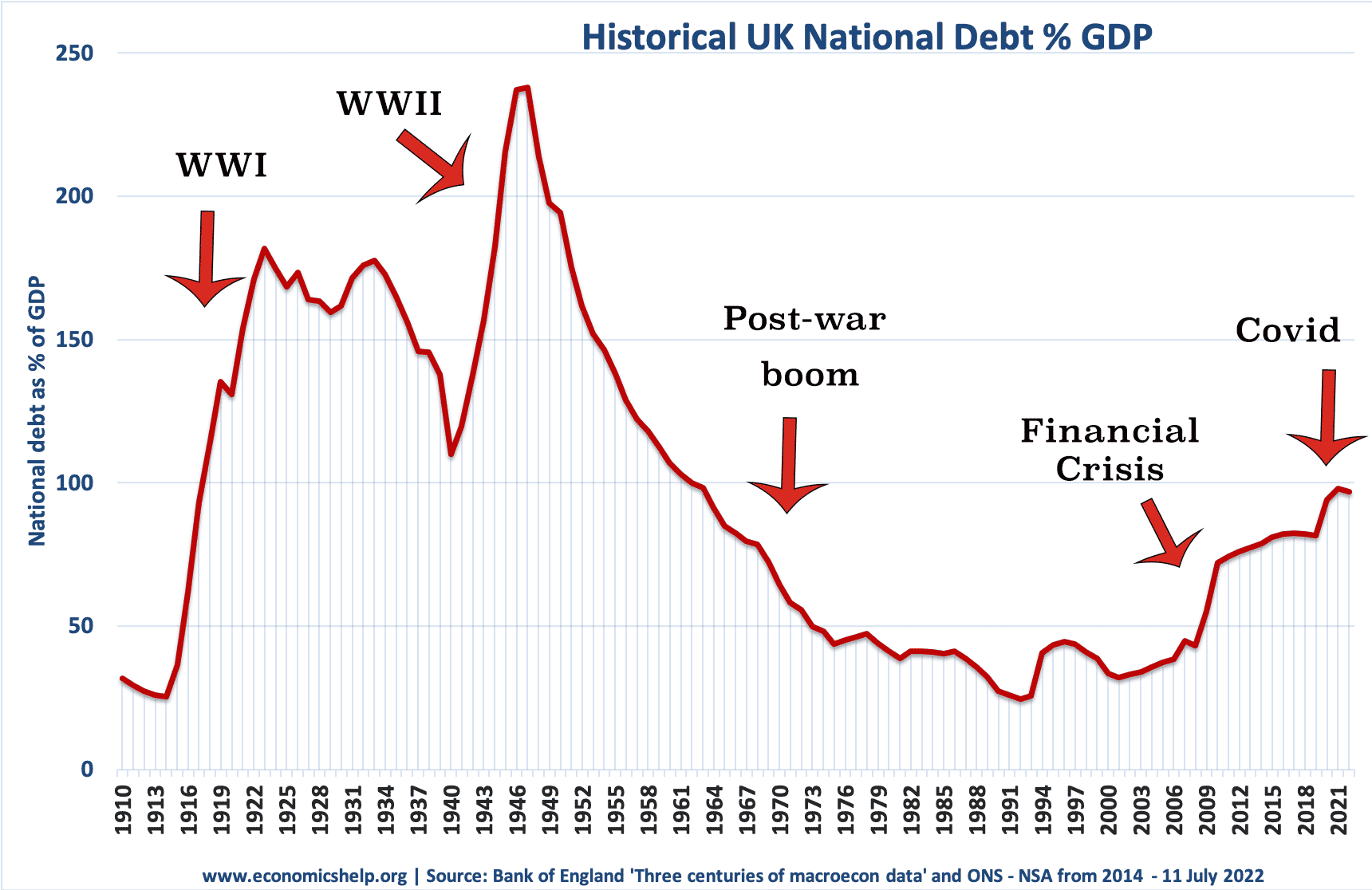

UK national debt since 1900

Source: Reinhart, Camen M. and Kenneth S. Rogoff, “From Financial Crash to Debt Crisis,” NBER Working Paper 15795, March 2010. and OBR from 2010.

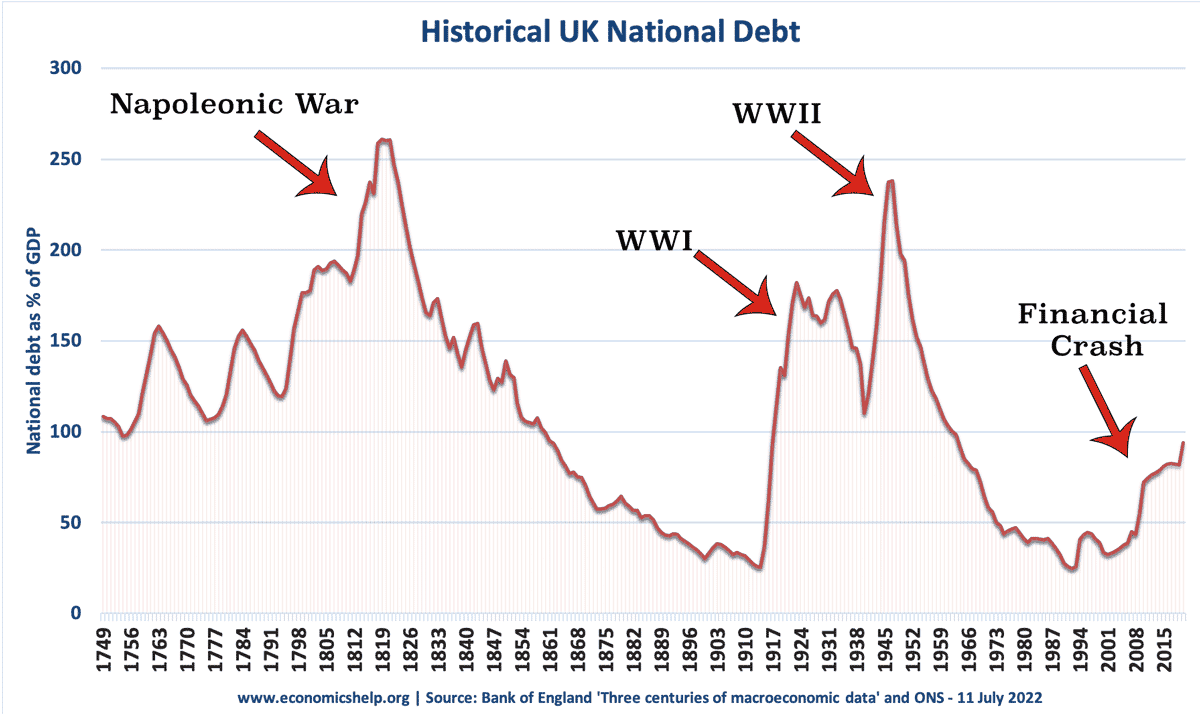

These graphs show that government debt as a % of GDP has been much higher in the past. Notably in the aftermath of the two world wars. This suggests that current UK debt is manageable compared to the early 1950s. (note, even with a national debt of 200% of GDP in the 1950s, UK avoided default and even managed to set up the welfare state and NHS.

Debt reduction and growth

The post-war levels of national debt suggest that high debt levels are not incompatible with rising living standards and high economic growth.

- The reduction in debt as a % of GDP 1950-1980 was primarily due to a prolonged period of economic growth. See: how the UK reduced debt in the post-war period

- This contrasts with the experience of the UK in the 1920s when in the post First World War, the UK adopted austerity policies (and high exchange rate) but failed to reduce debt to GDP. Debt in Post-First World War period.

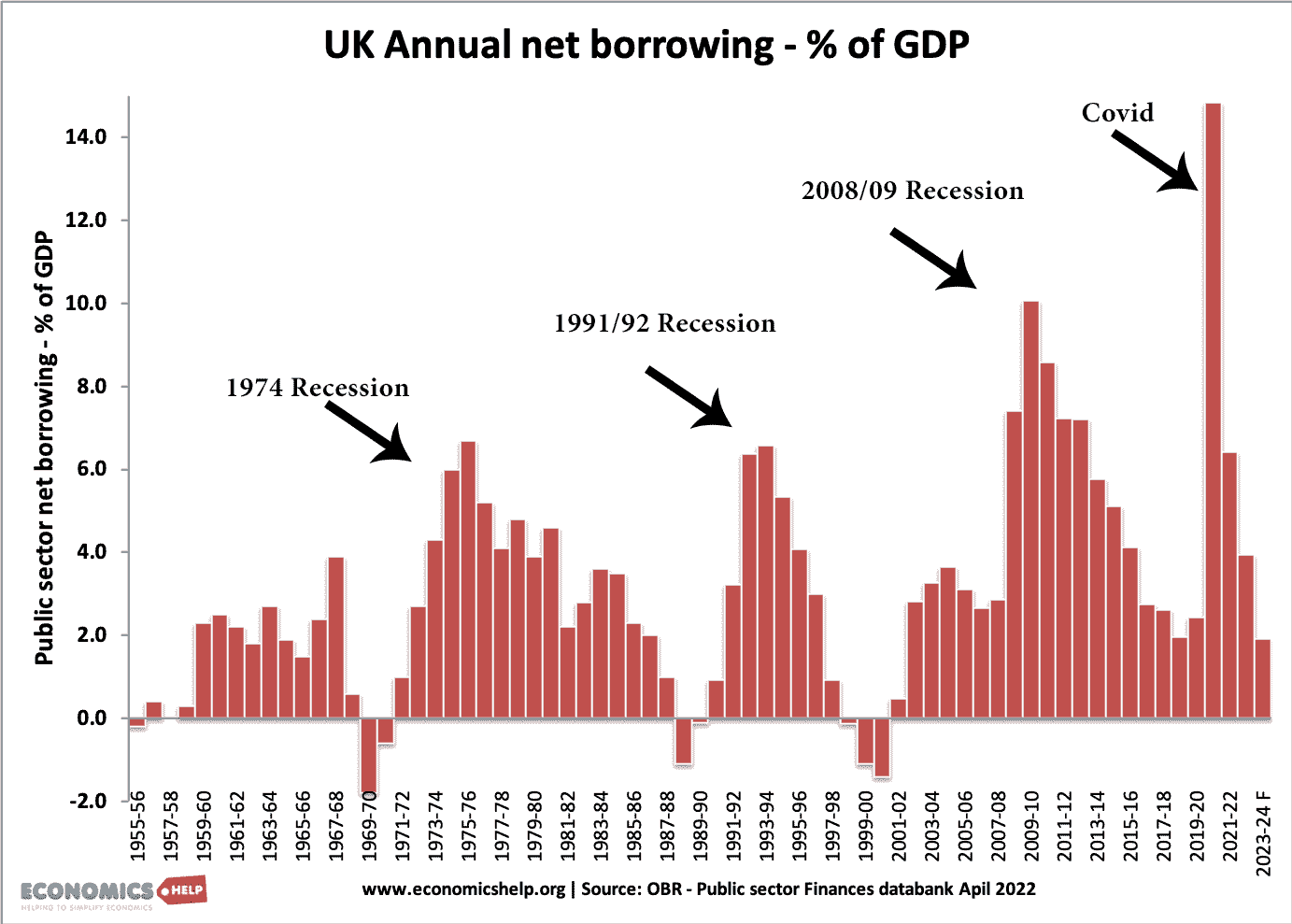

Budget deficit – annual borrowing

This is the amount the government has to borrow per year.

- In the financial year of 2021, PSNB ex was estimated to have been £146.8 billion.

Annual borrowing since 1950. Figures for 2023-24 are forecasts (and rather optimistic!)

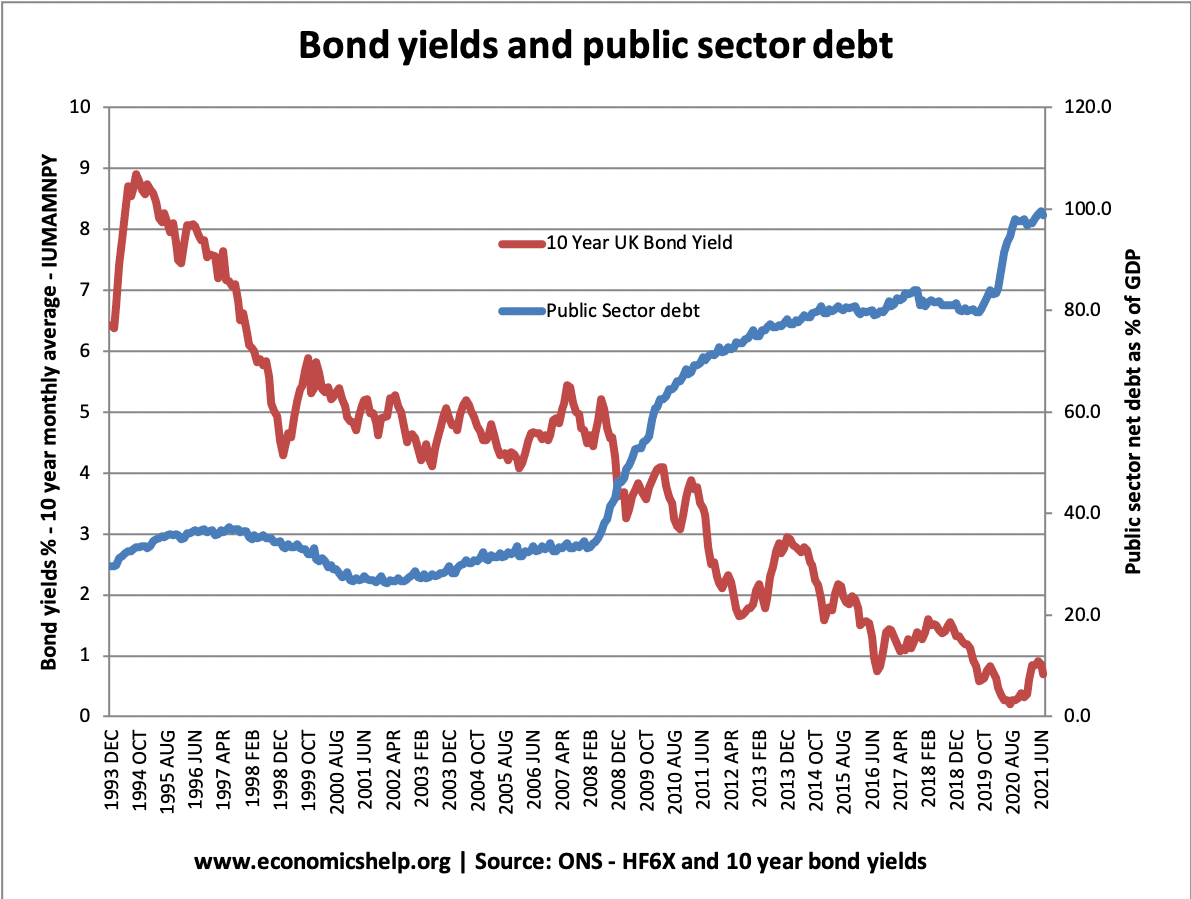

Debt and bond yields

Bond yields a the interest that the government pay bond/gilt holders. It reflects the cost of borrowing for the government. Lower bond yields reduce the cost of government borrowing.

Since 2007, UK bond yields have fallen. Countries in the Eurozone with similar debt levels saw a sharp rise in bond yields putting greater pressure on their government to cut spending quickly. However, being outside the Euro with an independent Central Bank (willing to act as lender of last resort to the government) means markets don’t fear a liquidity crisis in the UK; Euro members who don’t have a Central Bank willing to buy bonds during a liquidity crisis have been more at risk to rising bond yields and fears over government debt.

See also: Bond yields on European debt | (reasons for falling UK bond yields)

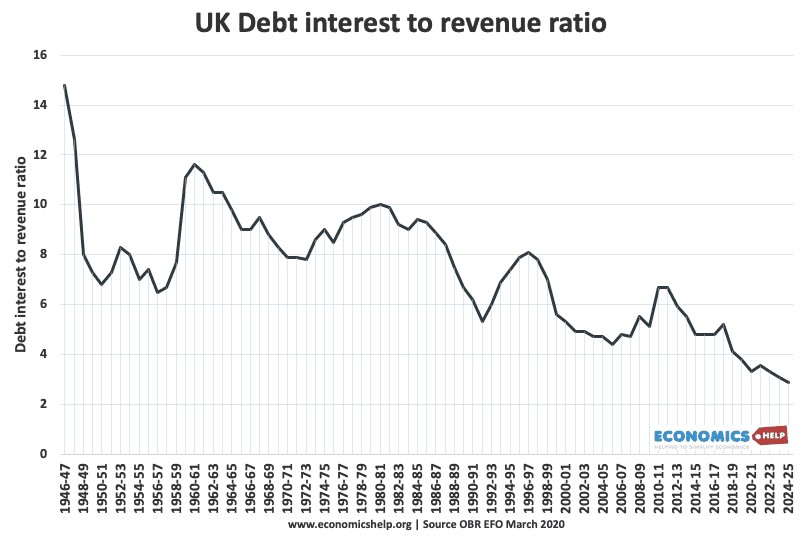

Cost of Interest Payments on National Debt

The cost of National debt is the interest the government has to pay on the bonds and gilts it sells. According to the OBR in 2022-23, debt interest payments will be £83 billion. (2.5% of GDP) or 5.2% of total spending. It is lower than in previous decades because of lower bond yields.

See also: UK Debt interest payments

The era of low interest rates post 1992 has helped to reduce UK debt interest payments as a ratio of government revenue. However, with interest rates and borrowing set to soar (2022/23, these predications will need to be revised upwards considerably.

Potential problems of National Debt

- Interest payments. The cost of paying interest on the government’s debt is very high. In 2011 debt interest payments will be £48 billion a year (est 3% of GDP). Public sector debt interest payments will be the 4th highest department after social security, health and education. Debt interest payments could rise close to £70bn given the forecast rise in national debt.

- Higher taxes / lower spending in the future.

- Crowding out of private sector investment/spending.

- The structural deficit will only get worse as an ageing population places greater strain on the UK’s pension liabilities. (demographic time bomb)

- Potential negative impact on the exchange rate (link)

- Potential of rising interest rates as markets become more reluctant to lend to the UK government.

However, government borrowing is not always as bad as people fear.

- Borrowing in a recession helps to offset a rise in private sector saving. Government borrowing helps maintain aggregate demand and prevents a fall in spending.

- In a liquidity trap and zero interest rates, governments can often borrow at very low rates for a long time (e.g. Japan and the UK) This is because people want to save and buy government bonds.

- Austerity measures (e.g. cutting spending and raising taxes) can lead to a decrease in economic growth and cause the deficit to remain the same % of GDP. Austerity measures and the economy | Timing of austerity

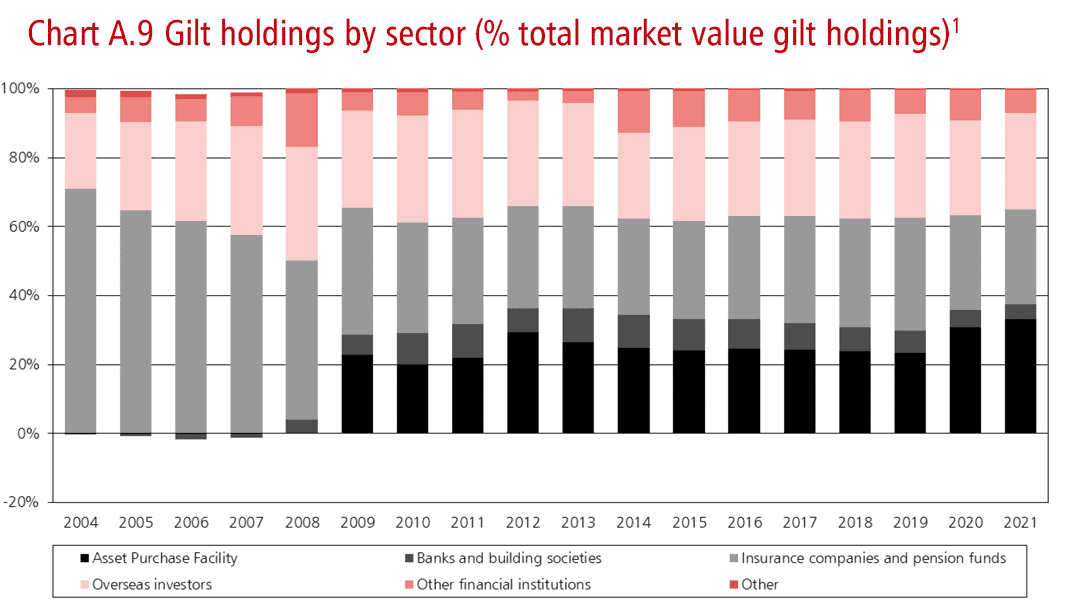

Who owns UK Debt?

The majority of UK debt used to be held by the UK private sector, in particular, UK insurance and pension funds. In recent years, the Bank of England has bought gilts taking its holding to 25% of UK public sector debt.

Source: DMO Debt Management Report 2022/23

- Overseas investors own about 28% of UK gilts (2022).

- The Asset Purchase Facility is purchases by the Bank of England as part of quantitive easing. This accounts for 26% of gilt holdings.

Total UK Debt – government + private

- Another way to examine UK debt is to look at both government debt and private debt combined.

- Total UK debt includes household sector debt, business sector debt, financial sector debt and government debt. This is over 500% of GDP. Total UK Debt

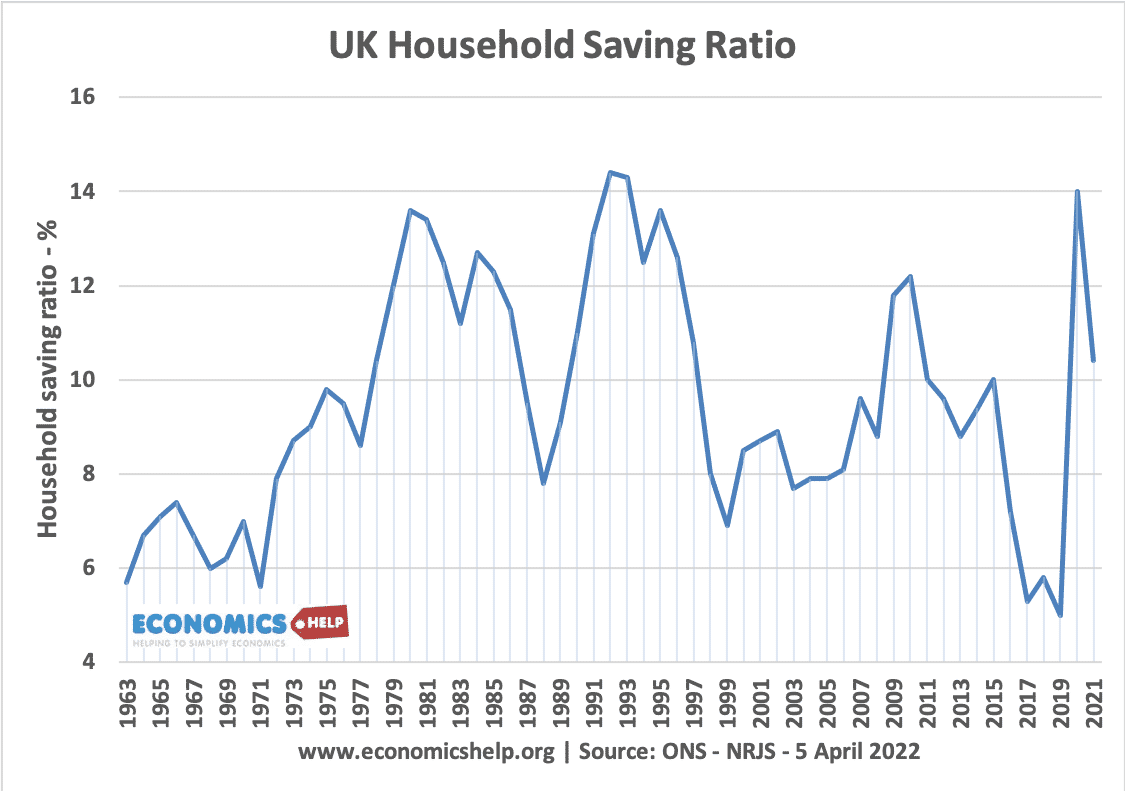

Private sector savings

When considering government borrowing, it is important to place it in context. From 2007 to 2012, we have seen a sharp rise in private sector saving (UK savings ratio). The private sector has been seeking to reduce their debt levels and increase savings (e.g. buying government bonds). This increase in savings led to a sharp fall in private sector spending and investment. The increase in government borrowing is making use of this steep increase in private sector savings and helping to offset the fall in AD. see: Private and public sector borrowing

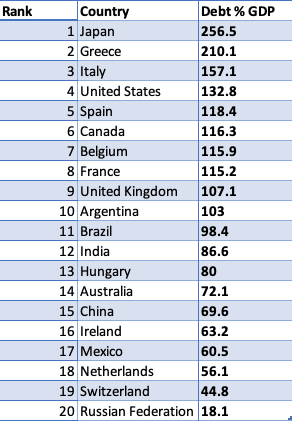

Comparison with other countries

Although 107% of GDP is high by recent UK standards, it is worth bearing in mind that other countries have a much bigger problem. Japan, for example, has a National debt of 256%, Italy is over 157%. The US national debt is over 132% of GDP. [See other countries debt].

How to reduce the debt to GDP ratio?

- Economic expansion which improves tax revenues and reduces spending on benefits like Job Seekers Allowance. The economic slowdown which has occurred since 2010 has pushed the UK into a period of slow economic growth – especially if we consider GDP per capita growth. Therefore the further squeeze on tax revenues has led to deficit-reduction targets being missed.

- Government spending cuts and tax increases (e.g. VAT) which improve public finances and deal with the structural deficit. The difficulty is the extent to which these spending cuts could reduce economic growth and hamper attempts to improve tax revenues. Some economists feel the timing of deficit consolidation is very important, and growth should come before fiscal consolidation.

- See: practical solutions to reducing debt without harming growth

Other countries debt

See also:

why cant we just printmore money to pay of the debt were in its not that hard to press a BUTTON and print out a few billion

Printing money causes inflation

“Printing money causes inflation” – Therefore the QE2 must cause more inflation?

It’s not as simple as that. Increasing monetary base during recession may cause only very limited inflation because banks are still reluctant to lend.

https://www.economicshelp.org/blog/111/inflation/money-supply-inflation/

Not necessarily, increasing monetary base may cause little inflation in a liquidity trap.

katie, there are huge problems with that, including all the problems that go along with inflation and distrust from the global community. It would probably be a wiser choice to just file bankruptcy/default, at least then you only have to deal with the distrust from the global community.

Its a tragedy that successive governments have let the UK get into this situation – it seems to me that every country is hugely in debt and its difficult to see how we truly stand, does anyone know of some stats on this – is see 35% of our debt is owned by foreign investors, but how much of other countries debt do we own?

“Its a tragedy that successive governments have let the UK get into this situation”

What is far more of a tragedy is that we let them.

People dont help,when in a tight corner they run plus we have sponger the world over here soaking the sytem and then have to pay the currupt gravy train eec.

Have read many of the these comments I do find most fundermentally flawed.

For example : We seem to compare the UK fiscal debt policies of that to other countries like Japan.

Yes indeed Japan has a large debt ratio that is high, however all of the debt is funded internally ie japanese nationals buy the Japanese bonds of the governement and these people are the main holders of these bonds.

Therefore the japanese people are the main holders of these bonds.

Also the japanese have the largest cash reserves in the world and also hold 300 trillion in reserves overseas infact they are the worlds largest creditor…

The US is one of its largest debtors.

Also the Japanese economy has a huge export advantage so their balance of payments is very strong.

The UK however finances most of its debts form overseas investors and has has simply mis managed the fiscal strategies of the markets.

The government has relied to heavily on borrowing maoney to stimilate the economy which is why the UK is in this awfull mess.

The bankers of course have been reckless howver if the the cheif whip is saying here is the money and its cheap and its going to be cheap for a longtime.

The debt levels of the UK are so dangerous that the UK governement is living in Denial.

We have simply maxed out all our credit lines and now are borrowing more just to fund the interest payments on the debt.

The Euro crisis will inevitably have a massive impact on the UK when I suspect German will leave the Euro as it can no longer go on funing the PIGS.

This in effect will of course cause problems for the UK as Europe is our neighbour and the banks are highley exposed to the eurozone.

Will there be more bank failures… Yes …

Will the government be able to nationalise all the banks … Probally.

What Impact will that have for the average joe…

Well we would see a large rise in taxes and much further cuts to public spending we could even see the UK defaulting on its debts and turning to the IMF for help.

Of course the current government do want to bring this up now as they are just putting plasters on a pipe which is springing leaks everywhere, how long can the plasters last before the pipe bursts…

We have all read the story about the ANT and the Grasshopper when we were kids, well we can reflect that on the current global situation.

The Ant and the Grasshopper.

Once upon a time there was the Grasshopper who was a happy go luck positive creature that loved all the fun of the summer and lazying in the feild crazing on the lovely rippened wheat.

One day he say the ant walking past carrying a heavy load and said ” why dont you come and join us and have some fun there is so much for everyone”. Dont be such a bore and relax.

The Ant repesonded by saying ” are you crazy winter is just a few weeks away and you are lazing here we have been working all summer building our nests raising our young and saving our reserves for winter”.

The grasshopper laughed and dismayed the ant as stupid. The ant carried on working so hard through the summer months carrying and working all day and all night as winter approached.

The grasshoppers by now were so fat and had eaten most of the corn and the wheat.

The Ants had stored up trillions in reserves and unbeknown to the grasshoppers the Generals of the grasshoppers had been borrowing the corn and the wheat from the ants so infact they owed the ants trillions.

The ants warned the generals that they faced a huge problem but the grasshopper generals were fearful of a revolt from the grasshoppers.

Winter arrived the temperatures dropped the 1st snowfall arrived the grasshoppers took shelter however there wasnt enough food to go around.

The grasshoppers started to become weak and begged the ants for help and the ants kindly agreed based on certain conditions. That they work like ants and curtail there irrational behaviour with regards to the food supplies.

The grasshoppers took the food supplies and engaged in yet another round of partying and lazing about thinking the ants would help them out.

The ants were not happy about the way the grasshoppers where behaving and started to demand that the grasshoppers pay back the reserves to the ants.

The Grasshoppers are unable to pay back so the ants apply interest the Grasshoppers borrow more until there credit lines are cut off eventually they are unable to pay back not even the interest payment.

Eventually the ants call in the army ants who go into the nests of the grasshoppers and pull out all the reserves and relocate it somewhere else.

The grasshoppers are weak and beging to die one by one.

This is simply the out look for the UK…and other grasshopper economies.

Thank you, was wondering about the Japan debt to GDP and why that wasnt more of an issue.

+1

I cannot understand this countries stand on the national debt. We appear to be cutting jobs and just relying on tax revenues, which just keep on going down.

This country needs to invest in housing and jobs in engineering and build our way out of what appears to be an on going recession.

This country after WW2 owed 180% GDP and during the war it was around 230%GDP and yet we managed to set up the national health service and build thousands of homes every year, without decent homes to rent this country will just go futher down the pan.

This country needs to get rid of these companies who hide in off shore bank accounts.

Why invest into the housing market further, that is practically just sweeping money under the rug, you cant gain income from other countries from a house, its imply sits there, we need to invest into the stock market, begin new businesses and work our way up from there.

I have read that the UK debt is £920bn to rise to £1.1-£1.2trillion by next year – if the government cuts are effective. However why is it that the CIA quote UK external Debt as $8.9trillion… that would be around £5.56trillion…. is this including public sector debt, private sector, government debt and all liabilities? It quotes the US debt as $14.3trillion which is consistent with what I’ve read.

I would like to make a few simple points.

1. The Debt in the UK is rising by approx £6000.00 Per SECOND !!!!.

Now we in the UK have approx 2.5 Million Unemployed, If EVERY ONE of them got a job tomorrow with a wage of £500.00 a WEEK….. The TAX and National Insurance deducted from them would NOT cover a DAYS interest accruing.

2. I live in Leeds the Average house price is £200,000 in my street. We have 2 retired police officers living in my street.

The Council Tax of all the properties in my street DOES NOT cover their pensions !!!!

….. Are you getting the picture yet.

In simple terms ….. if you have £100.00 coming in each week and you OWE £170.00…. I does not work AND it never WILL….