The Bank of England Monetary Policy Committee (MPC) is responsible for setting interest rates and trying to achieve a target rate of inflation.

Until 1997, the government set interest rates and monetary policy. But, it was felt that the government might make bad decisions because they would be influenced by short-term political pressures. Therefore, they decided to give the Bank of England independence.

In theory, the government still retain some control over the Bank of England, but in practise, they have little or no influence over the Bank’s monetary policy.

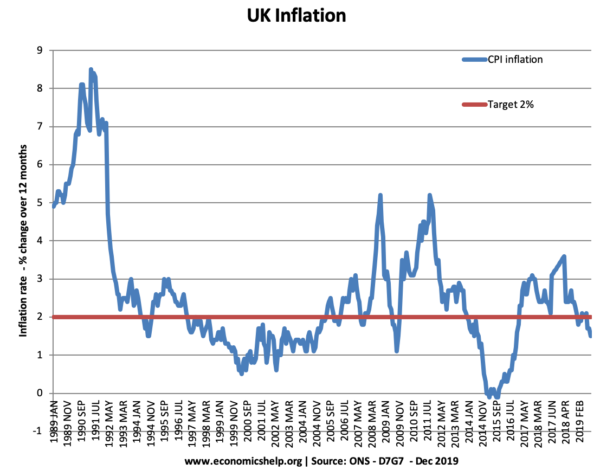

Since 1997, inflation has been more stable than in the 1970 and 1980s.

Since 1997, inflation has been more stable than in the 1970 and 1980s.

Independence of Bank of England

- In the UK, The Monetary Policy Committee has independence in setting interest rates.

- The government appoint members to the MPC. In theory, they could appoint members who are more sympathetic to the ‘government’s point of view’. In practice they don’t. Nor do the government threaten to remove members for choosing a certain monetary policy.

- The government set the inflation target currently CPI = 2% +/- 1. In theory the government could change the inflation target or remit of the MPC. In practise they haven’t. If there was a serious economic shock. e.g. rising oil prices causing cost-push inflation (stagflation – rising inflation and rising unemployment) some governments may be tempted to raise the inflation target from say 2% to 4%. In effect this is telling the MPC not to increase interest rates. In practise I think governments would have difficulty getting away with this. – Markets would soon lose confidence in monetary policy. Also, the Bank of England has often decided to accept a higher inflation rate rather than risk lower growth.

- The Government’s could threaten to change fiscal policy. For example, if the MPC keep interest rates higher than the government wants. They could threaten to use expansionary fiscal policy. – Cut taxes and increase spending. In practise the government hasn’t done this.

- The letter of explanation. If inflation misses the government’s target greater than 3% or less than 1% they have to write a letter of explanation to the chancellor. The MPC has always sought to avoid this. However, in theory the MPC could ignore the government’s inflation target and just write letters saying we are sorry inflation is too high. Although, I doubt the MPC would do that.

- Between 1997 and 2007, economic conditions were relatively benign. The government have been quite pleased with the economic situation. Therefore, they have felt little need to interfere with the operation of monetary policy. However, after 2007, the MPC have had a more difficult balancing act with higher cost-push inflation and lower growth.

See also:

External link

Do you think that a cut in the interest rate will cause a depreciation of the exchange rate in the UK?