Definition of capital mobility – easy for physical assets and finance to move across geographical boundaries.

Capital immobility – when capital faces restrictions on the free movement.

What is capital?

Capital principally refers to physical capital – durable goods used in the production process – machines, factories. This physical capital is determined by levels of investment.

When people refer to capital, they also may mean ‘financial capital’ or ‘short-term capital’. This is not physical machines, but money and liquid assets. This kind of capital can be much more mobile. For example, a multinational may move some of its financial capital from Europe to Australia to take advantage of higher interest rates in Australia.

Therefore capital flows can involve:

- Foreign Direct Investment (FDI) – e.g. Nissan building a factory in England.

- Portfolio Flows – short-term capital, e.g. taking advantage of different interest rates and moving saving accounts to a different country

- Bank transfers.

What does capital mobility mean?

- If capital is mobile, then it means it is easy and seamless to move capital from one country to another.

- Perfect capital mobility would imply no transaction or other costs in moving capital from one country to another.

- Capital immobility means it is difficult and expensive to move capital between countries.

What determines capital mobility?

- Tariffs/taxes on capital flows. Capital flows may be taxed by the government. e.g. tax on investment or capital gains tax on profitable capital flows. High levels of tax will discourage capital flows.

- Restrictions on capital flows. Some countries may impose restrictions on the amount of capital that can be taken into and out of a country. (Foreign exchange controls) For example, in the period of hyperinflation, Zimbabwe imposed capital controls on individuals taking foreign currency out of the country.

- Rules and Regulations. Governments can impose rules which increase the cost of moving capital from one country to another.

- Exchange Rate Volatility. If a country has a volatile exchange rate, this may discourage capital inflows as investors are worried about a devaluation in the exchange rate which reduces the profitability of investment. (this is an indirect factor)

Impact of Capital Mobility

- FDI. If capital is mobile, then it will be easier to attract Foreign Direct Investment into your country. It will also increase investment opportunities abroad.

- Better rate of return. With improved capital mobility, it will be easier to move financial capital around to gain higher yields and interest rates.

- Real exchange rates parity. If capital is mobile it should reduce differences in real exchange rates. If goods are relatively cheaper in the US, it should encourage people to buy goods there and transfer capital to low-cost countries. See: purchasing power parity

- It could help equalise incomes between different countries. E.g. with perfect capital mobility, it may encourage European firms to invest in developing countries who have lower wage rates. These capital inflows could help raise wages in developing economies.

Problems of Capital Mobility

- It could cause a sudden outflow of capital under times of uncertainty. These capital outflows could lead to job losses and unemployment. For example, suppose Greece felt it had to leave the Euro. This would mean the Greek currency would probably fall 25%. With perfect capital mobility, there would be a rapid outflow of money from Greece to other European countries. This could cause a run on Greek banks and cause significant disruption to the financial and economic situation. In this case, temporary capital restrictions would be helpful in making the transition from Euro to new Greek currency.

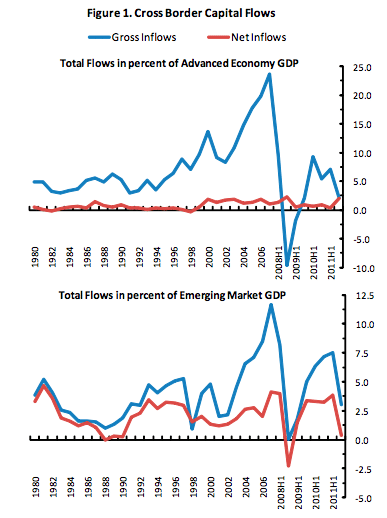

This shows rapid growth in capital flows – just before credit bubble and bust in 2008.

- Global Credit Crunch. Before the credit crunch, the bank system became increasingly globalised. European banks lent to US mortgage companies. These capital flows helped provide greater liquidity and lower interest rates, but, when US mortgage companies lost money, it meant that all the European banks were affected.

- Irrational Exuberance. In the run-up to the credit crunch, there was a growth in lending and also a growth in global imbalances – e.g. US ran large current account deficit, whilst China accumulated foreign reserves. This inflow of capital into the US, perhaps exacerbated the credit bubble in the US.

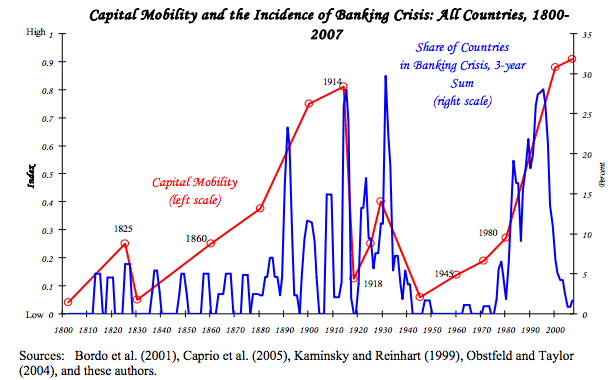

- Link between capital mobility and incidence of banking crisis.

Reinhard and Rogoff argue that as capital mobility increases, countries become more susceptible to a banking crisis.

Related

- Factor Immobility

- Policy trilemma – why capital controls is one out of three targets for monetary/exchange rate policy

Thanks satifactory