Readers Question: Why is the current recession in Europe so bad?

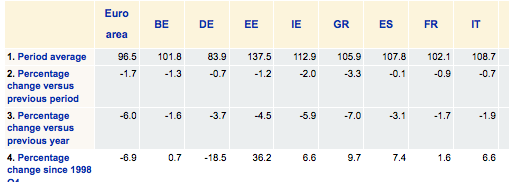

The recession in the Eurozone is one of the deepest recessions on record. For example, Greece are expecting 2013 to be the sixth consecutive year in recession (with on and off quarters of recovery)- this is one of the longest recession on record. Output in Greece is 16% lower than at the start. Other countries such as Spain, Ireland and Italy also face large falls in GDP, which have been much more prolonged than previous recessions.

There are a number of reasons why the European recession for Eurozone countries is so severe.

1. Spending Cuts

Faced with budgetary constraints, countries have been forced into ‘austerity measures’ For example, Madrid has been set a target by the European Commission of reducing the country’s budget deficit from 8.5 per cent to 5.8 per cent by the end of 2012, and to 3 per cent in 2013. This level of deficit reduction is difficult in normal circumstances. But, if you cut spending when economy is already in recession, then there will be a large fall in domestic demand and rise in unemployment. Spain already has an unemployment rate of 20%, spending cuts will inevitably worsen the unemployment problem.

2. Legacy of Asset Price Bubble and Household Debt.

In the boom years, countries such as Ireland and Spain both had a rapid increase in house prices. After the credit crunch, house prices have fallen by upto 40%, leaving many banks, business and homeowners facing higher levels of personal debt. This personal debt creates a big drag on spending. Households face the prospect of trying to pay off debt rather than spend. UK’s personal debt stands at £1.4 tn (close to 100% of GDP – up from 69% of GDP in 1997 link) This is known as a balance sheet recession.

A graph (EV) showing the rapid fall in real per capita housing equity in the US. – A major drag on US consumer spending.

3. Overvalued Exchange Rate and Internal Devaluation

Countries in the Eurozone which have become uncompetitive – Greece, Ireland, Portugal and Spain all face a difficulty in selling exports because their higher inflation rates have made exports less competitive. In the Euro, it is not possible to devalue, so countries need to try and reduce wage costs and prices. However, cutting wages (as we see in Greece, Spain and Portugal) gives people lower disposable income and therefore lower spending power.

See: Competitiveness in Europe

4. Problems in the Bond Market

The reason Eurozone economies have been ‘forced’ into aggressive austerity measures is that governments have been struggling to sell sufficient bonds. Concerns over Eurozone debt means buyers of bonds are demanding higher bond yields in return for increased risk. Spain has recently seen bond yields go back up to 6%. Markets fear that Spain could end up defaulting like Greece. Countries in the Eurozone also have greater liquidity issues in that there is no lender of last resort (no Central Bank willing to buy bonds). In early 2012, the ECB has been able to increase liquidity in an indirect way (providing funds at low cost) but this does not have same certainty as direct Central Bank intervention. (EU Debt crisis explained)

5. Global Factors

The economic downturn is being exacerbated by global economic uncertainty. The US has shown signs of recovery, but it doesn’t have the strong demand to pull the Eurozone out of recession. It looks more likely the Eurozone faltering will hamper chances of US recovery.

6. Commodity Prices

Combined with falling domestic demand, Europe and the US have faced an unwanted rise in commodity prices. Rising oil prices have translated into higher prices and cost-push inflation. This has further squeezed living standards.

Related