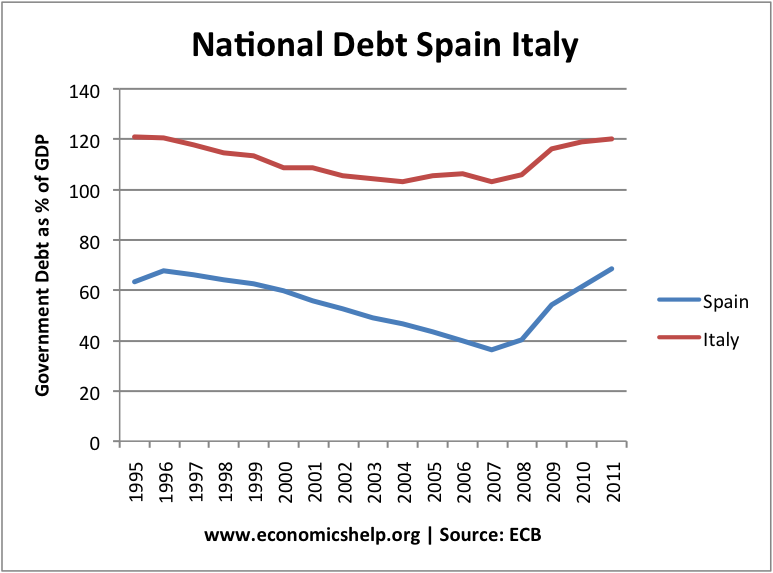

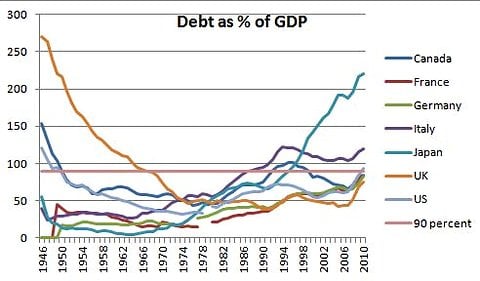

Italy has struggled to reduce national debt as a % of GDP since government debt has risen to over 100% of GDP in the late 1980s

National Debt Italy

- Italy has the second highest public sector debt in Europe, after Greece. The IMF predict public sector debt of 123.4 % of GDP in 2012.

- By 2013, Italian national debt is forecast to 123.8%

Historical Italian National Debt

Source: Debt and Growth in G7 (up until 1970s, Italian debt was below 50% of GDP. Source: Krugman)

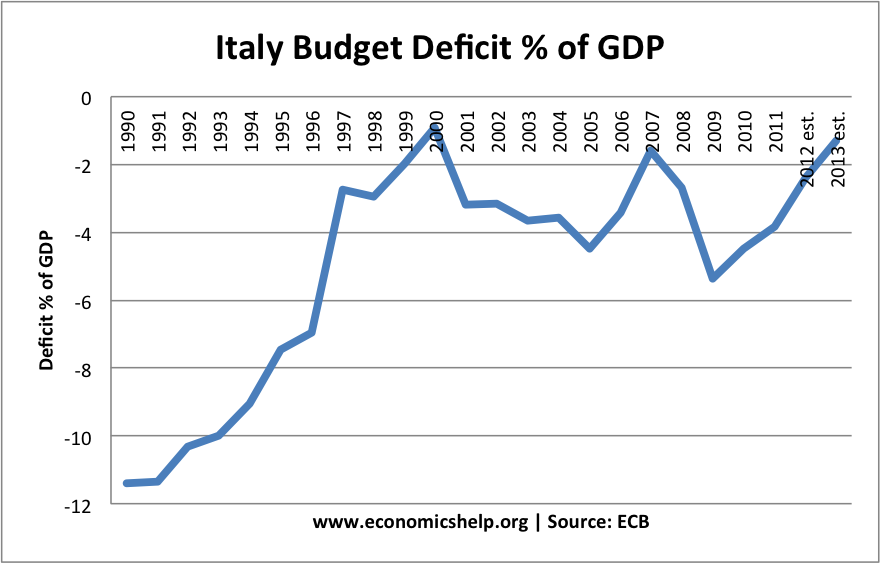

Italian Budget Deficit

Despite the large total debt, Italy has a relatively low budget deficit as % of GDP.

The Estimated budget deficits for 2012 and 2013 have been revised. The IMF predict that the deficit will be 2.4% of GDP in 2012, above the government’s own target of 1.6% (Reuters)

Italian Bond Yields

Despite reducing the budget deficit to relatively low levels, the bond markets have expressed unwillingness to buy Italian bond yields because of the size of total outstanding debt, poor prospects for growth and the wider implications of the Eurozone structure / crisis.

Italian 10 year bond yields are currently, just below 6% – after peaking at just over 7% at the start of 2010.

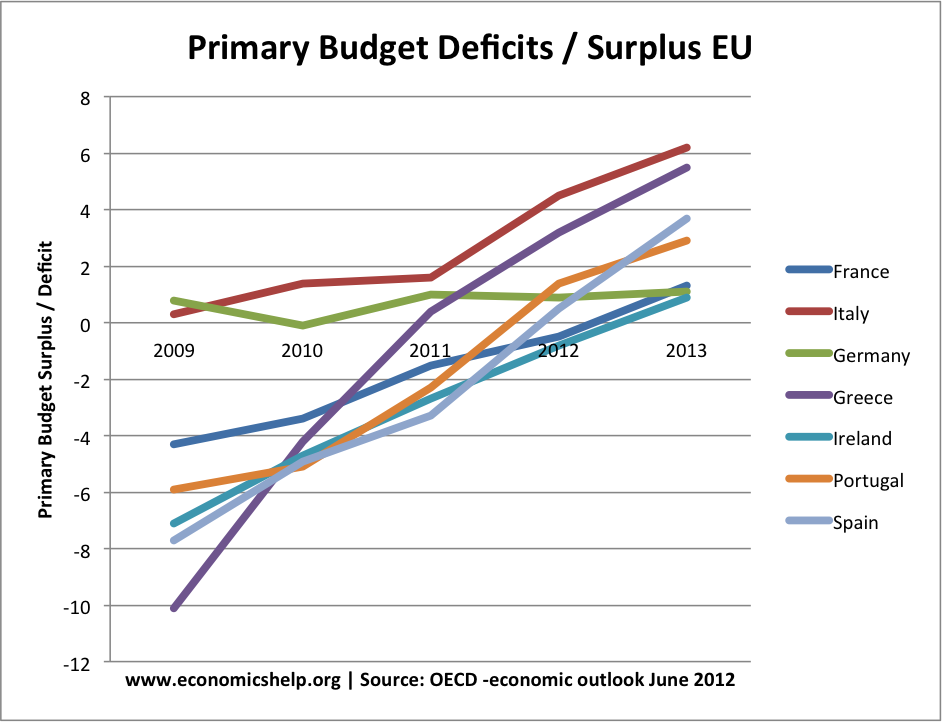

- The unfortunate situation is that, ignoring interest payments on debt, Italy is running a primary budget surplus.

- The IMF predict the Italian budget balance excluding debt servicing costs – will be 3.0 percent of GDP in 2012 and 4.0 percent in 2013.

Factors Causing Italian Debt Crisis

Why is a country with a primary budget surplus experiencing a debt crisis?

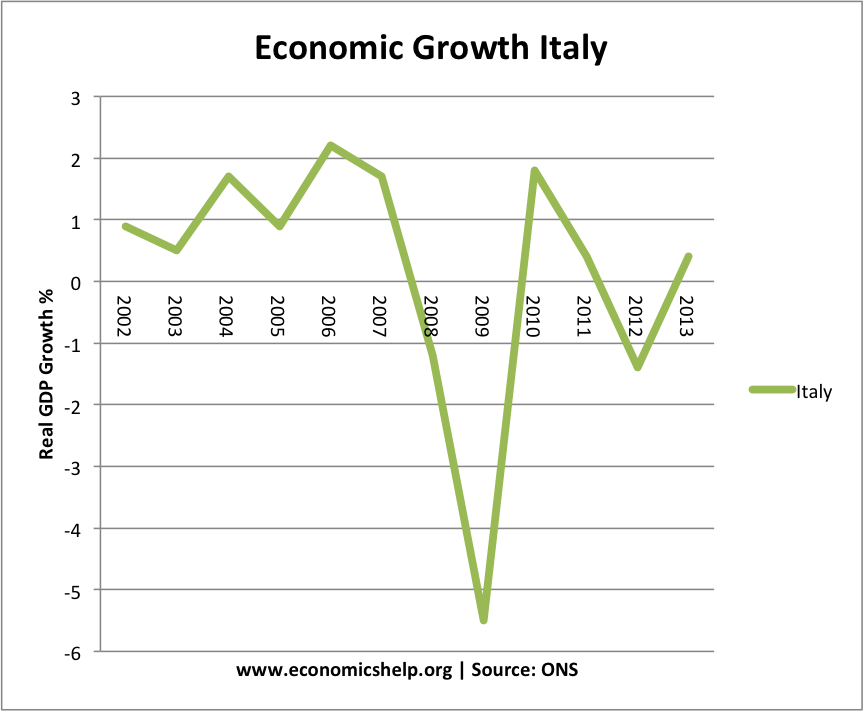

1. Poor Performance of Economic Growth

Since 1990, Italy has experienced sluggish growth. With only small increase in real GDP it has proved difficult to reduce the debt to GDP ratio.

Since the early 1990s the Italian economy has performed badly compared to its Eurozone counterparts.

source: economist

Unfortunately, Italy is caught in a familiar trap. Being in the Eurozone:

- Italy is facing rising bond yields and pressure to pursue austerity measures. Spending cuts and higher taxes are depressing demand further

- No independent monetary policy to offset fiscal austerity. ECB unwilling / unable to act as lender of last resort mean markets fear liquidity crisis in Italy.

- No ability to devalue and restore competitiveness

- No real fiscal transfers to stimulate spending

Given such a set of economic policies and circumstances, it is unsurprising that growth forecasts have been slashed and Italy is stuck in an unfortunate deflationary debt spiral.

2. Long Term Tax Collection Problems

Italy has a poor track record on tax collection and wasteful government spending.In particular, the size of the black economy means that substantial parts of economic activity remain untaxed.

Economists estimate that around 540 billion euros (£434 billion) is lost through Italy’s black economy through tax evasion by individuals and companies – the figure is around 35 per cent of the country’s GDP and last year more than 12 billion euros were recovered. (Telegraph)

3. Competitiveness

Italy has lagged behind the EU average for competitiveness.

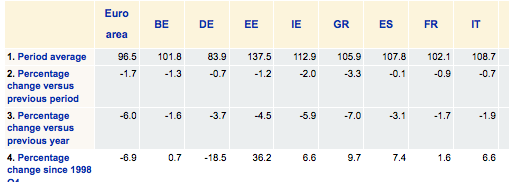

- Harmonised competitive indicators in the EU (2011 Q1), source: ECB Stats based on unit labour costs indices for the total economy:

- Italy has seens a 6.6% increase in unit labour costs since 1998, compared to Euro area seeing a fall of 6.9%.

The other issue is the long-term decline in Italian competitiveness. Wage costs have risen faster than Germany and this has contributed to slow export growth. However, without option of devaluation, the process of restoring competitiveness is liable to be very slow, relying on internal devaluation and wage cuts.

This Vox article argues that for countries with high debt to GDP, internal devaluation is liable to lead to even higher public sector debt.

For a country with a debt to GDP ratio as high as 100%, an internal devaluation of 20% (a common estimate of what is ‘needed to restore competitiveness in the South of Europe) amounts to a corresponding increase in the value of its debt in real terms. (Vox link)

4. Fall in Confidence and expectations

Italy has suffered from a 70% fall in inward investment since 2007, this is due to concerns over Italy as a place to invest. Factors such as:

- Higher labour costs.

- Italy scores low in the World Bank indicator of how easy it is to do business – 80th.

Could Italy Leave the Euro?

Italy was one of the most enthusiastic supporters of the Euro. It was hoped joining the Euro, would tie the Italian economy to the fortunes of the stronger northern nations. However, with bond yields rising and austerity measures failing to solve debt crisis – whilst simultaneously angering the electorate, people are now starting to talk of leaving the Euro (once considered a form of economic blasphemy) in Italy.

The tragedy is that Italy is not Greece.

- Combined public and private debt is 260pc of GDP, similar to Germany and much lower than France, Spain, or the UK (UK total debt). With private wealth of €8.6 trillion, Italians are richer per capita than Germans.

- Italy scores top on the IMF’s long-term debt sustainability indicator at 4.1, ahead of Germany 4.6, France 7.9, the UK 13.3, Japan 14.3, and the US 17.

- Italy has a primary budget deficit of 4% – something the UK is no where near. The fact that Italy is in debt crisis is partly a reflection of long standing debt problems, but more significantly it is a result of the Euro straight jacket which Italy finds itself in.

If Italy could devalue it would help boost exports and improve economic growth.

If Italy has an independent Central Bank to print money to buy bonds, Italy wouldn’t be seeing crippling bond yields. This might give it the opportunity to grow out of the debt. But, instead they are being forced into policies of austerity which are exacerbating the crisis rather than solving it.

Primary Budget deficits in EU

The irony is that Italy has the largest primary budget surplus (deficit – cost of interest payments). This shows the cost of servicing the debt is one of the biggest problems facing Italy.

Related

9 thoughts on “Italian Debt Crisis”

Comments are closed.