Readers Question: What policies could Germany / the EU use to help save the Euro?

The Euro has many problems. The most obvious outer problem is rising bond yields and the threat of sovereign debt default. Related to sovereign debt default is a banking default, e.g. from Spanish banks which would cause knock-on effects. But, the problems of the Euro are deeper than just the issue of bond yields and debt default.

So far the current policy involves:

- Asking countries in trouble to pursue austerity and cut government spending – hoping that reducing budget deficits will restore stability to the bond market and avoid the need for further bailouts.

- Providing temporary loans to help governments meet the shortfall. e.g. the Spanish government are being given bailout funds so the Spanish government can bailout the Spanish banks.

- Structural reform and internal devaluation to help improve competitiveness in peripheral Eurozone countries

The impact of these policies have not been successful.

- Bond yields have continue to rise. Governments, such as Italy and Spain are still at risk of default.

- Austerity measures combined with overvalued exchange rates are pushing economies further into recession, which has harmed prospects of reducing debt to GDP.

- Internal devaluation risks taking too long to restore competitiveness

To Save The Euro, some or all of the following are needed.

- Joint liability of European debt. Eurobonds where debt is pooled.

- Direct recapitalisation of European banks

- Printing Money to buy bonds and provide liquidity for governments facing a liquidity crisis.

- Economic growth to give countries a chance to improve tax revenues and reduce debt / GDP ratios

- Restoring competitiveness amongst peripheral Eurozone countries who are struggling in the fixed exchange rate of the Euro.

- Structural reform / supply side policies which improves tax collection and improves productivity and competitiveness.

Policies to Save the Euro

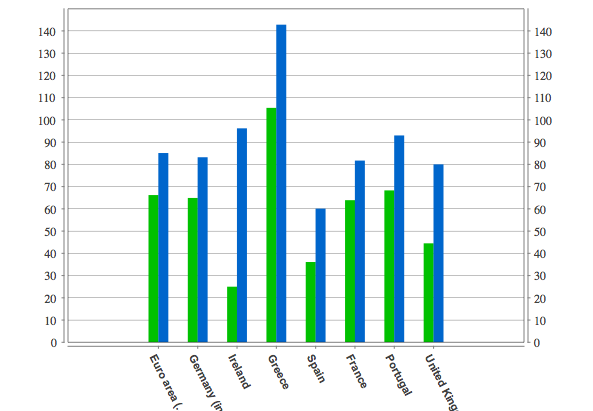

Public Sector debt as % of GDP

EU Debt 2007-2010

Source: EU Stat

1. Appreciate nature of crisis. Firstly, there needs to be an appreciation that the Euro-crisis is more than just profligate spending in southern Europe, In 2007, both Spain (35% of GDP) and Ireland (22% of GDP) both had lower public sector debt than Germany (63%). Government debt is a consequence of the crisis not the cause. At the moment, German finance ministers seem to suggest that if only southern Europe cut government spending all problems will be solved. But, the main problems in Eurozone are:

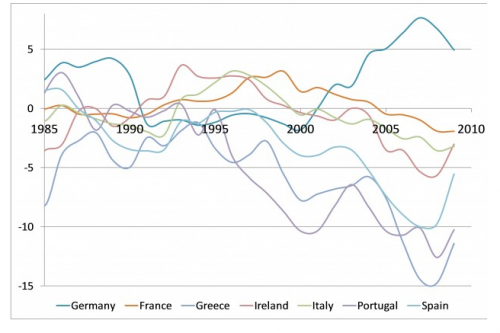

- Divergence in competitiveness causing a two speed Europe

- Stagnant economic growth and high unemployment (European recession) Rising bond yields are partly a reflection of poor prospects for nominal GDP growth.

2. Pursue Economic Growth. Germany and the ECB need a general policy to attempt to reduce debt through growth, rather than reduce spending – even if it causes recession. The ECB should be given a dual target – not just low inflation, but also maintain economic growth and avoid a negative output gap. We need to end the deflationary bias which exists in the Eurozone.

3. Higher inflation target. Higher inflation in the Eurozone will make it easier for the peripheral countries to improve competitiveness. It makes the process of internal devaluation less painful. A higher inflation target means that peripheral countries will be able to regain competitiveness through moderate inflation, rather than deflation. Deflation is very difficult due to price stickiness and the psychological problems of deflation. (see: Problems of deflation)

4. Restore Competitiveness in Peripheral nations. A structural problem in the Eurozone is the German current account surplus (6% of GDP) compared to current account deficits in southern Europe. Higher consumer spending in Germany will help boost export demand in other countries. The easiest way to restore competitiveness in the rest of the Eurozone would be for Germany to leave – a recognition the German economy is currently too strong to be in the same single currency as other Eurozone members.

5. Eurobonds – If there is a reluctance/ inability to print money, restore competitiveness and improve economic growth there needs to be at least some kind of fiscal union. Eurobonds involve pooling debt and will help reduce bond yields and giving countries a greater opportunity to reduce debt in a manageable way. The German chancellor Angela Merkel has frequently expressed her opposition to eurobonds for understandable political reasons. There is an understandable political reluctance for Germany to bailout costs of Southern Europe debt. But, without Eurobonds, it seems impossible to stop the debt crisis escalating. A concern about Eurobonds is that they would be introduced with very strict fiscal rules, which can create further deflationary problems.

6. Printing Money. Printing money is anathema to Germany and the ECB for understandable reasons. But, quantitative easing would not be inflationary in the current liquidity trap that Europe finds itself in. Creating money and purchasing directly government bonds is one way to prevent liquidity crisis and give an alternative to the crippling bond yields and policies of austerity. The ECB would need reform.

7. Structural Reform. The EU is correct that peripheral countries could benefit from supply side reforms which improve competitiveness and help to improve tax collection. Countries like Italy need significant changes to improve tax collection and prevent leakage into the black market that currently happens. Also, countries will benefit from supply side reforms which help to improve labour market flexibility and help to improve productivity growth. However, as valuable as structural reforms can be, we cannot rely on these alone. They are not guaranteed to work, at best will take several years, and it will be too late.

Related