What are the key issues affecting the UK economy over the next few years?

Recession and Recovery

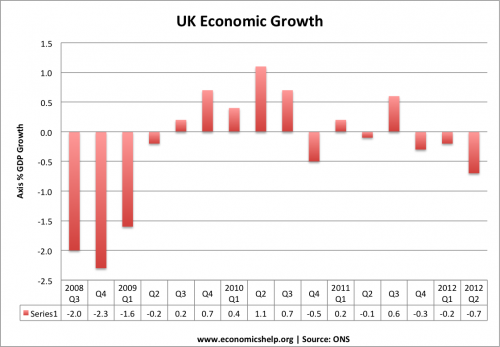

The biggest problem facing the UK economy is the lack of economic recovery. After a fall in GDP of 6% in 2008/09, the economy briefly recovered, but the recent double dip recession of 2012 has left the UK in a longer economic downturn than the Great Depression. A key factor over the next few years is whether the UK economy can return to a normal rate of economic growth or whether we may become stuck in a Japanese style period of economic stagnation.

If the UK economy can return to its long run trend rate of economic growth (2.5% and over), we can expect to see a fall in demand deficient unemployment and start to reduce the growing numbers of the long-term unemployed. A return to economic growth would improve government tax revenues and help reduce the budget deficit and stabilise the countries long-term debt. Economic growth would also give firms and consumers the opportunity to reduce their debt overhang from the previous credit crunch.

If the UK economy fails to recover, we will see a continued fall in living standards, persistently high unemployment and it will prove very difficult to reduce the government’s debt to GDP ratio.

Economic growth is a key factor in determining other problems such as unemployment, debt and the banking sector.

Issues affecting economic growth

- Will the Eurozone crisis deepen, leading to a fall in UK exports to our main trading partner? – The EU has also re-entered recession, and has poor prospects of recovery given their current fiscal and monetary policies.

- Will the government commit to further austerity and job cuts in the public sector or will it change policy and be willing to finance substantial sums in public sector infrastructure? There is likely to be a fudge with small scale investment, and overall small reductions in public spending as they stick with their deficit reduction plans.

- Supply Side Miracle? Rather belatedly the government have become more concerned with economic growth. However, rather than tackle the issue of aggregate demand, they are pinning their hopes on supply side reforms – Tax cuts to boost incentives. Reducing planning restrictions to encourage people to build conservatories. However, governments often over-estimate the potential of minor supply side policies to overcome a fundamental lack of aggregate demand. (see role of supply side policies in recession)

- Housing Market. Further falls in house prices would weaken consumer wealth and lead to lower spending.

- Consumer confidence. After reaching an all time low, how will this recover?

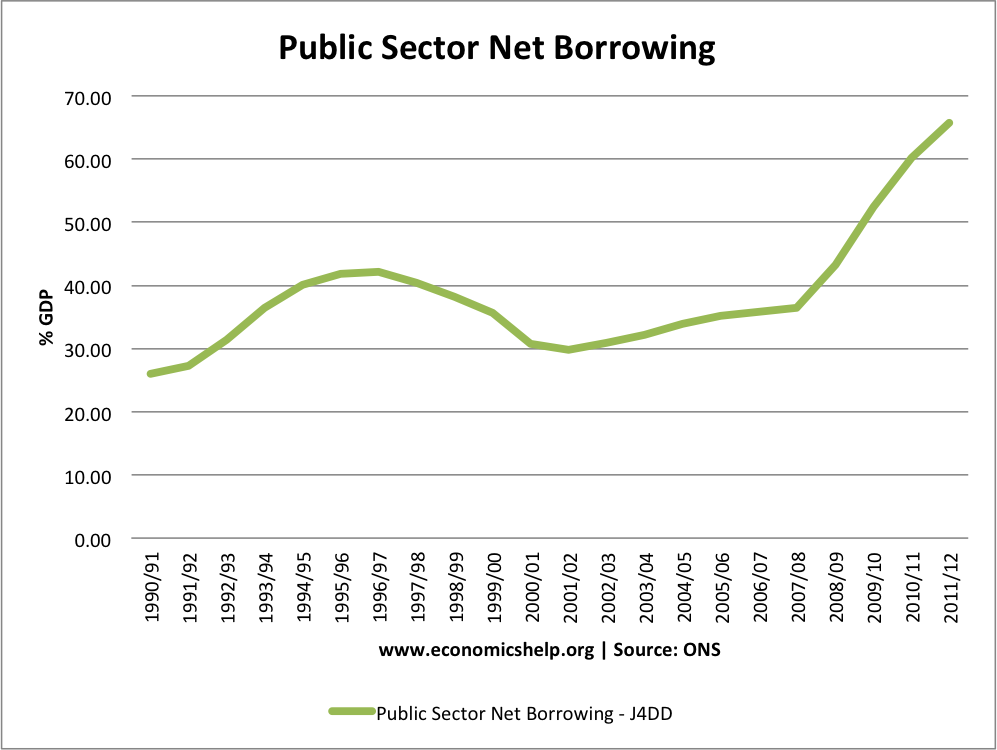

Government Debt / Deficit

The Euro debt crisis has focused attention on the UK’s rapid growth in debt since 2008. The government responded by saying that deficit reduction was the highest economic priority. However, even relatively mild austerity policies contributed to a double dip recession. This second recession meant tax revenues have been less than expected and the government is in danger of missing their deficit reduction targets. Some economists even say that the austerity measures have been self-defeating.

Markets seem to be willing to keep buying UK debt, with UK bond yields falling to less than 2% (10 year bonds). But, still there is concern over the level of debt, giving the government less room for fiscal expansion.

More on UK national debt

Monetary Policy / Inflation

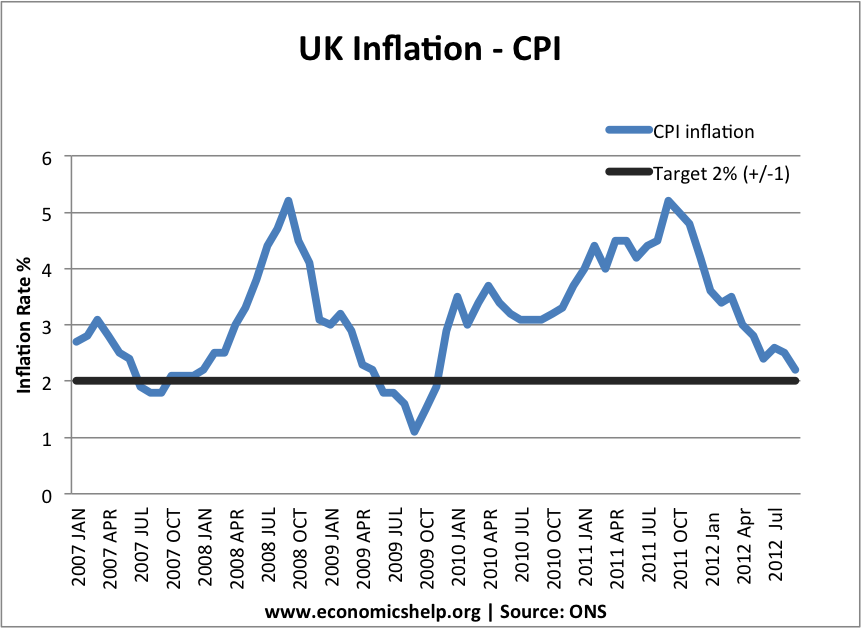

Despite the length of the recession, inflation has often been stubbornly over the government’s target of 2%. With fiscal policy limited by the government’s attempt to reduce the deficit, there is greater pressure on monetary policy to provide an economic stimulus.

So far the MPC have been willing to tolerate inflation above target. They have also been willing to pursue unconventional monetary policy – Quantitative easing. However, if the economy continues to stagnate, the MPC will face a further difficult choice of how much to use monetary policy as a tool to promote growth. Should the MPC worry about the inflationary potential of further rounds of quantitative easing or should they be most concerned about recession and unemployment?

Unemployment

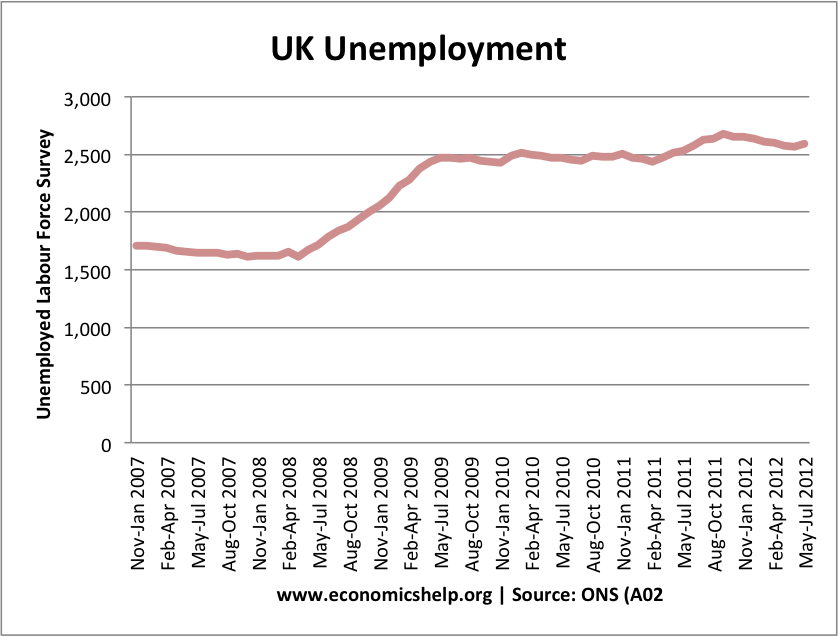

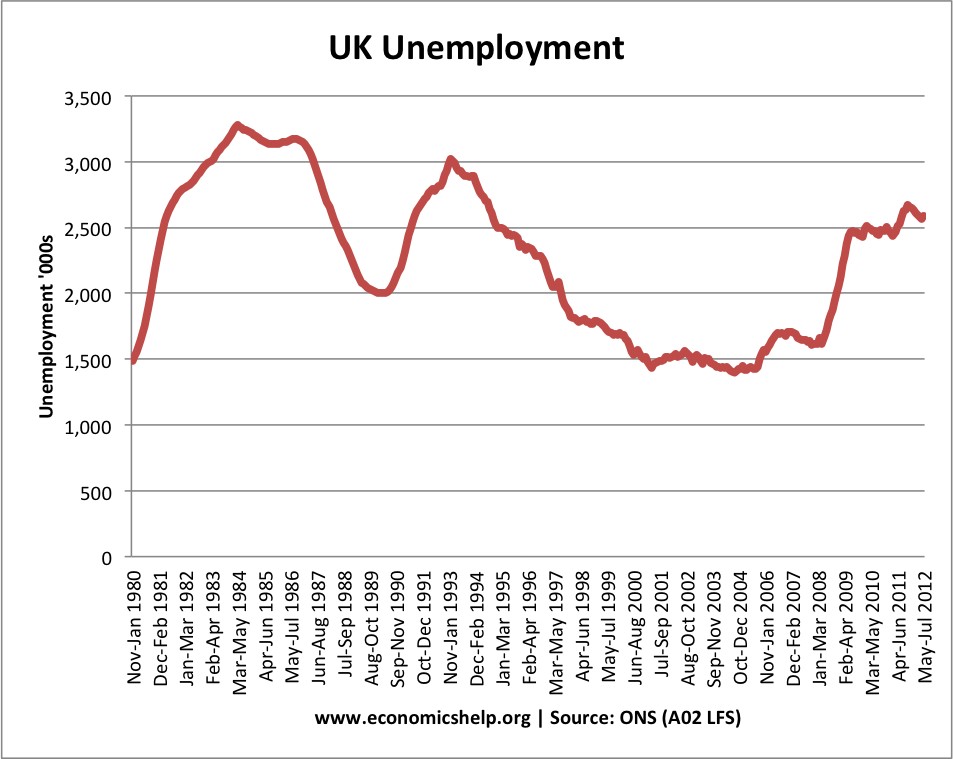

UK unemployment has risen to over 8% since the recession started. This is still less than the European average. It is also lower than previous recessions, when unemployment rose at a faster rate. This suggests the UK labour market is fairly flexible. (It is also much harder to get benefits). However, the rise in unemployment to 2.6 million is still of great concern; in particular the rise in numbers of long-term unemployment. The Institute for Public Policy Research stated that the number of people out of work for more than a year – is up to 904,000 in the latest figures.

Long-term unemployment is damaging to those involved – both financially and emotionally. Unemployment also increases the danger of social division and social problems.

UK Current Account deficit

Less important than other objectives, the UK current account is still a rough guide to economic pressures. Last month, there was a drop in imports and rise in exports. A growing current account deficit may be a cause for concern showing a decline in UK competitiveness. But, it depends how it is financed. (Is a current account deficit a problem)

Other Issues

- Banking Sector – If banks make further losses in double dip recession and Eurozone crisis, there could be need for bailouts.

- Total UK Debt level of private + public debt. UK one of most indebted countries.

- Exchange rate – how will the Pound fare?

- Consumer confidence

- Savings ratio

- Housing market

“But, still there is concern over the level of debt, giving the government less room for fiscal expansion.” The latter “concern” by our economically illiterate elite is complete nonsense.

If government wants to implement expansion and doesn’t want to incur more debt, it can just print money and spend it, as Keynes and Milton Friedman pointed out. (That’s about the thousandth time I’ve made that point, but it never seems to get thru.)

“With fiscal policy limited by the government’s attempt to reduce the deficit…” That just confirms that the government is economically illiterate. “The government” should study the reasons behind a phrase that Keynes uttered: “Look after unemployment and the budget will look after itself”.