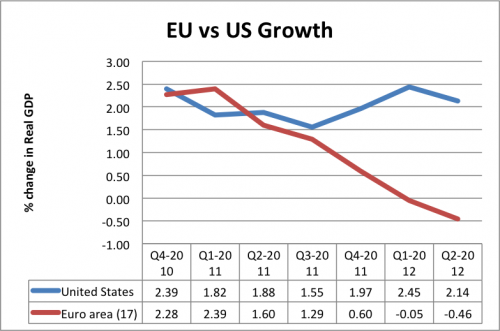

In 2009, US and EU unemployment rates both stood at 10% – but since then EU unemployment has increased to 12% and US unemployment fallen to 7.9%. (see: US v EU unemployment)

These contrasting fortunes in unemployment are a reflection of diverging rates of economic growth. Whilst, Europe has entered a double dip recession, the US has experienced a sustained economic recovery. It is also a reflection of different economic policy – the EU has become obsessed with reducing budget deficits, the US has given more focus to promoting economic recovery.

However, in the face of concerns over levels of US government borrowing and impending debt ceilings, many in the US are pushing for a rapid fiscal consolidation.

But is US austerity necessary? and what will be the impact of austerity on a) the budget deficit and b) economic growth c) long-term structural spending and debt commitments?

Is Austerity Necessary in US?

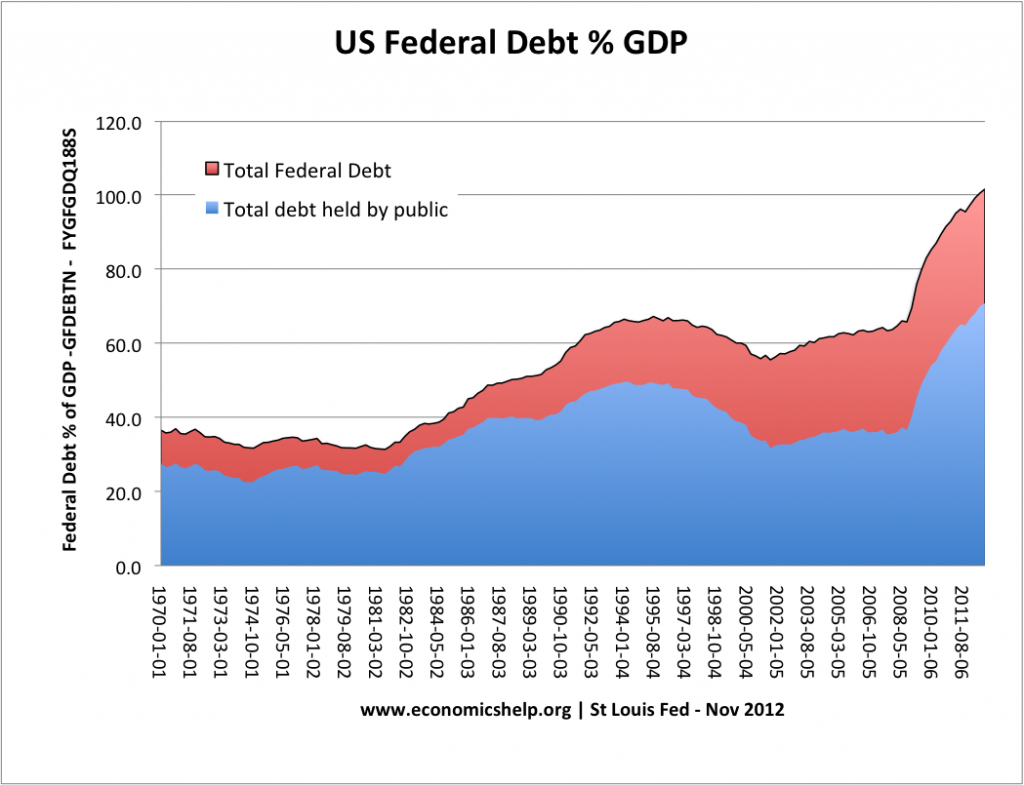

Total Federal Debt increased to 101% of GDP in Q2 2012. It is a sharp increase since 2008, when debt was just over 60% of GDP. But, this is to be expected in a recession as deep as past recession.

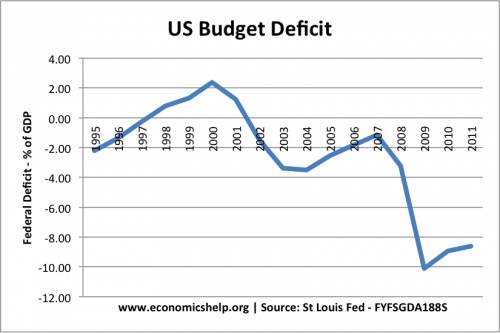

US Budget Deficit

The US Federal deficit has experienced record peace time levels.

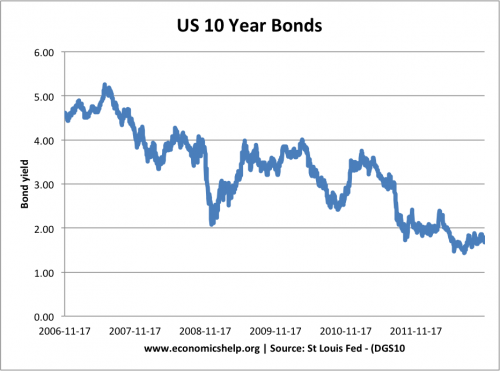

Demand for US Bonds Remains High

Despite the record deficits, there is no sign that markets have lost their appetite to buy US bonds and lend the US government money.

Despite a ballooning deficit, US bond yields have continued their downward path. It means the US government is able to borrow at a record low levels of interest.

The rapid rise in US government borrowing over this period, is an indication of the cyclical downturn. Tax receipts fell, and automatic fiscal stabilisers like unemployment benefit spending increased. Continued economic growth will see a reduction in both the cyclical deficit and improve the debt to GDP ratio.

Since the recession, the US saving rate has increased. The private sector have reduced spending and investment, preferring to reduce their debts. This explains why US bond yields have fallen – there is still a high demand. It also explains why it is good that US government debt increased. Without government spending to take over falling private sector spending, the recession would have been much deeper.

Bond yields are likely to rise if the economic recovery becomes more sustained. As the economy becomes stronger, fiscal consolidation will be easier to accommodate. However, the CBO estimate that if the fiscal cliff tax increases and spending cuts are implemented at the end of 2012, then it will sniff out the fragile US recovery. Instead of growth of 1.7%, the US will experience a double dip recession with GDP falling 0.5%. (US fiscal cliff explained)

This would mean the US will mirror the European and UK experience of premature fiscal tightening causing a double dip recession.

From an economic perspective, the US should not worry about the short run deficit, but concentrate on economic recovery and long-term structural problems over the long-term. However, politics is likely to interfere and arguments over the debt ceiling are highly likely to create uncertainty and cause a premature end to economic recovery.

Impact of Austerity

If the US goes into a double dip recession as a consequence of mis-timed austerity, then it may find the improvement in the budget deficit will be much more disappointing than anticipated. Evidence from the UK and Europe is that fiscal austerity can even be self-defeating – in other words fiscal consolidation leads to such a big reduction in GDP, that tax revenues fall and outweigh the spending cuts.

This premature fiscal tightening would do little to solve the underlying long-term pressures on government entitlement spending (such as health care and pensions)

Could the US economy absorb Austerity?

To some extent the US economy is different to Europe.

- The Federal Reserve appear willing to allow greater monetary easing. Quantitative easing could be extended to offset the fiscal tightening. However, evidence suggests that in a liquidity trap, monetary policy alone cannot boost economic growth. This contrasts with the ECB who remain inflation hawks in the face of depression level economic activity.

- Recovery in the Housing Market. After being the first housing market to collapse in 2006, there are signs that finally the housing market is starting to recover. Rising house prices and greater stability can help increase consumer confidence and consumer spending. This contrasts to European economies like Spain, where there are still fears house prices will fall further.

- Exchange Rate. Monetary easing by the federal reserve would lead to depreciation of dollar and boost exports. Already the US trade deficit has narrowed on the base of strong export demand. This could provide a boost to domestic demand. However, the UK experience shows that an independent currency and depreciation is not necessarily enough to avoid a recession.

Conclusion

So far the US has resisted the greatest calls to panic over the budget deficit. Despite a mixture of fears from hyperinflation to rising bond yields, the current course has led to a steady economic recovery and a fall in bond yields. The expected debt crisis has failed to materialise. This does not mean the US can permanently ignore the projected long run fiscal deficit. However, to deal with these issues does not require the unnecessary pain of a short sharp shock, which achieves little else but an unwelcome double dip recession.

Related