Readers Question: After the insightful post on ‘Italian Economic Decline’, I was particularly captured by the % debt to GDP line graph of the different developed countries. The one thing that really caught my eye was Japan’s huge % debt to GDP and yet their government bond yields are consistently declining. Aren’t the markets worried that Japan may default on their debt someday or is the fact that they have a lender of last resort (no fear of liquidity problems) unlike Italy and their 0% interest rates shielding them from augmenting yields?

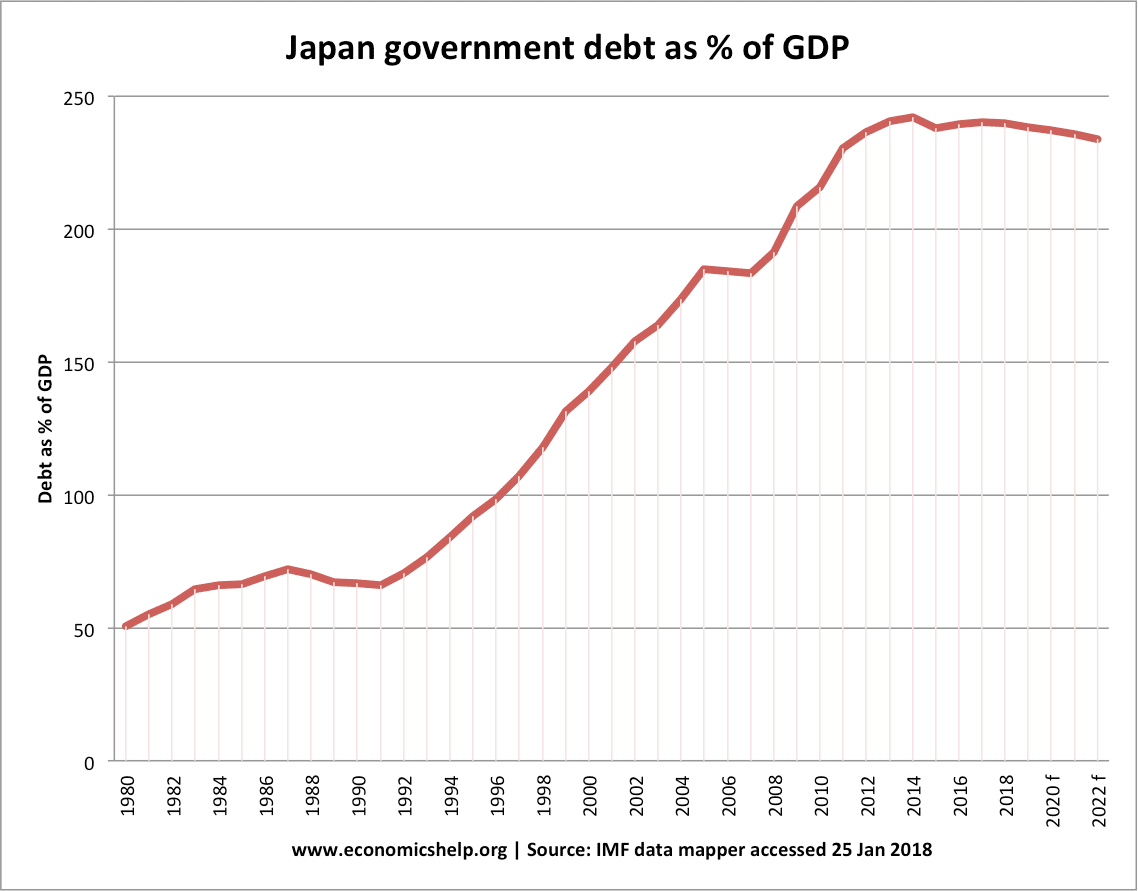

It is true that Japanese public sector debt is over 239% of GDP, yet bond yields in Japan remain low. It seems the markets have no current concerns over Japanese repayment. Spain might feel aggrieved that they face rapidly rising bond yields – even though their public sector debt (70% of GDP in 2011) is considerably lower.

- Japan debt 229.1% of GDP on a gross basis, and 127.8% of GDP on a net basis

Why Can Japan Government Debt be So High at Low-Interest rates?

- High levels of savings in Japan. Japan’s saving ratio has fallen in recent years (partly due to an ageing population) but although it may sound a paradox, there are still high levels of domestic saving. Up to now, this large pool of savings has been used to buy Japanese government debt. (Japan Saving ratio)

- Liquidity Trap. Japan has been stuck in a partial liquidity trap for several years. Basically, interest rates are very low, but this has failed to stimulate prolonged economic growth. Inflation remains very close to zero, and the prospect of deflation has encouraged people to put their money into government securities rather than spend.

- Bank of Japan’s holdings of Government bonds. The Bank of Japan has supported government borrowing by buying large quantities of Japanese bonds. (B of J) holdings. “At the end of March, the BOJ held 9.7% of the nearly 1 quadrillion yen ($12.6 trillion) total of outstanding government debt. In addition, the central bank buys ¥21.6 trillion JGBs annually to provide liquidity for economic growth” (WSJ). The importance of this is also related to confidence. Markets have confidence that the Bank of Japan will intervene to buy bonds and prevent any liquidity shortages.

- 95% of debt is held domestically. The majority of Japanese government debt is held by domestic investors. They do not need to rely on foreign investors. Therefore, Japan does not have to fear a loss of confidence from other countries. In the case of Greece, Spain and Portugal – foreign investors have been worried about the possibility of Euro exit. This would lead to significant devaluation and loss of savings. Therefore, most foreign investors have been demand higher interest rate yield in Spain.

The two main reasons are the Central Bank’s intervention and the high level of domestic savings. In the current economic climate, Japanese have been willing to buy sufficient bonds to finance debt. However, there is concerns that if the Japanese saving ratio continues to decline, this could be reversed.

Potential Problems of Japan’s Debt

This deserves its own post. But, a few quick notes

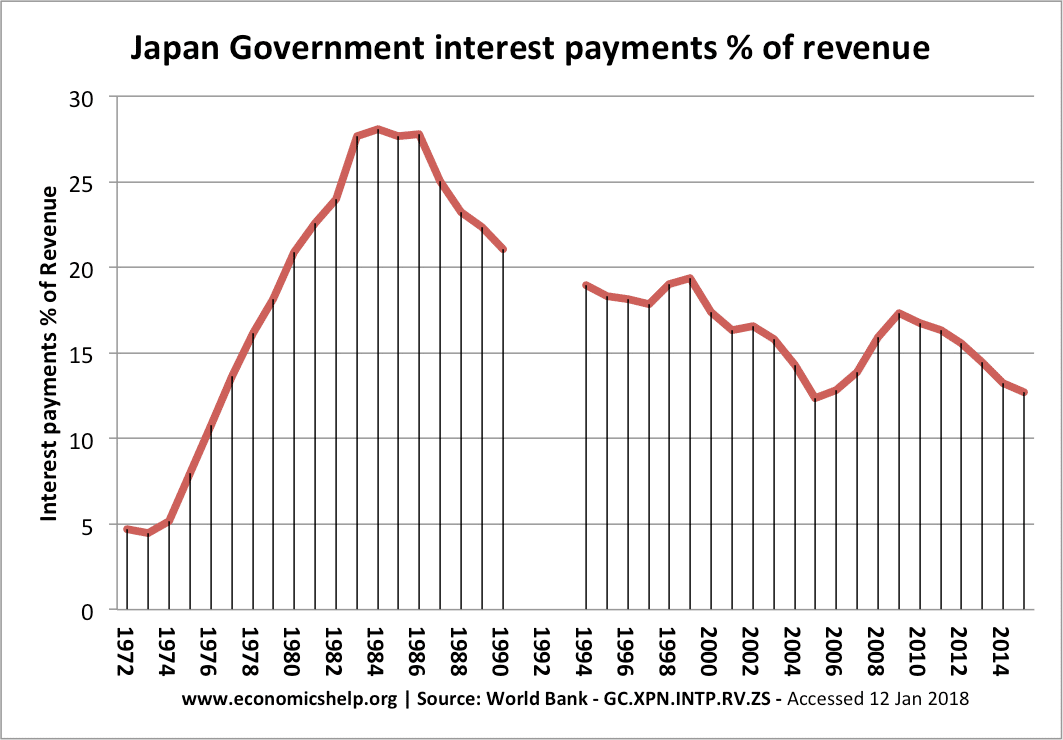

- The cost of servicing Japanese debt is 13% of the federal budget (link) – even with interest rates of 1%. If interest rates were to increase, Japan would soon find itself in difficulty.

- Borrowing over 239% of GDP for a sustained period is unprecedented.

- Bank of Japan holding more long-term bonds makes it increasingly difficult to unwind its position should things change.

- Japan faces an ageing population putting greater strain on social security spending. An ageing population will also lead to a fall in the savings ratio, meaning that domestic savings can’t mop up all the increase in government spending.

Related

External links

- Japan’s debt problem at Forbes

- How Long can Japanese bond yields defy gravity? at Econbrowser (2012)

THE primary reason the Japanese govt can borrow at very low nominal rates is that their economy is in or very near deflation. The increasing value of the yen is added to the return to their bond investors.

The other reasons you give are also important.

Thanks Ed. Good point.

I also heard recently that regulators in Japan instructed regional banks that hold a large amount of Japanese government bonds to shorten the growth of their holdings to reduce their interest rate risk. I think this implies even the regulators in Tokyo are becoming more nervous about the health of the market.

well, eventually all lenders, even the country’s own nationals, will come collecting. Japan will eventually have to pay up or go into default.