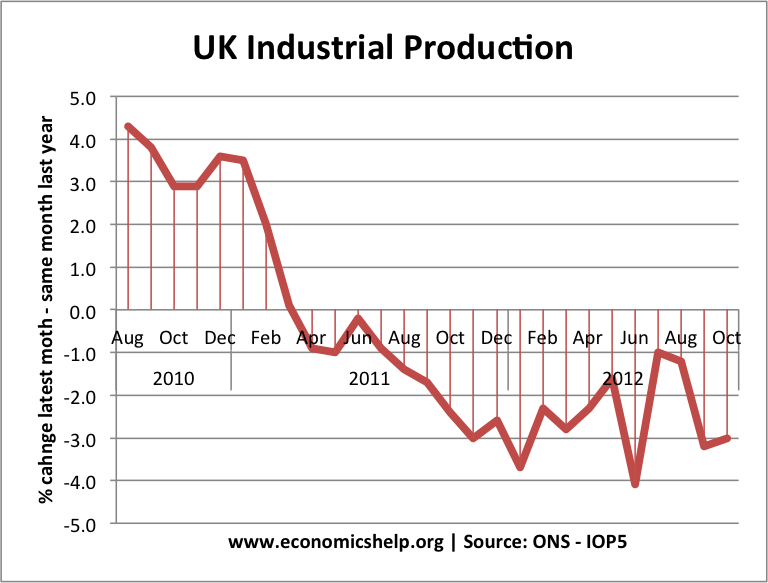

Unfortunately, despite the post-Olympic bounce in GDP, other aspects of the UK economy look pretty grim. In manufacturing and industrial output, there has been no real recovery. In manufacturing it is not so much a triple dip recession – more a prolonged double dip. Manufacturing output is 2.1 per cent lower in October 2012 compared with October 2011;

Source: ONS

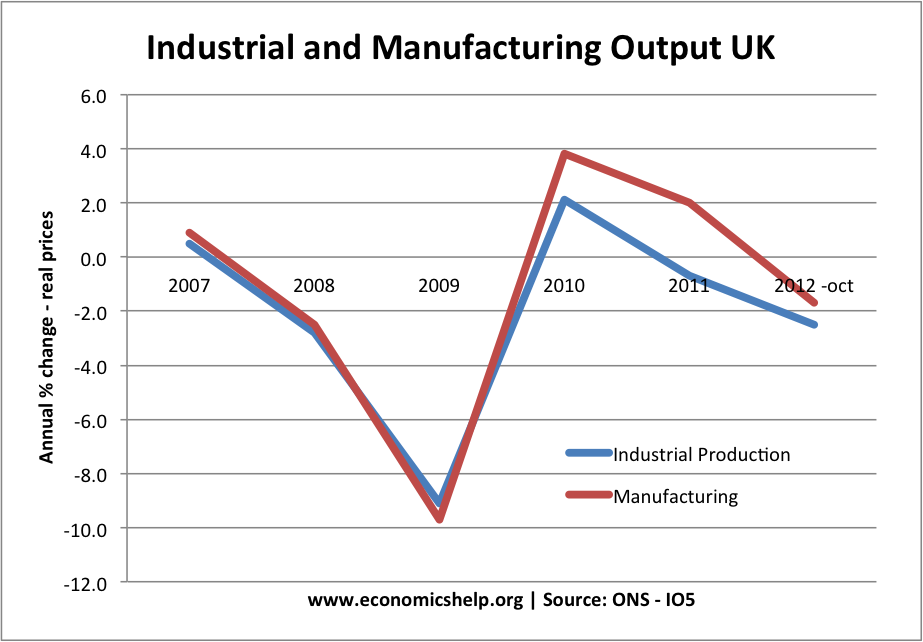

Looking at data since 2007, we see a similar pattern to GDP.

Industrial production = manufacturing output, + mining + water supply + electricity, gas and steam

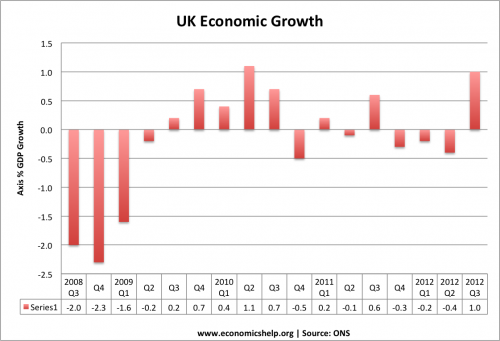

Recent UK Economic Growth

Source: ONS – National income accounts | Economic Growth stats

These figures for industrial production mean Q4 growth is likely to be negative – unless there is a bounce in the service sector.

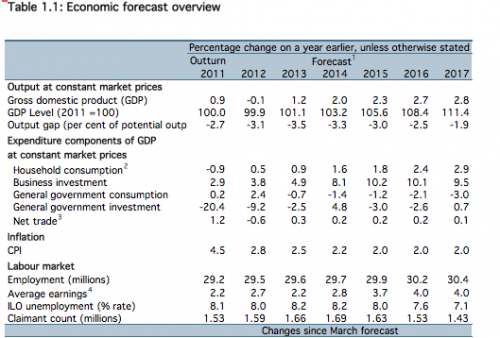

Forecasts for Growth in 2013

The OBR do forecast economic growth for 2013 of 1.2%. Though they state growth may be stronger towards the end of the year – still leaving scope for a triple dip recession before the economy recovers.

However, the OBR – like other forecasting agencies – have frequently been over-optimistic about the future of UK economic recovery. Since March, they have had to downgrade their growth prospects. The combined impact of austerity and the on-going downturn in the Eurozone is holding back aggregate demand leading to the prolonged economic stagnation we are seeing

David Cameron recently stated the UK should take a few lessons from German manufacturing, in particular with regard to promoting skills that business really need. He may have a good point, though it was perhaps unfortunate timing that Germany has just slashed its growth forecasts for 2013 – from 1.6 per cent growth just 0.4 per cent. – Showing that if there is a deficiency of demand, even enviable levels of productivity have their limits.

Related