Readers Question: In this era, Inflation had gotten really high specially in countries like Pakistan. Hows will the Inflation level go down ? or will it even let the country develop ?

Inflation is one of the several problems that the Pakistan economy faces. The good news is that inflation has been falling in the past two years. But, it is still one of the highest in the region; and in addition to inflation, there are also other inter-related problems the Pakistani economy faces.

Pakistan has a forecast of real GDP growth of 3.25% in 2013 – but, given the rise in the population, this growth is insufficient to improve living standards. Real GDP per capita growth has been stagnant in recent years. (real GDP per capita – measures output per person)

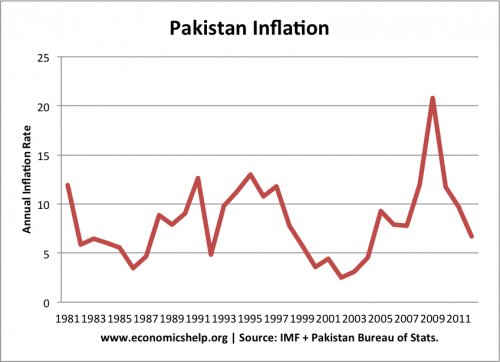

Inflation in Pakistan

Inflation peaked at 20% in 2009 and has now fallen to just under 7% at the end of 2012. However, many expect inflation to increase back up above 10% – because of cost-push factors.

Causes of Inflation in Pakistan include:

- Rising energy prices.

- Rising food prices. Agriculture is one of the mainstays of the Pakistan economy with 45% of the labour force employed in agriculture. However, the country has faced food shortages, pushing up food prices.

- There are concerns the financing of the budget deficit could create inflationary pressures too.

The poor growth in food productivity means that output in Pakistan is rising slower than in other countries. The consequence is that food prices are rising faster than output, leaving people in food poverty. (UN report) Rising food prices are a real concern for poorer households, who don’t have rising incomes to meet the higher cost. A recent survey suggests 50% of households are ‘food insecure’.

Tax Deficit and Budget Deficit

Pakistan has one of the lowest tax revenues as a % of GDP in the world. Pakistan tax revenues account for just 9.1% of GDP in 2011. Tax evasion and tax avoidance is widespread, with even leading politicians failing to submit a tax return. With limited tax revenues, the government has struggled to prevent a growth in the budget deficit. The budget deficit in 2011, reached 8% of GDP. (Economist on Pakistan economy) Although total debt to GDP is only close to 60%, Pakistan is struggling to finance their debt domestically – therefore, there has been a rapid growth in external debt. The increased deficit and external debt, has increased the cost of debt interest payments – taking a bigger share of limited tax revenues.

There is great scope for increasing tax revenue and plugging the budget hole, but successive governments have struggled to take on vested interests within society.

Supply Side Constraints

With tax revenues of just 9% of GDP, Pakistan has very limited resources for spending on infrastructure, health care and education. The main areas of government spending are on military, interest payments, and power subsidies. The government only pay 0.5% of GDP on health care, which is very low by international standards. Supply constraints in energy, transport and education have meant that there has been a stagnation in productivity growth. This creates both cost push inflationary pressures and limits the rate of economic growth. In particular, the IMF state ‘A key structural impediment to growth is the problems in the energy sector, which have resulted in widespread and unpredictable power outages’. (link)

Dealing with Inflation

In the short term, inflation could be tackled through demand side policies – deflationary fiscal policy and higher interest rates. However, this would damage Pakistan’s fragile economic growth. With a rising population, there is a need to increase economic growth, rather than cause a recession.

The underlying cause of Pakistan’s inflation seems to be supply constraints and cost push factors – rather than excess demand. In the long-term, it is necessary to try and reduce these bottle necks and increase agricultural and industrial productivity.

It is not easy to tackle this supply side issue because they are long-term issues requiring investment in infrastructure and dealing with power shortages.

Conclusion

Not everything is bad news. Inflation has fallen a little, economic growth is positive. Pakistan has a young population, which should be an asset. The country has a lot of potential which isn’t being realised. The first step would seem to be to raise more tax revenues, reduce the budget deficit, and tackle the cultural issue of non-payment of taxes. This will enable more to be invested in supply side improvements, which would be a start to improving supply side factors

Related