Interesting to read this from Lord Oakeshott, the Liberal Democrats’ former Treasury spokesman

“The economy is as flat as a pancake. No growth means no progress in the Coalition’s central purpose of reducing the deficit. We Liberal Democrats did not sign up to stagflation and a vicious circle of self-defeating cuts. It is time to challenge the Treasury orthodoxy that has learnt nothing since the 1930s.

The Treasury View could be summarised as the belief that:

- The budget deficit needs to be reduced whatever the economic circumstance. The Treasury view states that balancing the budget is important for restoring confidence. (See: Confidence Fairy)

- The Treasury view usually states that austerity measures will not adversely affect the economy. e.g. Cutting government spending will cause a rise in private spending to replace it. In other words, government spending is crowding out private spending.

The Keynesian view criticises this Treasury orthodoxy because they argue in a recession, government spending is not crowding out the private sector.

In 1931, Treasury officials put pressure on the government to implement an austerity budget – Tax increases, and cuts to unemployment benefits in the middle of a recession. (It led to the minority Labour government breaking up, with most Labour MPs leaving government. The hapless Ramsay McDonald was left to form a National Coalition with mainly Conservative MPs.

The austerity during the height of the Great Depression made the economy worse – though leaving the Gold Standard did help.

The sad thing is that the Treasury view had also prevailed in the UK during the 1920s.

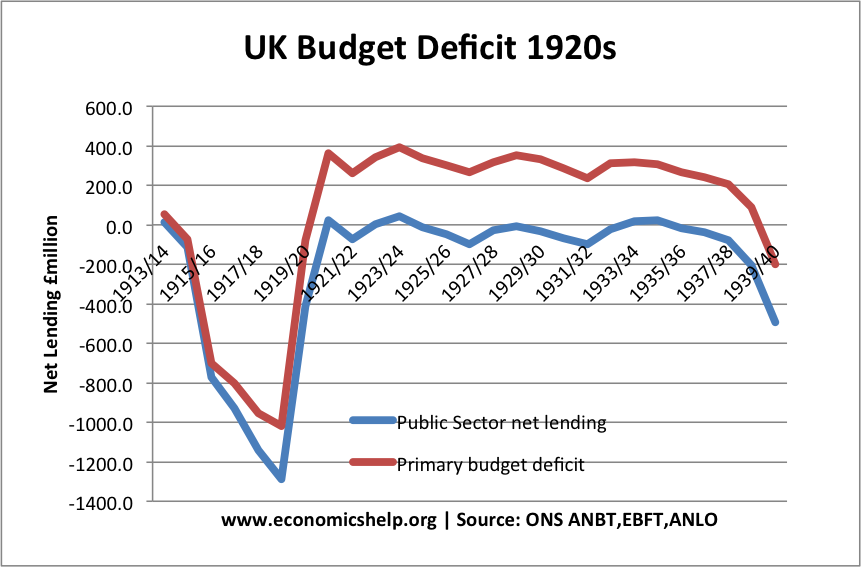

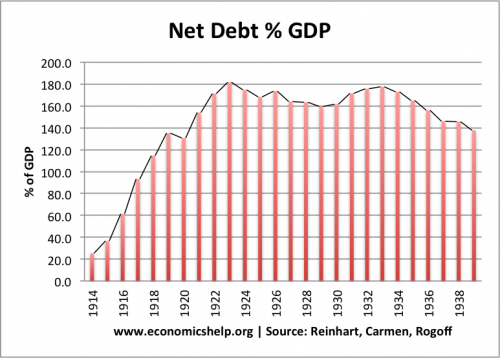

In an effort to reduce national debt as a % of GDP, throughout the 1920s, the UK ran primary budget surpluses throughout the decade (excluding interest payments, tax revenue was greater than government spending). Yet, despite these efforts at fiscal austerity, national debt as a % of GDP was stubbornly high and failed to fall because (apart from a few years) growth was stagnant.

Years of austerity failed to make a dint in national debt as a % of GDP.

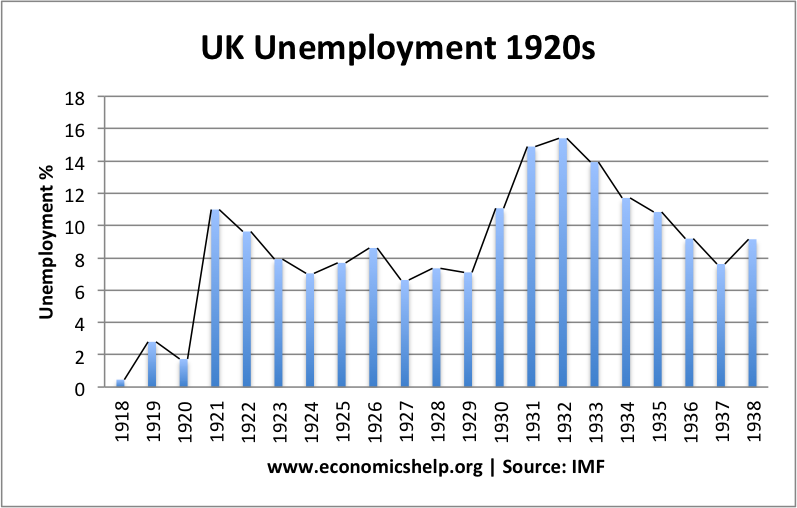

Leading to high unemployment.

There were some people arguing we should challenge the Treasury Orthodoxy back in 2010 (Spending cuts and the Economy, 2010). But, for want of a better saying

‘better late than never.

Related

1 thought on “The Treasury View”

Comments are closed.