Readers question: Why is public debt stated as a proportion of GDP and not as a proportion of the government tax take?

Generally, government debt is shown as a % of real GDP because this is best reflection of a countries ability to repay.

For example, in France, the government spends 52% of GDP (National Output). In Switzerland, the government spends just 32%. In France the government takes a higher share of tax than in Switzerland. If France and Switzerland had equal levels of debt, then Switzerland would look more indebted, because the debt would be a higher % of tax revenue. French debt would look a smaller burden because the tax revenue is relatively larger.

However, this wouldn’t completely reflect the ability to repay the debt. For example, if Switzerland had a high level of debt to tax, it is in a better position to increase tax rates to raise more revenue if necessary. France by contrast already has high tax rates, and when France tries to increases tax rates it may create disincentives (like famous movie stars moving to Russia).

Also, you could argue that a lower tax country like Switzerland will encourage more private enterprise and a stronger economy. If a country was strangled by high taxes. It would see it’s debt to tax ratio fall, but the economy may weaken.

However, although it is best to measure government debt as a % of GDP, it is still useful to examine debt as a proportion of government tax take. For example, some developing economies struggle to raise tax revenue. A large proportion of GDP may be beyond the government. If the government can only collect 10% of GDP in tax revenue, this limits their ability to repay even modest levels of debt. It is definitely worth taking into account.

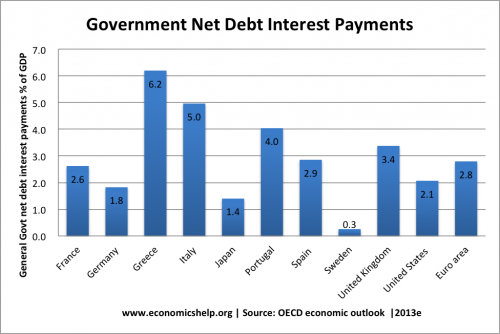

Debt Interest payments as a % of Tax Revenue.

One useful tool for measuring the affordability of government debt is relative cost of debt interest payments as a % of GDP and as a % of tax revenue.

This graph shows government net debt interest payments as a % of GDP

In the explanation above using France and Switzerland the argument is that repaying the debt would incorrectly look a smaller burden for France then for Switzerland because the French would find it harder to raise tax. This view does not take into account that the French who already extract more tax from their people could repay their debt by reducing their much larger Government spending (by say 20% of GDP to that equal to Switzerland’s spending) before having to increase their tax. Hence the burden of repaying their debt would actually be smaller. Also the GDP of the French would be relatively smaller than it would have been had the French only spent 32% of GDP by the disincentives which would have already driven movie stars to Russia.

A point not mentioned is that GDP is product produced within a country’s borders but not necessarily owned by its own citizens. Yet the Government Debt is fully owned by its citizens.

If a country becomes increasingly in debt, and spends large amounts of income servicing this debt this will be reflected in a decreased GNI but not a decreased GDP. Similarly, if a country sells off its resources to entities outside their country this will also be reflected over time in decreased GNI, but not decreased GDP. This would make the use of GDP more attractive for politicians in countries with increasing national debt and decreasing assets.

very interesting counter argument @jmazz. Many thanks