A list of some modern-day protectionist measures, including tariffs, domestic subsidies to exporters, and non-tariff barriers which restrict imports.

Types of Protectionism

- Tariffs – This is a tax on imports.

- Quotas – This is a physical limit on the quantity of imports

- Embargoes – This is a total ban on a good, this may be done to stop dangerous substances

- Subsidies – If a government subsidises domestic production this gives them an unfair advantage over competitors.

- Administrative barriers – Making it more difficult to trade, e.g. imposing minimum environmental standards.

- Competitive devaluation – manipulating currency to make exports cheaper.

Specific examples

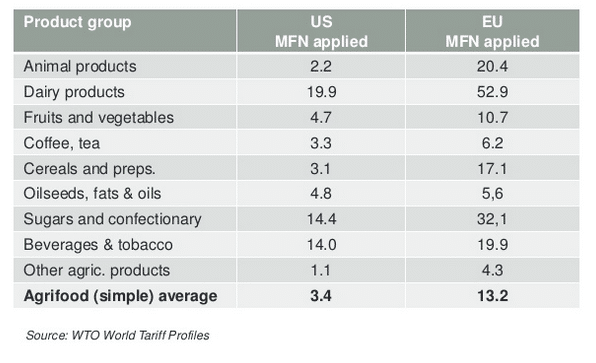

1. EU Common Agricultural Policy (CAP). Despite reforms and some reduction in tariff rates, the EU still impose substantial tariff rates on many agricultural markets. The aim is to increase prices for domestic European farmers in order to increase their income.

Some selected tariffs on EU agricultural products including:

- For medium/ low-quality wheat, a duty of €12 per tonne. Barley, a tariff of €16 per tonne. Oats, €89 per tonne,

- Beef tariff or ‘Hilton Quota’ The EU’s current quota 37,800 tonnes – charged 20% import duty. Above, the quota, the duty is much higher: €2,700–€4,700 per tonne. (link)

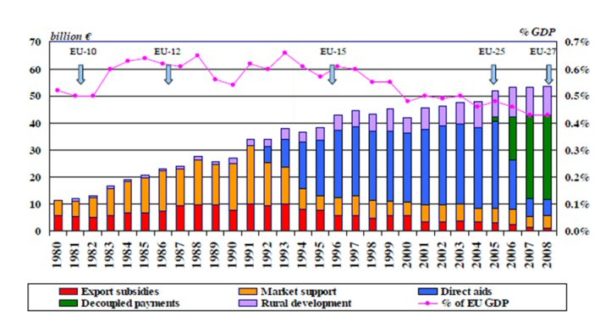

EU agricultural protectionism

This shows spending on market support has fallen. But, EU farmers benefit from direct subsidies.

2. Banana wars. For a long time, there were substantial tariffs on banana imports from Latin America. Exporters had to pay €176 (£141) per tonne of bananas. But, in 2012, an agreement has seen these tariffs reduced. (Banana wars) at Telegraph

3. Tariffs on imports of Chinese tyres into US. The US imposed tariffs of 35% on imports of tyres from China. This tariff was upheld by WTO (FT)

4. Argentina food tariffs. Argentina has increased imports duties on 100 products, including over a dozen agricultural goods under the Mercosur Common External Tariff (CET). (Agra.net). In this example, tariffs on the import of milk powder were increased to 9% after record levels of imports and fears Argentinian farmers would suffer falling incomes. (Argentinian milk powder tariffs)

5. Escalated tariffs. This occurs when higher tariffs are placed on processed food. This creates a disincentive for countries to process and add value to the raw commodity. For example, a WTO report found that the average EU tariff on primary food products (in 2008) was 9.9% but for processed food products it was more than twice as high, at 19.4%. This is for the EU’s MFN (most favoured nation) (Protectionist measures)

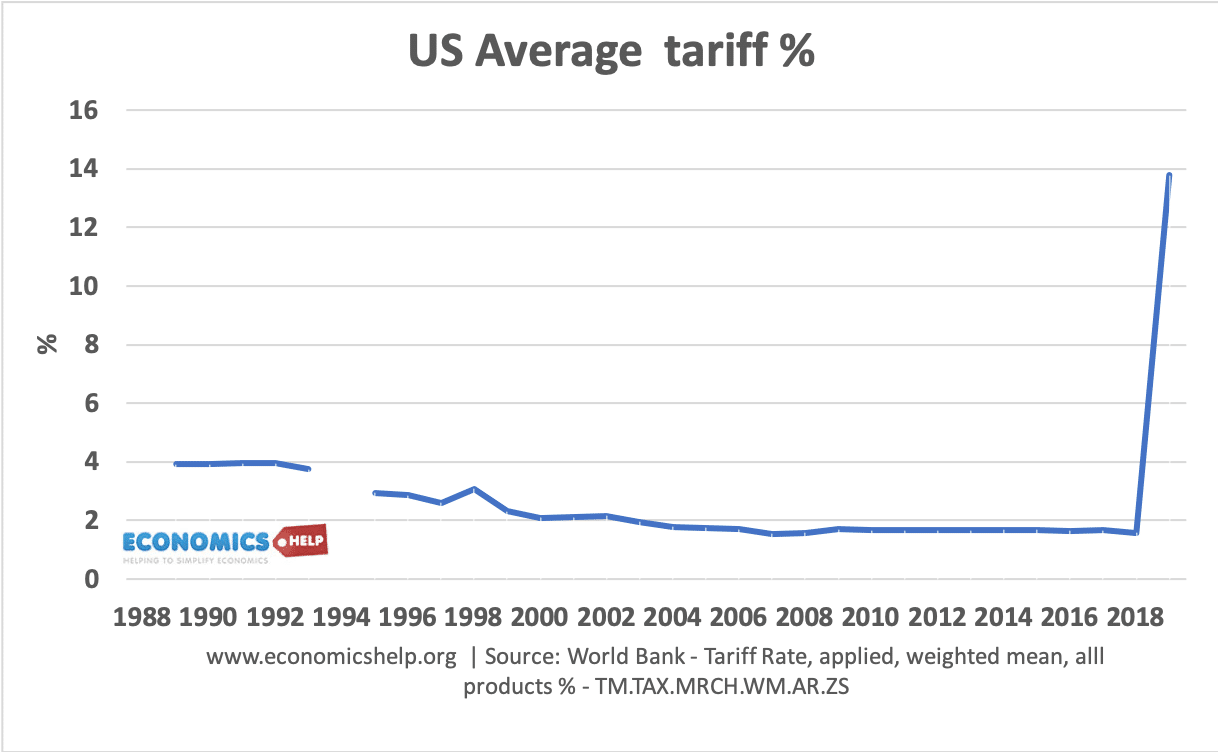

6. Trump tariffs. In March 2018 President Trump imposed tariffs on steel (25%) and aluminum (10%) from most countries President Trump raised tariffs on imports of many Chinese goods such as fridges, washing machines and clothes.

China retaliated by placing tariffs on US agricultural exports, like soy.

5. Anti-Dumping Tariffs ‘Dumping’ occurs when firms sell goods below a ‘fair market price’ e.g. below cost, because of excess supply. This can flood a domestic market with cheap imports and make it difficult for domestic firms to stay in business. In this case, countries may justify tariffs on the grounds they are preventing this damaging effect of dumping.

Tariffs are justified by the WTO, if you can prove dumping is occurring.

- China tariffs on imports of stainless steel tubes from EU and Japan. Tariffs vary between 9% and 14% (BBC Link)

6. Illegal Subsidies Another form of protectionism occurs when a country gives a subsidy or support to a domestic export industry. This gives the exporters an unfair advantage in the world market.

- 1. Subsidy of European airlines. For example, European airlines have been criticised for receiving ‘unfair’ support from their government. Though European governments respond they were just preventing the airline from going bust. This article from the Economist, suggests that the practice of subsidising European airlines has been declining.

- 2. China subsidies for its car industry. In 2012, the US filed a complaint that China was given excess subsidies to its car industry giving an unfair competitive advantage. USTR said the targeted export bases made at least $1 billion in subsidies available to auto and auto-parts exporters in China during the years 2009 through 2011. (link)

- 3. Calls for tariffs on imports of solar panels from China. (China Daily)

7. Growth of Red Tape Rather than put tariffs which break WTO rules, some countries prefer to strangle trade by imposing red tape, bureaucracy and things which increase the administration cost of trading. This has the same effect of discouraging imports. For example, the increasingly stringent standards set by the private sector in the area of certification and traceability create difficulties for developing countries exports. (EU Protectionist measures)

An increasingly popular method nowadays is to strangle traders not with high tariffs, which are easy to spot, but with red tape, which is not. Protectionism Alert at Economist

8. Devaluation as protectionism. In the past, China has sought to target its exchange rate. They have sought to keep the currency undervalued by using its foreign exchange reserves to buy foreign assets such as dollar securities. See: Chinese Currency manipulation

Many argue that this currency manipulation is a form of unfair trade protection policy. By reducing the value of its currency, China help to make its exports more competitive at the expense of the EU and US producers.

9. US Inflation-Reduction Act (2022) This gave large subsidies to US firms that develop green technology, such as EV. Competitors argue this gives the US an unfair advantage as their costs are effectively much lower. The EU have claimed the subsidies are contrary to international trade law (European Parliament 2023, Lester 2023). The EU is considering implementing own green subsidies to counter threat of US>

The EU is considering a similar response

Why Trade Protectionism?

Countries may impose tariffs on goods because:

- Infant industry argument – protect new industries

- Diversify the economy – help develop new industries to give more diversity to economy

- Raise revenue

- Protect certain key industries from international competition to try and safeguard jobs.

- Protect domestic jobs which are threatened by the rise of imports.

Related

External links

very useful website thanks

A very rich website thanks it has nourished my mind

Tatek Deneke: the article is rich in data, usefull and revealed practical realworld situation