One of the striking feature of the Eurozone crisis was how countries with relatively low levels of government debt, rushed into severe austerity. And as a consequence of this austerity saw a drop in the rate of economic growth, and an increase in their debt to GDP ratio.

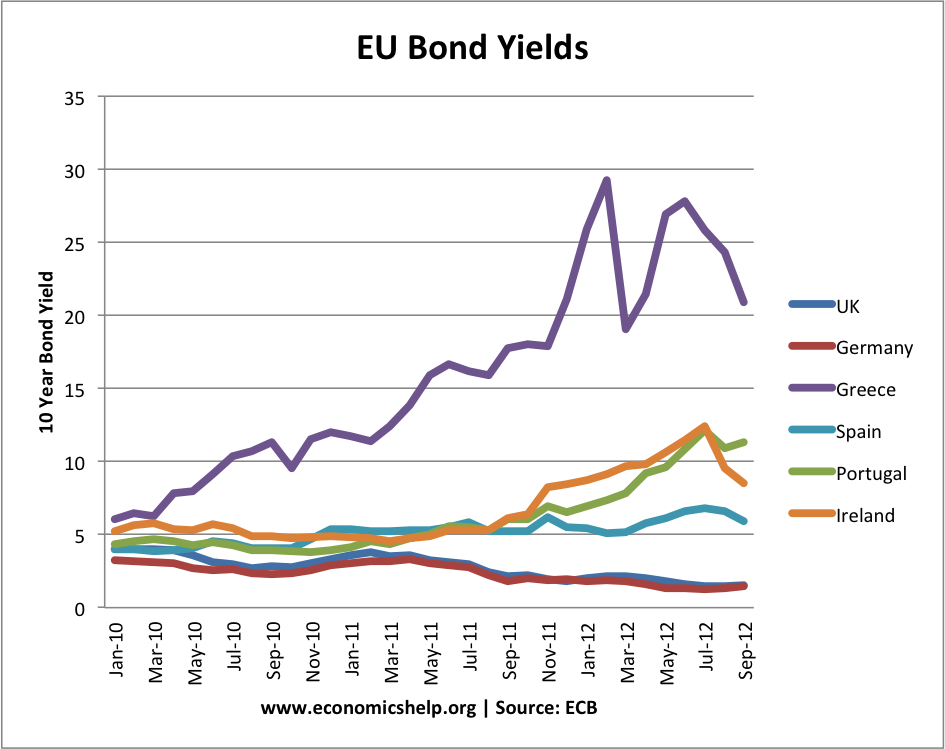

One of the main reasons for the rush to austerity was the rapid rise in bond yields that occurred in 2010-2011.

Bond yields rose in the Eurozone because markets feared illiquidity. (temporary shortages of people to buy bonds, causing widespread selling and drop in prices)

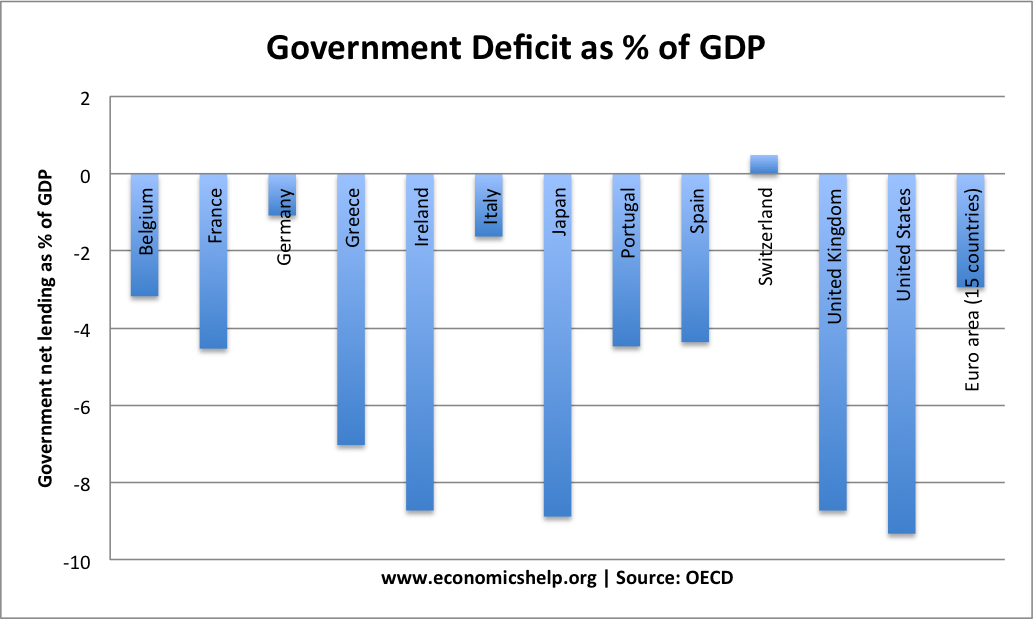

The highest budget deficits in 2012– Ireland, Japan, UK and US.

Japan, UK and US all maintained low bond yields. It was only countries in Eurozone which saw rapid increase in bond yields. Portugal’s deficit in 2012 was just over 4% of GDP. Italy had a primary budget surplus, but both saw very high bond yields.

With the exception of Greece and perhaps Ireland, the rise in bond yields wasn’t due to concerns about insolvency. (debt levels were manageable by historical standards. Spain’s public sector debt was lower than UK) but was because without a Central Bank willing to act, markets had no confidence in their bonds.

The episode revealed a fundamental weakness in the Euro project. Countries experienced unnecessary panics about their bond market because there was no Central Bank willing to act as lender of last resort. (problems with Euro)

In recent months, after years of prevarication, the ECB has finally been willing to buy unlimited bonds. This has, so far, led to a sharp drop in bond yields. Showing that it was always the lack of strong Central Bank action that was unnecessarily causing bond yields to be too high.

The Tragic Consequences of Panic Driven Austerity.

Unfortunately, the damage has been done. Two years of austerity, and the double dip European recession is much deeper than the EU and ECB ever expected. Unemployment in peripheral countries is dangerously high; it will be very difficult to get out of the deflationary debt spiral.

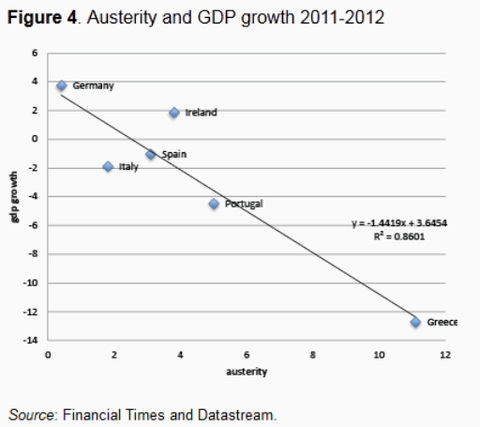

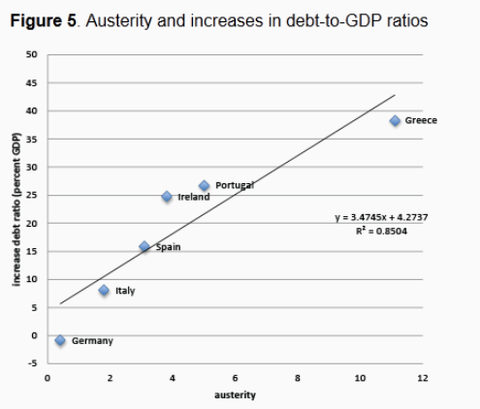

Paul De Grauwe, Yuemei Ji, 21 February 2013, produced a study on this theme ‘Panic driven austerity‘, and showed how panic driven austerity has led to dire economic consequences.

Strong correlation between the extent of austerity and negative impact on GDP growth

Strong correlation between greater austerity and higher debt to GDP ratios. Straightening the idea of ‘self-defeating austerity‘

This report is important because:

- I am unconvinced everyone in Europe appreciates the structural weakness of the Euro. There is no guarantee that the ECB will maintain a commitment to act decisively. There are strong pressures from people in Germany to pull back from unlimited bond purchases. There is still a very strong risk for future bond panics within the Eurozone.

- There is still a great reluctance in Europe to appreciate the damage that austerity has done to both economic growth, and ironically debt to GDP ratios.