The polluter pays principle (PPP) is a basic economic idea that firms or consumers should pay for the cost of the negative externality they create. The polluter pays principle usually refers to environmental costs, but it could be extended to any external cost.

In a purely free market, you would only face your private costs. However, for goods with negative externalities, there are additional external costs, e.g. damage to the environment. This means the social cost of some goods is greater than the private cost.

The polluter pays principle is simply the idea that we should pay the total social cost including the environmental costs. This requires some authority or government agency to calculate our external costs and make sure that we pay the full social cost. A simple example is a tax on petrol. When consuming petrol, we create pollution. The tax means the price we pay more closely reflects the social cost.

The polluter pays principle is a way of ‘internalising the externality’. It makes the firm/consumer pay the total social cost, rather than just the private cost. (Social cost = private cost+ external cost)

The polluter pays principle is an important basis of international law. In 1972, the OECD wrote Guiding Principles concerning International Economic Aspects of Environmental Policies, stating:

“… the polluter should bear the expenses of carrying out the above-mentioned measures decided by public authorities to ensure that the environment is in an acceptable state.”

The polluter pays principle was incorporated into the 1992 Rio summit The declaration stated:

Principle 16: “National authorities should endeavour to promote the internalization of environmental costs and the use of economic instruments, taking into account the approach that the polluter should, in principle, bear the cost of pollution, with due regard to the public interest and without distorting international trade and investment.” (earth.org)

Polluter pays principle and property rights

The polluter pays principle requires either government intervention or the presence of clearly defined property rights.

If someone has access to a river, they can sue a chemical firm if they create a cost of pollution. For other goods, it is harder to define property rights. For example, the pollution from a car affects everyone in society and also other countries. In this case, it is impractical to extend property rights to try and deal with the problem. The pollution faced by individuals is relatively low. In this case, government regulation is the only effective method.

To ensure that the polluter pays, government intervention will involve:

- Estimation of the external cost of the pollution.

- Place a tax on good to make people pay the true social cost or they may require the firm to pay to clean up the costs they create.

- To make sure a firm pays, money may need to be deposited as insurance against the worst case environmental scenario. Some environmental tragedies could cause the firm to go bankrupt meaning it can’t cover the full environmental cost.

Difficulties of implementing polluter pays principle

- It can be difficult to measure how much pollution is produced, e.g. firms may try to hide the extent of their pollution.

- It can be difficult to impose regulations or tax on firms from other countries. For example, when we contribute to global warming, the problem affects everyone around the world, but it can be difficult to create international agreements to impose penalties on those polluting.

- Pollution havens. These are countries which have weaker environmental legislation and firms can escape taxes and regulations on pollution by shifting production to those countries.

- Some costs are unexpected and occur after the event. e.g. in building a nuclear power plant.

- Administration costs of collecting information and implementing tax. For example, a few drunks late at night may make a lot of noise and disturb the neighbourhood, but it would be impractical to impose a tax on those who make noise after a hard days night. Administration costs have prevented the extension of congestion charge to smaller cities like Manchester – even though in principle it would make economic sense to have a charge for those who cause the external cost of congestion.

The difficulties of implementing the polluter pays principle doesn’t undermine its validity. It just means in the real world it will be hard, if not impossible to get a perfect approximation of the external cost. As long as we get closer to the social cost, there will be an increase in economic welfare.

However, some may argue that certain types of environmental pollution are so bad they should just be banned rather than taxing them, e.g. it is immoral to pollute a river and therefore we shouldn’t allow it to occur even if the polluter does pay some financial cost.

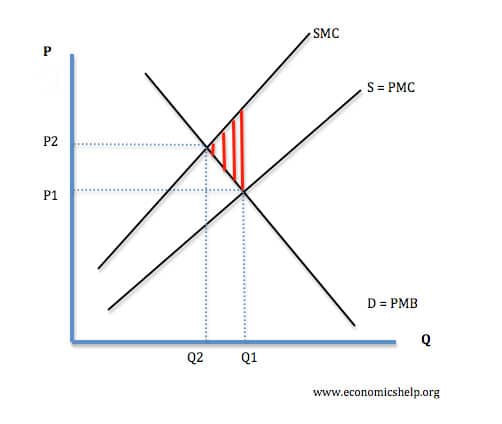

Welfare loss of external costs in a free market

If the polluter doesn’t pay, we get overconsumption and deadweight welfare loss (shown by the red triangle).

The free market equilibrium is Q1. But at Q1, the social cost (SMC) is greater than social benefit (SMB)

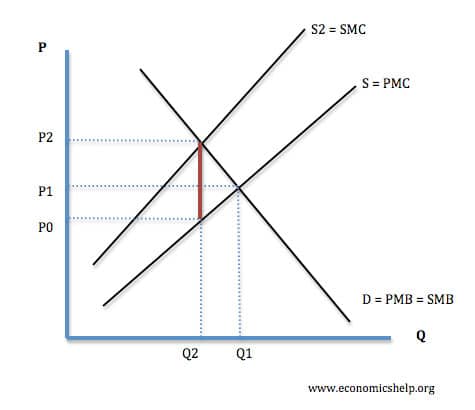

Diagram showing the tax on a negative externality

In this example, the original market equilibrium is Q1, P1. People only pay the private marginal cost (PMC). However, this good has an external cost – therefore the social marginal cost (SMC) is greater than PMC. A tax of P2-P0 makes people pay the true social cost and means the ‘polluter is paying’ the full cost. Thi the reduces quantity to Q2. This tax reduces the deadweight welfare loss and achieves social efficiency at Q2.

Reverse of the Polluter Pays Principle

The reverse of the polluter pays principle is that those who experience the external costs, should be compensated. If your environment gets polluted and your quality of life suffers, the polluter should be taxed and the money given to those residents who had experienced the costs. However

Examples

External links

- Polluter pays principle in EU Law – the difficulties of incorporating environmental costs into the market price.

(Not to be confused with Purchasing power parity (PPP)

well polluter pays principles cannot be upheld sustainabled in developing countries such as Sierra Leone. because poor or week legislation is ordered by EPA

It seems that the ability of polluters to pay meaningful amounts for the damage that they cause relies on their continued ability to generate revenue: they will not pay damages from lots of money in the bank, but with their continuing operations. This will continue to damage the Earth.

We need to take bull by the horns and engage in the discussion of how to shut them down. This is the only path towards a livable climate.