- Sudden increase in interest rates (e.g. in 1992, UK government increased rates to 15%)

- Direct money controls by the government (rarely used by Western Governments these days)

- A drying up of funds in the capital markets

The credit crunch of 2007-08 was driven by a sharp rise in defaults on sub-prime mortgages. These mortgages were mainly in America but the resulting shortage of funds spread throughout the rest of the world.

Steps to 2007/08 Credit Crunch

- US mortgage lenders sold many inappropriate mortgages to customers with low income and poor credit. It was hoped with a booming housing market, mortgages would remain affordable.

- Often there were lax controls on the sale of mortgage products. Mortgage brokers got paid for selling a mortgage, so there was an incentive to sell mortgages even if they were too expensive and high chance of default.

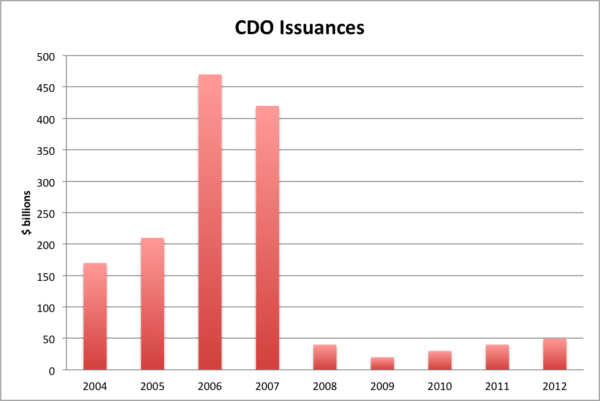

- To sell more profitable sub-prime mortgages, mortgage companies bundled the debt into consolidation packages and sold the debt on to other finance companies. In other words, mortgage companies borrowed to be able to lend mortgages. The lending was not financed out of savings accounts. (the traditional banking model)

- These mortgage debts were bought by financial intermediaries. The idea was to spread the risk, but, actually, it just spread the problem.

- Usually, sub-prime mortgages would have a high-risk assessment rating. But, when the mortgage bundles got passed onto other lenders, rating agencies gave these risky sub-prime mortgages a low-risk rating. Therefore, the financial system denied the extent of risk in their balance sheets.

- Many of these mortgages had an introductory period of 1-2 years of very low-interest rates. At the end of this period, interest rates increased significantly, reducing mortgage affordability.

- In 2007, the US had to increase interest rates because of inflation. This made mortgage payments more expensive. Furthermore, many homeowners who had taken out mortgages two years earlier now faced ballooning mortgage payments as their introductory period ended. Homeowners also faced lower disposable income because of rising health care costs, rising petrol prices and rising food prices.

- This caused a rise in mortgage defaults, as many new homeowners could not afford mortgage payments. These defaults also signalled the end of the US housing boom. US house prices started to fall, and this caused more mortgage problems. For example, people with 100% mortgages now faced negative equity. It also meant that the loans were no longer secured. If people did default, the bank couldn’t guarantee to recoup the initial loan.

- The number of defaults caused many medium-sized US mortgage companies to go bankrupt. However, the losses weren’t confined to mortgage lenders; many banks also lost billions of pounds in the bad mortgage debt they had bought off US mortgage companies. Banks had to write off massive losses and this made them reluctant to make any further lending, especially in the now risky subprime sector.

- The result was that all around the world, it became very difficult to raise funds and borrow money. The cost of interbank lending has increased significantly. Often it was very difficult to borrow any money at all. The markets dried up.

- This affected many firms who had been exposed to the sub-prime lending. It also affected a wide variety of firms who now have difficulty borrowing money. For example, biotech companies rely on ‘high risk’ investment and are now struggling to get enough funds.

- The slow down in borrowing has contributed to a slowing economy with the possibility of a recession in the US a real problem.

Credit Crunch in the UK

- UK mortgage lenders did not lend so many bad mortgages. Although mortgage lending became more relaxed in the past few years, it still had more controls in place than the US.

- However, the credit crunch caused very serious problems for Northern Rock. Northern Rock had a high % of risky loans, but, also had the highest % of loans financed through reselling in the capital markets. When the sub-prime crisis hit, Northern Rock could no longer raise enough funds in the usual capital markets. It was left with a shortfall and eventually had to make the humiliating step of asking the Bank of England for emergency funds. Because the Bank asked for emergency funds, this caused its customers to worry and start to withdraw savings (even though savings weren’t directly affected)

- As a result of the credit crunch, the UK has seen a change in the mortgage market. Mortgages have become more expensive. Risky mortgage products like 125% mortgages have been removed from the market.

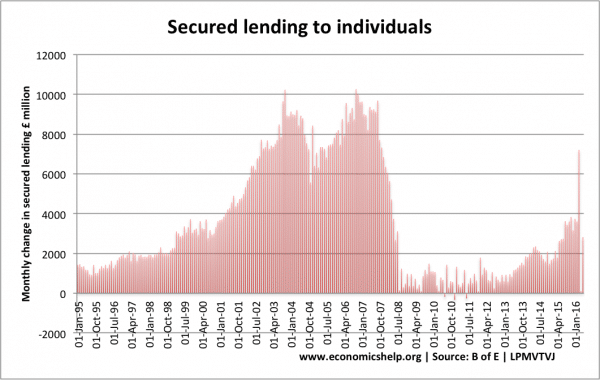

Secured lending to individuals has fallen since 2008 crisis. - UK Banks continue to face problems. HBOS (Owner of Halifax) struggled to finance its balance sheet. Like Northern Rock, it financed an expansion of lending by borrowing. Now money markets have frozen up; they couldn’t raise enough money to maintain liquidity.

- Falling house prices. After mortgages were difficult to get, demand for houses slumped, causing a fall in house prices have fallen and negative equity. However, due to a shortage of supply, UK house prices recovered much more quickly than abroad.

- Bradford & Bingley was nationalised because it couldn’t raise enough finance. The B&B had specialised in buy to let loans, which are particularly susceptible to falling house prices.

Impact of credit crunch on wider economy

- The fall in bank lending led to a fall in investment and lower consumer spending.

- Falling house prices created a negative wealth effect, leading to a fall in consumer spending.

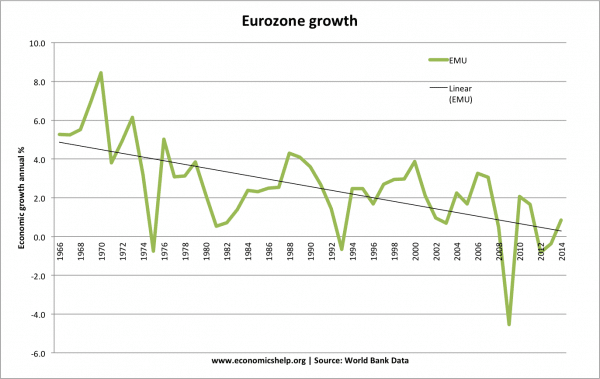

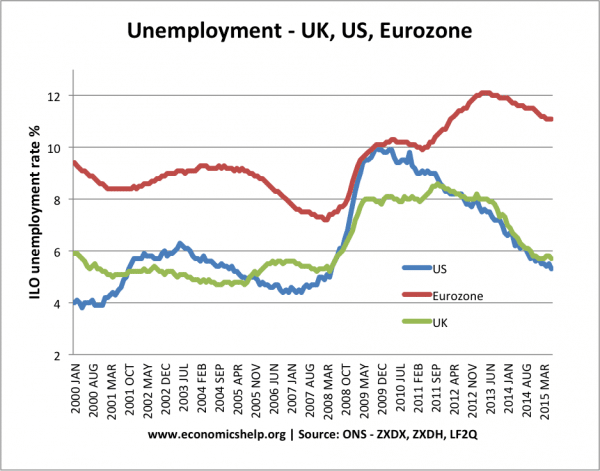

- The recession led to a rapid rise in levels of government borrowing. In response, the UK and many Eurozone economies pursued a degree of fiscal austerity – cutting spending/higher taxes to try and reduce levels of government borrowing. But, austerity in a time of recession, led to further decline in aggregate demand.

Why did Credit crunch spread around the world?

The crisis started in US, but it spread around the world because

1. Foreign banks bought collateralised US debt. Many of these subprime mortgage loans were rebundled into CDOs and sold onto financial institutions around the world. For example, many British and European banks had exposure to these mortgage loans. Therefore, when defaults rose, European banks lost a lot of money.

2. Global Credit Crunch. The banking system is internationally linked. When some banks started to lose money they became reluctant to lend to other. Therefore the international banking system became affected and banks stopped lending to each other and therefore it became difficult for firms and consumers to borrow from banks. This decline in bank lending contributed to a fall in aggregate demand. Even countries which didn’t have any exposure to subprime lending were affected by the global credit crunch.

Credit Default Options – illustrate boom and bust.

3. Global Trade. With the US entering recession, their demand for exports fell. So many countries experienced a decline in exports. This decline in global trade contributed to the global recession.

4. Confidence. Problems in the financial and banking sectors adversely affected the confidence of consumers and firms leading to lower growth

Who was to Blame for Credit Crunch?

Estate Agents/mortgage salesmen

Estate agents would be a populist target. However, I don’t think they can be blamed for cause of the credit crunch. They may give bad advice, like trying to encourage people to buy at the peak of a boom, but, the price of houses are determined by market forces and not estate agents.

Banks for Making Poor Loans

In the boom years, banks made an increasing number of loans with little regard to bad credit. Banks found ways to increase the number of mortgage loans through strategies such as interest-only, 100% mortgages and lending to people with poor credit history. The result is that more homeowners are at risk of mortgage defaults. It is this rise in mortgage defaults that is leading to bank losses and reducing their willingness to lend.

- UK banks could argue that they have been positively responsible compared to their American counterparts. UK banks will argue that without the US Subprime debacle, the mortgage industry wouldn’t have collapsed like it has. Mortgage repossessions in the UK, although increasing by 40% in last 12 months, are still a small % of the total mortgage market.

Speculators

Rising house prices encouraged people to buy houses. In London, many houses were snapped up by foreigners, this contributed to the boom. It is in these areas where house prices are now falling rapidly. However, this merely exacerbated volatility of house prices rather than causing the credit crunch

The Government

It could be argued the government should have done more to regulate banks who were lending irresponsibly. The credit crunch has shown that financial institutions can easily abuse systems of self-regulation. The big question is whether government bail outs of banks in trouble has created moral hazard. – By preventing banks from going under, have the governments given tacit approval for future bad decision making?

Related

- Euro debt crisis explained – how the credit crunch contributed to the Euro debt crisis.

- EU Debt crisis

- Double dip recession – longest recession since 1930s

I need to know one of the responses by goverment to the crises has been to take a stake in a number of banks/bulding societies. how does this effect the mix of the UK economy.

A credit crunch (also known as a credit squeeze or credit crisis) is a reduction in the general availability of loans (or credit) or a sudden tightening of the conditions required to obtain a loan from the banks. A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates. In such situations, the relationship between credit availability and interest rates has implicitly changed, such that either credit becomes less available at any given official interest rate, or there ceases to be a clear relationship between interest rates and credit availability (i.e. credit rationing occurs).

Why has corporate borrowing risen in recent years particularly by businesses with low credit scores?

very interesting , good job and thanks for sharing such a good blog.

You completely failed to give the Clinton administration its due credit for causing the banks to lend money to those who could not afford the mortgages. How would this have ended if the Clinton administration had left things alone.