Frequently we hear the argument that there is no austerity in the UK. Government spending has even continued to rise during the recession. Some would even go so far as to say that the modest rise in government spending is proof that expansionary fiscal policy is a failure, and we should actually be cutting government spending at a much faster rate.

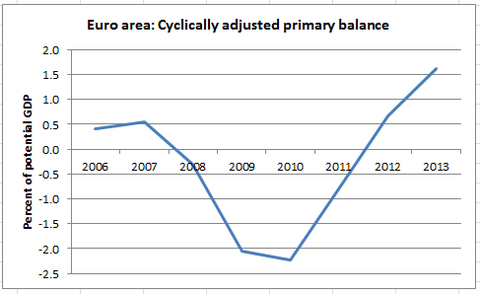

This would be like the experiment that is happening in Europe.

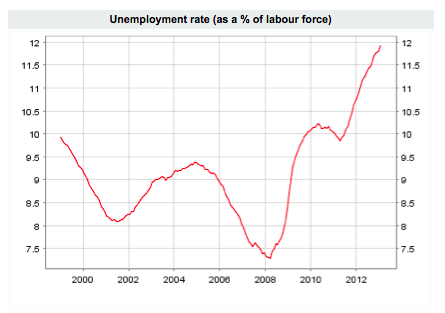

As Paul Krugman says, that is a lot of fiscal tightening at exactly the time when the private sector is weak. No wonder we have European unemployment showing a similar rise:

Source: ECB

UK Austerity Lite

Changes in Government spending

- Changes in government spending 2009-10 +4.6%

- Changes in Government spending 2010-11 +0.3%

- Change in government spending 2011-12 -1.5%

(BTW: I’m still chasing up HM Treasury for more statistics on real government spending + government spending as % of GDP. I find it hard to extract because the ONS doesn’t publish)

A critic may argue – government spending rose in 2010-11 so talk of austerity is misplaced.

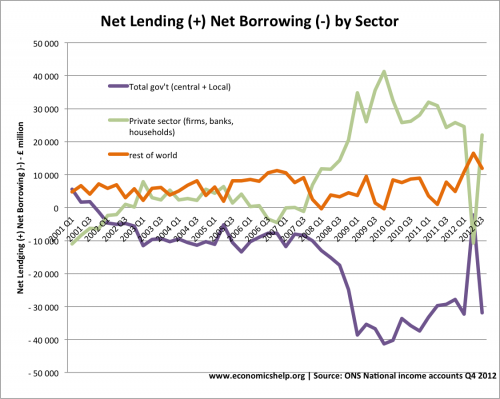

But, in a recession, fiscal policy is supposed to be counter-cyclical. If the private sector is reducing investment, reducing spending and increasing saving, then there should be a significant increase in government spending to offset the fall in private sector expenditure.

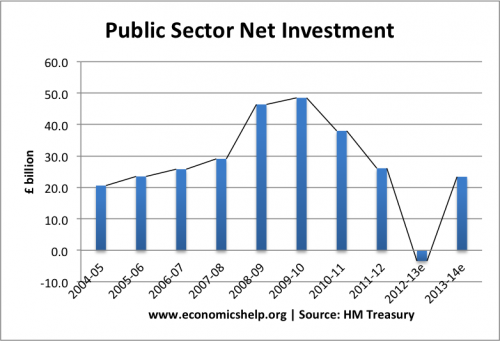

Also worth noting: In a recession, you would expect a sharp rise in government spending on cyclical benefits, e.g. rising unemployment requires higher government spending on benefits. To limit overall government spending increases to 0.3% – requires substantial cuts in some areas. (e.g. we see the fall in public sector net investment)

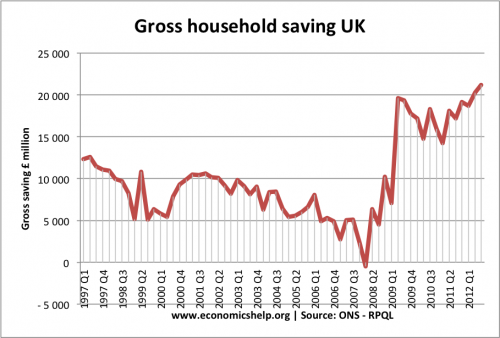

Suppose the private sector increased savings significantly – this means money is being withdrawn from the circular flow of income. In the recession, this becomes unproductive savings. They are not being used to finance investment because banks don’t want to take any risks in lending to private sector. The result is that these savings sit in bank vaults or end up buying government bonds (which is why gilt yields have fallen)

Look what happened to domestic savings in the UK.

Gross household savings in UK – guess when the recession occurred.

When evaluating government debt, it is helpful to see the wider economic picture.

If the private sector move from being net borrowers to net lenders, you would expect a big drop in GDP. This is why government spending should take the strain.

Falling asleep at the wheel

Simon Wren Lewis makes a good point that at the start of the recession, if the Central Bank refused to cut interest rates, we would rightly claim they are failing at their duty to pursue counter-cyclical monetary policy. (causing recession)

But, why not use the same evaluation for fiscal policy? In a recession, we should expect higher government spending for two reasons:

- Automatic fiscal stabilisers (government automatically spend more on unemployment benefits)

- Discretionary fiscal policy. To deal with falling private sector spending, the government should step in and provide a counter-balance to the falling demand in the economy.

If keep government spending constant during a recession, we are effectively pursuing deflationary fiscal policy.

Net public sector investment has been squeezed in 2012/13 by the government’s austerity policies.

Conclusion

When evaluating the fiscal stance of a government, it is important to look beyond just the raw figures on overall government spending.

- Automatic fiscal stabilisers will cause an increase in cyclical spending.

- But, also, if the government wants to avoid falling GDP, then it needs to be willing to make use of rise in private savings and increase spending during the period of economic stagnation.

One final point

This is not an argument for higher government spending overall, you could argue that the rise in government spending during Labour was a failure of Keynesian economics. Because in the boom period, the deficit should have been reduced not increased.

I do believe in very serious recessions we should be willing to use fiscal policy as intended – counter cyclical fiscal policy.

Related

Do we really have austerity? Both John Redwood (Tory MP) and Stefan Karlsson have claimed that the much publicised “cuts” are non-existent. That is, they claim government spending has increased, not decreased since the Tories came to power.

If this is correct, it’s surprising the Tories don’t make more use of this point. But when you’ve done more research into government spending relative to GDP, you may find the Redwood and Karlsson are wrong. Keep up the good work.

Agree. If one considers UK debt / borrowing budget as the same as a ‘household’ budget (as the example used by politicians), then it is clearly wrong. The real problem disclosed by this is simply that most people vote on this wrong understanding, and they vote for a balanced budget… and they therefore get the idiots in charge that provide just this.

The true balanced budget (vs household analogy) for UK is Imports/Exports. If the UK keeps this in balance, it can do whatever it wants with the debt/borrowing (subject to keeping inflationary levers in control).

So, for the whole of my life, ALL UK governments have misunderstood the simple underlying processes for expanding and controlling the economic health of the UK…. and are still doing it!

see:

http://www.commonsensethinking.co.uk/demagogy.html

Cheers

JP