Readers Question: Assess the effectiveness of the UK’s taxation structure in terms of reducing inequalities, negative externalities and unemployment.

Some of the UK’s tax system is progressive. A progressive tax takes a bigger % of income from higher earners. The UK’s income tax system is progressive. In 2012-13, the tax threshold will be over £8,100 This means people on low income, pay zero income tax. For people earning over £34,000, they will pay a marginal tax rate of 40%. For earners over £150,000 there is a marginal tax rate of 45%

The system of marginal tax rates means that the average tax rate increases the more you earn. You only pay 45% tax on income over £100,000.

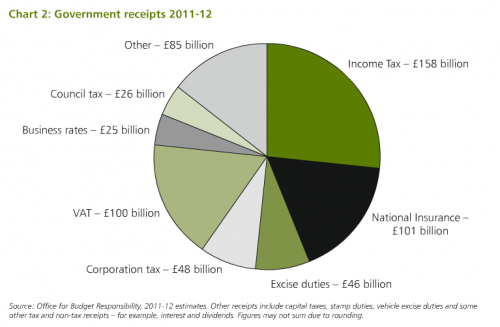

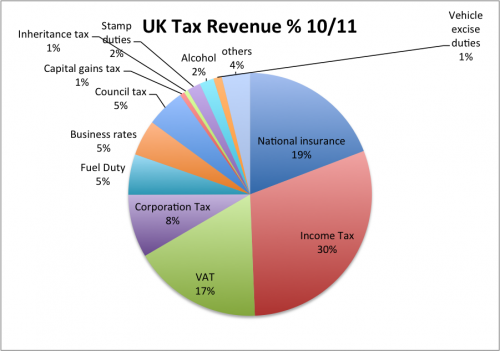

National insurance is also quite progressive as it takes a % of your income. However, with national insurance there are upper limits so you don’t have to pay tax on income above that. Income and NI taxes account for 50% of total tax revenue. The government have admitted that the combination of income tax and NI makes it unnecessarily complicated. A commission will be looking at merging the two.

However, although the income tax system is progressive, other taxes are more regressive.

At 20% VAT tends to be more regressive. People on low income have a higher marginal propensity to consume. Therefore, the VAT they pay is a higher % of their total income. People on high income will spend more and will pay more VAT, but they will have a lower marginal propensity to consume (People on high incomes can afford to save a higher % of income). Therefore, VAT will be a smaller % of income spent. The regressive nature of VAT is slightly compensated by the fact that in theory, necessities like food (e.g. cold pastries, cabbages) don’t have VAT. VAT is supposed to be targeted at luxury goods.

Other taxes like excise duties on cigarettes are much more regressive. Smoking rates tend to be higher amongst people with lower incomes. Also, it will be a much bigger % of income than for rich smokers.

Council Tax can also be quite regressive and arguably unfair. People living in expensive areas end up having high housing costs, but also a higher council tax band. Arguably a fairer method of collecting local tax would be a local income tax.

Another problem with the UK tax system is the scope for having offshore accounts and avoiding paying tax through tax avoidance schemes. Tax avoidance is often easier by people with high incomes. Offshore tax avoidance

The Mirrless report by Institute of Fiscal Studies argued that the UK tax system was costly, ineffective and complicated. Guardian link

Although, the Tax Justice movement were critical of this Mirrless report.