Readers Question: over the next 10 years, should the government make greater or lesser use of measures such as road pricing or taxes on fuel to reduce road use?

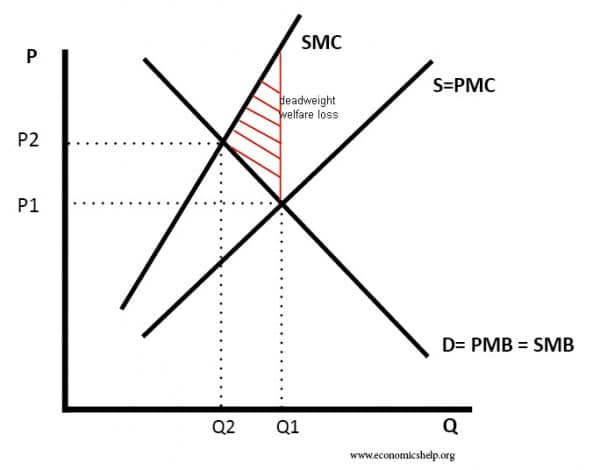

In the UK, road use creates many external costs. This includes increased pollution, congestion, and accidents. Therefore, the social cost of driving is greater than the private cost. In a free market, this leads to over-consumption, (people ignore external costs when deciding whether to drive). This causes economic costs such as lost output due to congestion. Therefore, there is a good argument for governments to intervene to overcome market failure.

Diagram for market failure with negative externality

A tax on fuel will reduce demand for car use and make people pay the social cost. This increases social efficiency and also raises revenue for the government. This money can be spent on subsidising alternatives to car use.

Road pricing is even more accurate in making motorists pay the social cost. This is because with road pricing a higher tax can be charged when congestion is at its worse (rush hour in city centres) Petrol tax doesn’t distinguish between road use that causes congestion.

However, there are concerns about making greater use of road pricing and taxes on fuel.

Firstly, road pricing is difficult to implement. It requires high administration costs and is difficult to enforce. It also involves greater encroachment on people’s privacy.

Demand for road use is inelastic. Therefore, higher taxes may not solve the problem. The government should look at providing alternatives.

Taxes are already quite high. It is argued by motorists that they may already may the social cost. However, the social cost is difficult to measure, for example, it may depend on how serious global warming is.

Road pricing in city centres may cause a loss of business in city centres and encourage out of town shopping. This may lead to social costs within city centres. It depends whether alternative transport is provided.

Conclusion

Road pricing can provide a role in overcoming market failure associated with road use. It is the best way of making people pay the social cost. However, it should not be used in isolation. To effectively reduce road use, it is necessary to provide alternative forms of transport. However, higher taxes do create the necessary funds for these alternatives.

See also

a very nice assessment, covering the question nicely n pretty well set out….