Readers Question: But what happens to the balance of payments in a recession? (from: What happens in a recession)

In a recession, the current account is likely to show an improvement (reduction in deficit). This is because:

- In a recession consumer spending falls, therefore spending on imports decreases.

- In a recession, interest rates are cut. Therefore exchange rate depreciates making exports cheaper and imports more expensive. This reduction in the exchange rate improves the current account.

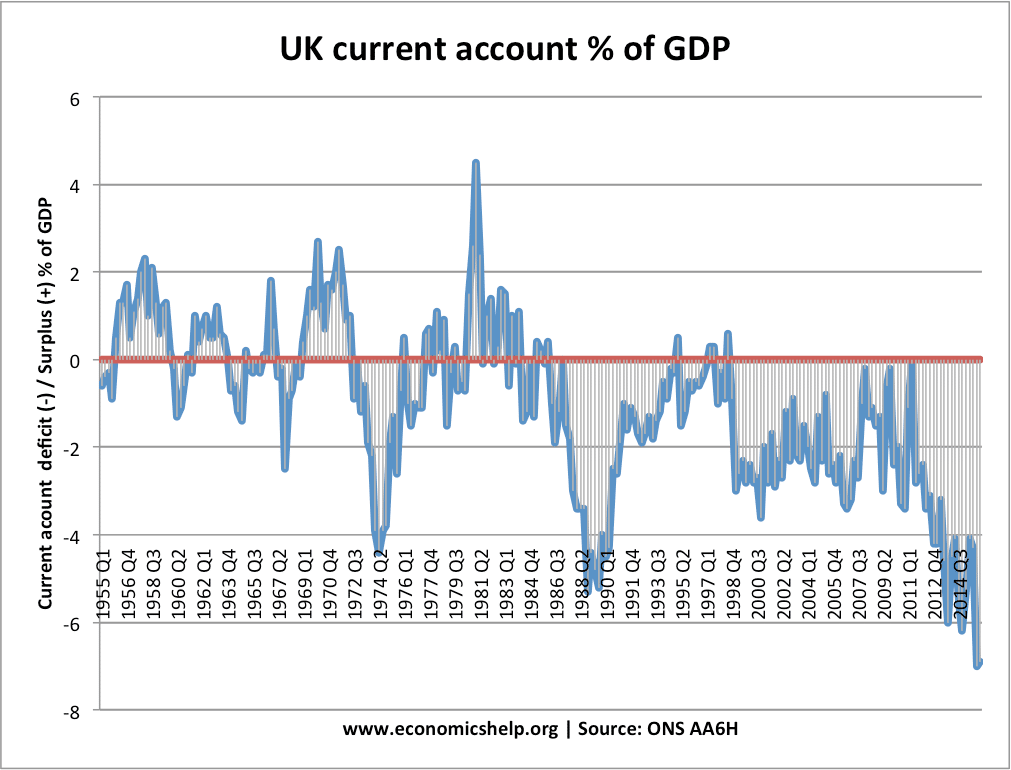

Current account deficits are often cyclical – increasing when consumer demand is strong, reducing when consumer spending falls. This is certainly the case for a country like the UK, which has a high marginal propensity to import.

Also, there is often a time lag before an exchange rate depreciation has an impact on the current account deficit.

Also, it depends on the global economic cycle. If a country enters a recession, but all its main trading partners enter a recession at the same time, then the impact on export-import spending will be less noticeable. Because although the country reduces import spending – they will also see a fall in export demand.

Evaluation

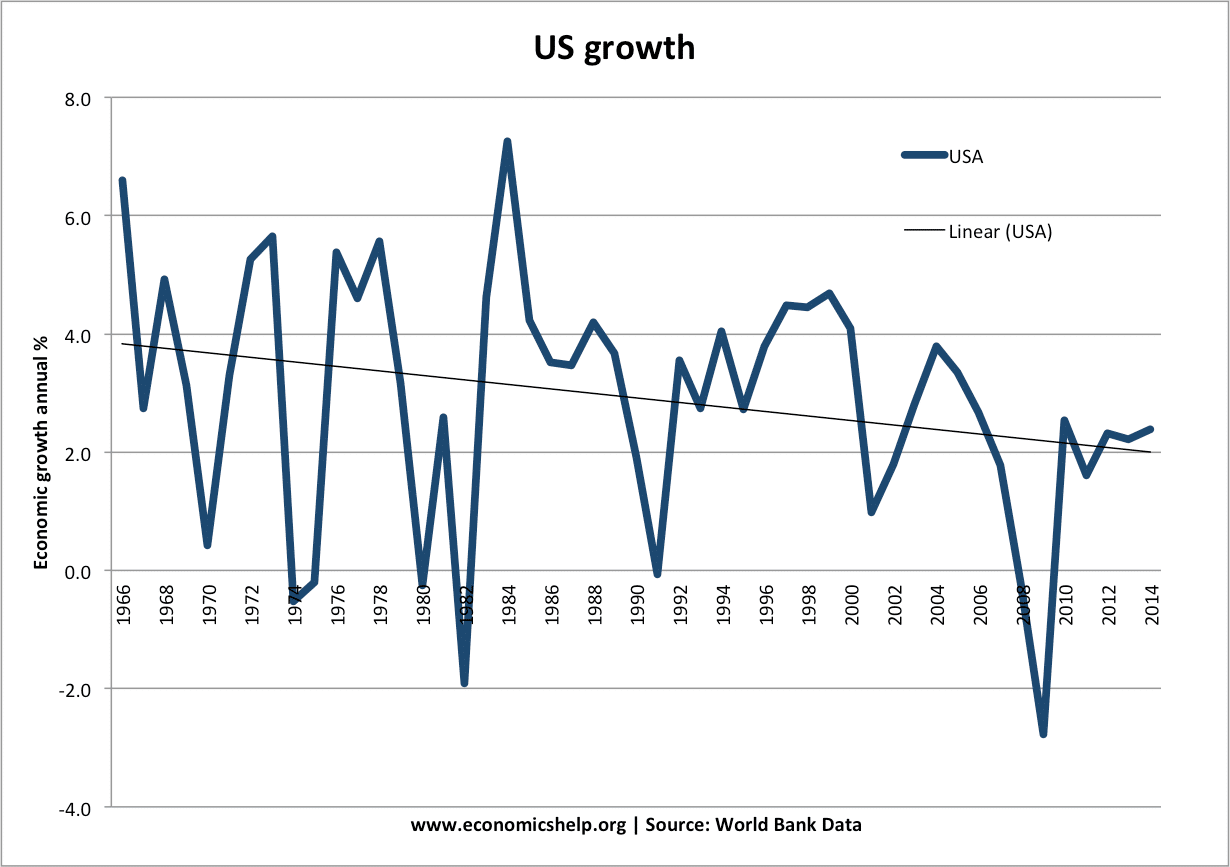

However, a recession is not guaranteed to improve the current account deficit, especially for countries like Germany and China who rely on export-led growth. In a global recession they see a fall in the demand for their exports so could see a deterioration in the current account. However, economies like the US and UK tend to be more reliant on consumer spending and so a fall in economic growth causes bigger fall in import spending.

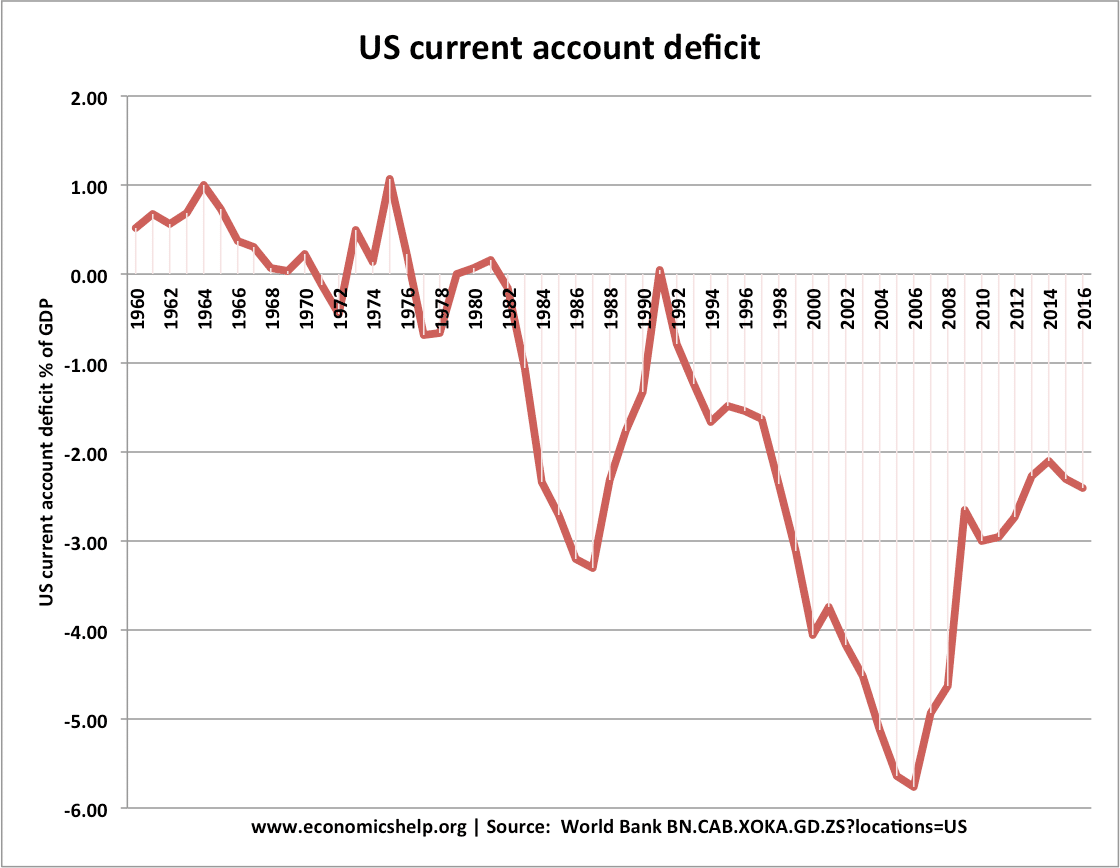

US current account 1960 2017

The US experienced recession in 1980, 1991 and 2008/09. In these occasions we can see an improvement in the US current account – a reduction in the deficit.

UK current account

The UK saw improvement in current account during 1981 and 1991 recession. There was a small improvement in 2009 – but deteriorated 2010-2015 – despite weak economic growth

Related