Keynesian economics developed in the 1930s offering a response to the unique challenges of the Great Depression.

Keynesian economics involves:

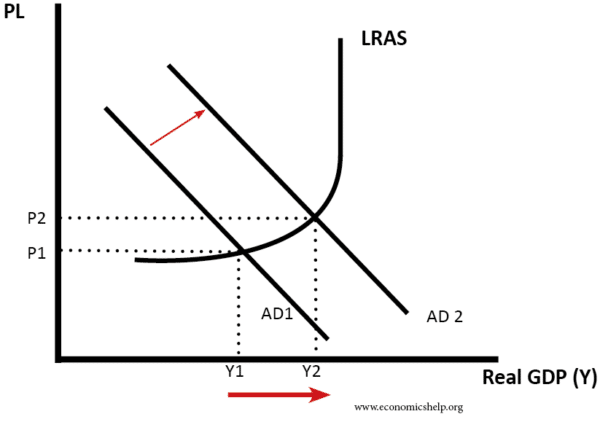

- Government intervention to stabilise the economic cycle e.g. expansionary fiscal policy – cutting tax and increasing spending. The argument is that governments can speed up economic recovery.

Criticisms of Keynesian Economics

- Borrowing causes higher interest rates and financial crowding out. Keynesian economics advocated increasing a budget deficit in a recession. However, it is argued this causes crowding out. For a government to borrow more, the interest rate on bonds rises. With higher interest rates, this discourages investment by the private sector.

- Resource crowding out. If the government borrows to finance higher investment, the government is borrowing from the private sector and therefore, the private sector has fewer resources to finance private sector investment.

- Inflation. A problem of fiscal expansion is that it often comes too late when economy is recovering anyway and therefore, it causes inflation.

- The difficulty of predicting output gap. An assumption of Keynesian economics is that it is possible to know how much demand needs to be increased to deal with output gap. However, the output gap can vary. For example, if there is an unexpected fall in productivity then the negative output gap may become very low – despite low rates of economic growth. In this situation, the appropriate response is not increasing demand, but supply-side reforms to boost productivity.

- Ricardian equivalence. This is an argument that if the government pursue expansionary fiscal policy e.g. cutting taxes financed by borrowing, then people will not spend the tax cut – because they believe that taxes will have to rise in the future to pay off the debt, therefore, expansionary fiscal policy has no effect.

- Encourages big government. In a recession governments increase spending, but, after recession government spending remains leading to high tax and spend regimes. Milton Friedman quipped ‘nothing was so permanent as a temporary government programme.” Government spending projects may be designed for the short-term, but once started it creates powerful political pressure groups who lobby the government to hold onto them.

- Time Lags. It takes a long time to change aggregate demand by the time AD increases it may be too late and it leads to inflation.

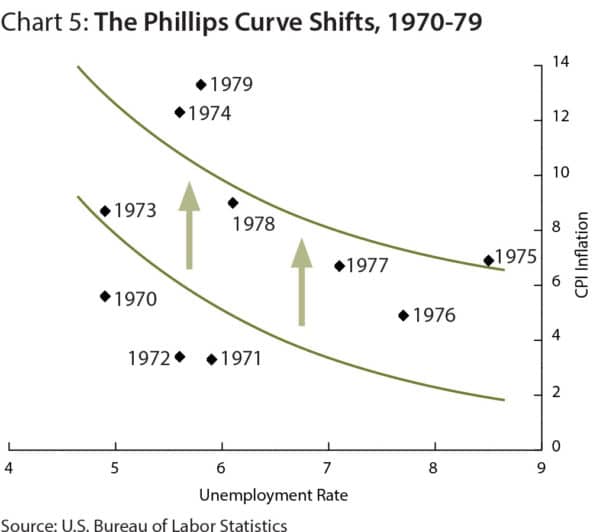

- Break-down of Phillips Curve trade-off. In the 1950s and 60s, Keynesian demand management was in vogue – as governments appeared to have a choice between unemployment and inflation. However, in the 1970s, there was a period of stagflation (higher inflation and higher unemployment). It appeared to critics of Keynesian demand management, that policies to boost demand were only aggravating inflation and not reducing unemployment in the long-term. To Monetarist critics, such as Milton Friedman, the better policy was to target low inflation – and accept there may be a temporary period of unemployment. Friedman and other ‘supply-side economists’ tended to focus on supply-side reforms to increase market efficiency and reduce imperfections in labour markets (such as minimum wages and labour markets)

Specific criticisms of Keynesianism

Modern Monetary Theory (MMT). MMT would stress that in a recession government spending can be financed by printing money rather than borrowing.

Austrian school. Austrians are more critical of government intervention. They argue government intervention only prevents the private sector dealing with the disequilibrium.

Response to criticisms of Keynesian economics

- Expansionary fiscal policy should be pursued during a liquidity trap/recession. In this situation, there is a rise in private sector savings that are unused. Government borrowing will not ‘crowd out’ these unused resources because the private sector is not at full employment.

- Keynesian economics doesn’t per se advocate bigger government. In an economic boom, the government should reduce the budget deficit. Critics often misrepresent Keynesian economics to be anything related to government spending

- Keynes didn’t advocate higher inflation. He argued that inflation could be damaging and a low inflationary environment conducive to strong economic growth. However, in a liquidity trap, inflation is not a problem.

Related

Thank you for helping me

Sir plz, suggest me that criticism of keynssian system and criticism of keynssian theory are same

Did you got the answer?

Thank you very much it was helpful