- Externalities occur when producing or consuming a good cause an impact on third parties not directly related to the transaction.

- Externalities can either be positive or negative. They can also occur from production or consumption.

- For example, just driving into a city centre, will cause external costs of more pollution and congestion to those living in the city.

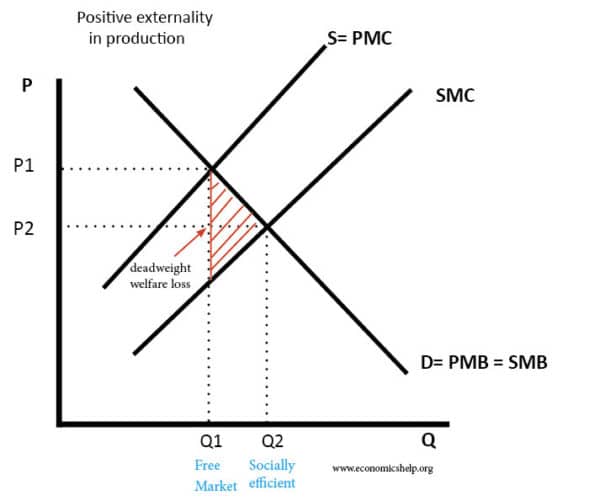

Positive Externality in Production

This occurs when producing a good cause a benefit to a third party not directly involved.

Example: A farmer grows apple trees. An external benefit is that he provides nectar for a nearby beekeeper who gains increased honey as a result of the farmers’ orchard.

In this case, the social cost is less than the private cost. The beekeeper saves the cost of having to provide a source of nectar.

In this example, it works both ways. The beekeeper provides an external benefit to the apple grower because his bees help to fertilise the apple tree.

Other examples of positive externality in production

- A private school provides an external benefit because the workforce will be more educated in the future and it saves the cost of government education in a publically-funded school.

- Providing a cafe which employs previously homeless people helps to reduce the social problem of homelessness.

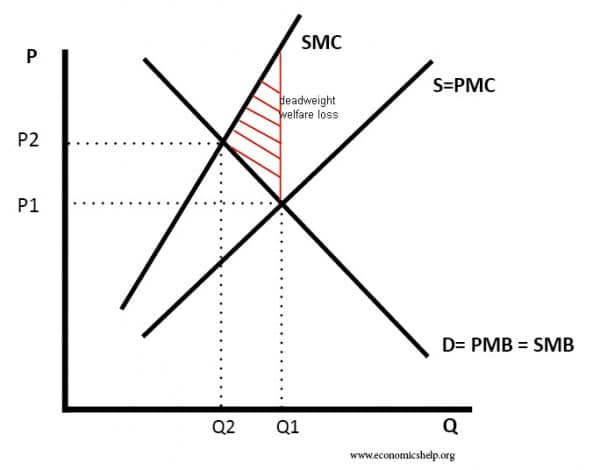

Negative Externality in Production

This is when producing a good causes an external cost to a third party. Therefore, the social cost of production is greater than the private cost

Making furniture by cutting down rainforests in the Amazon leads to negative externalities to other people. Firstly it harms the indigenous people of the Amazon rainforest. It also leads to higher global warming as there are fewer trees to absorb carbon dioxide. The social cost of making furniture is greater than the private cost to a firm.

Other examples of a negative externality in production

- Non-organic vegetable growing. Farmers use fertilizers and pesticides which harm insects and also can get into the food chain, causing health problems in the future.

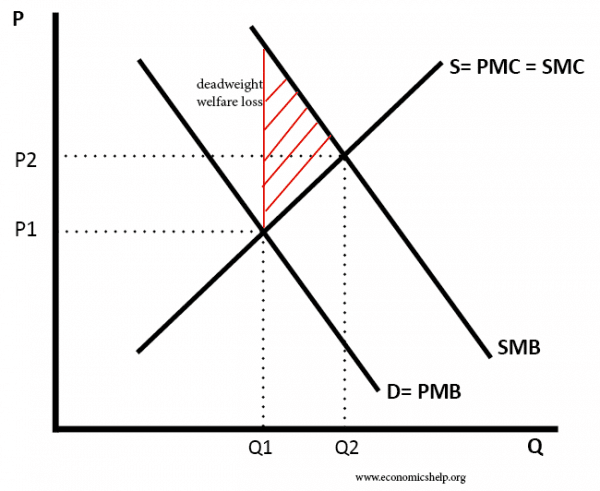

Positive Externality in Consumption

For example, if you take a three-year training course in information technology, you gain personal skills, but also other people in the economy can benefit from your knowledge. The social benefit of consuming education is greater than your personal benefit.

Other examples of positive externality in consumption

- Buying an electric car which reduces pollution

- Buying a bicycle which reduces pollution and congestion.

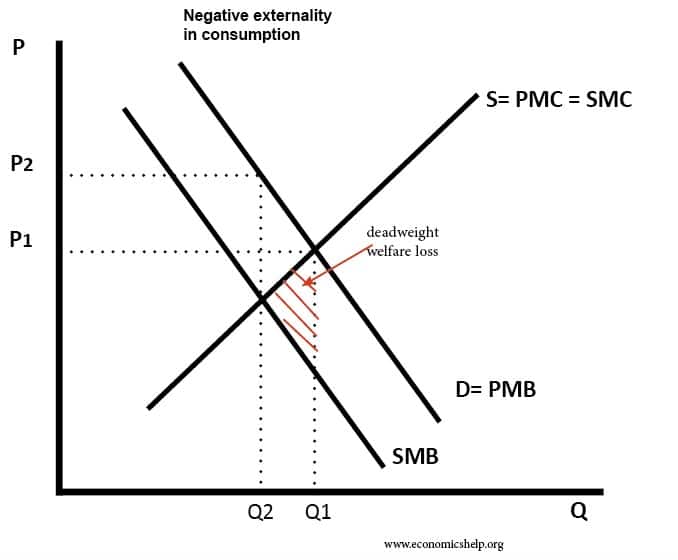

Negative externality in consumption

When consuming a product causes costs to a third party. For example, if you smoke in a crowded room, other people have to breathe in your smoke. This is unpleasant for them and can leave them exposed to health problems associated with smoking.

Other examples of negative externalities in consumption

- Drinking alcohol and then driving can lead to accidents which hurt innocent bystanders.

- Playing loud music annoys your neighbour

Pigou on Externalities

In 1920, Arthur C. Pigou wrote The Economics of Welfare which is an early exposition of this concept

Pigou noted that private business pursued their own marginal private interests. However, industrialists were not concerned with any external costs to others in society. In other words, they had no incentive to internalise the full social costs of their actions and this led to a deadweight welfare loss.

Pigou used an example of a contractor building a factory in the middle of a neighbourhood. The factory leads to external costs faced by those living in the locality. These external costs include:

- Pollution,

- Congestion

- Damage to health

- Loss of light

Pigou also used the example of alcohol. Alcohol has a private benefit to firms but also the sale of alcohol leads to additional costs to society in terms of increased demand for healthcare and law and order.

Pigouvian tax – A tax placed on a good to take into account these external costs and move output closer to the level of social efficiency.

Overcoming externalities

To overcome externalities, we require some form of government intervention

- Tax. To reduce consumption of negative externalities, we can place a tax on goods with negative externalities

- Subsidy. To increase consumption of positive externalities, we can place a subsidy on these goods.

- Regulation. The government may place regulations which limit the amount of pollution.

- Nudges and behavioural economics – The government could place incentives and make it easier to choose less costly environmental choices.

Related