Limit Pricing is a pricing strategy a monopolist may use to discourage entry. If a monopolist set its profit maximising price (where MR=MC) the level of supernormal profit would be so high it attracts new firms into the market. Limit pricing involves reducing the price sufficiently to deter entry. It leads to less profit than possible in short-term, but it can enable the firm to retain its monopoly position and long-term profitability.

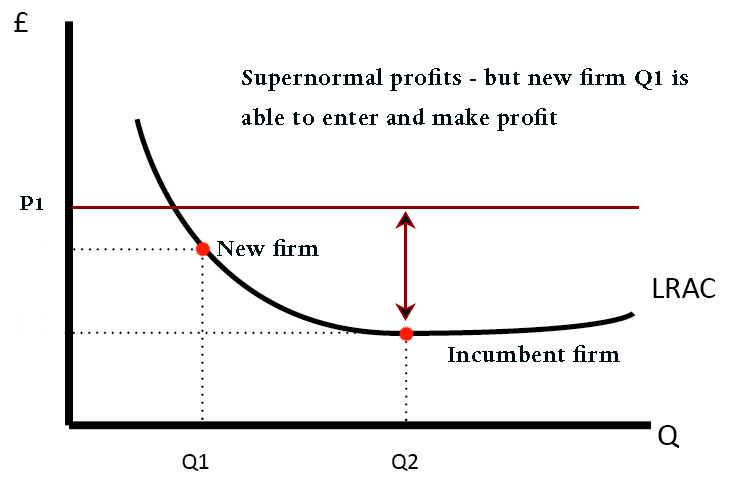

Profit maximisation in the short run

In the short-run, a firm may set price using usual profit maximisation rules (where MR=MC). This could lead to a price of P1.

If the new firm produces at Q1, with a market price of P1, that is higher than its average costs – so it is profitable for a new firm to enter.

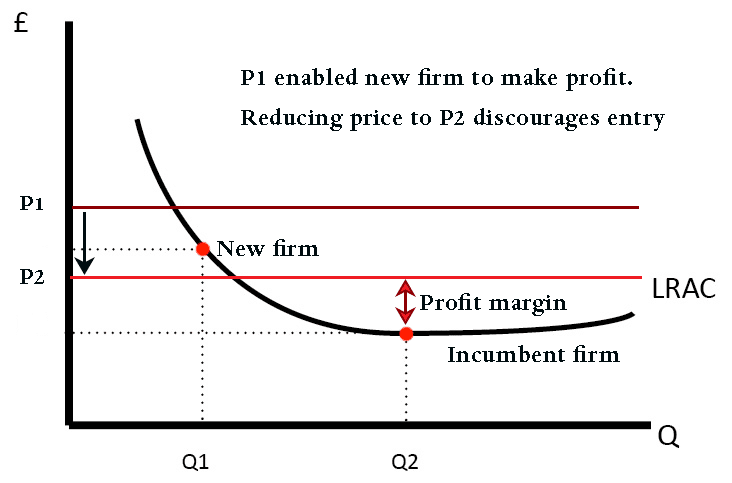

Limit pricing

Therefore, rather than encouraging a new firm to enter, the monopolist may decide to set a price below this profit maximising level, but still high enough to enable it to make higher profits than in a competitive market.

For limit pricing to be effective, the monopolist needs to decrease the price to the point where a new firm will not be able to make any profit on entering the market.

By discouraging entry, the incumbent firm is guaranteed an ‘easy life’ and guaranteed high profits.

The monopolist may also build excess capacity as a threat that if firms enter, it will reduce the price even further.

Evaluation of limit pricing

- A large multinational may be willing to enter a market – even if it is unprofitable in the short-term. The large multinational can use its reserves and profit elsewhere to subsidies a loss-making entry. For example, Google entered the market for mobile phones – despite no experience. Limit pricing is not effective if new firms have the capacity to absorb losses.

- Rather than limit pricing, a firm may set the profit maximising price, but then react when a new firm enters. If a new firm enters, it lowers price to make it difficult. It could go to an extreme and engage in predatory price – setting the price below average cost to force the rival out of business. Predatory pricing is illegal, which is a reason to choose limit pricing instead.

- Limit pricing will be more effective in industries with substantial economies of scale – for example, industries, such as steel and aeroplane manufacture. It gives an advantage to the incumbent and disadvantage to potential new firms. For industries, with few economies of scale, such as restaurants and bars, limit pricing will not be effective

Related

- Predatory Pricing

- Monopoly diagram – profit maximisation

- Barriers to Entry

Last updated: 28th November 2019, Tejvan Pettinger, www.economicshelp.org, Oxford, UK