The oil price is determined by supply and demand side factors. Rising oil prices are indicative of rising demand and/or shortages of supply. The oil price is also affected by market speculation.

Rising Demand

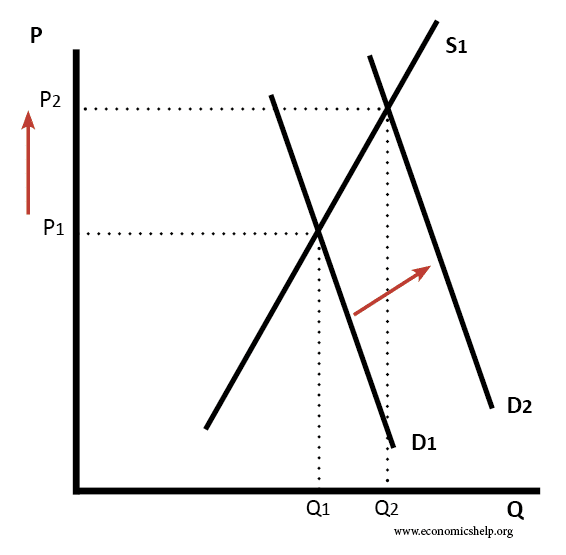

Increasing demand will push up the price of oil. A short-term rise in demand could lead to a significant increase in price because supply is quite inelastic – at least in the short-term.

A significant cause of rising demand for oil is simply a growing global population. An increasing number of people have greater energy demands causing a steady rise in demand for oil

Secondly, economic growth is a major cause of rising oil demand. With higher economic growth, there is an increase in derived demand for transport, oil and also energy. In recent years, strong economic growth in India and China has led to a significant rise in demand for oil. For example, the growing middle class in China have aspirations to own a car, therefore the increase in income can cause a proportionately bigger % increase in demand.

Technology. In recent years we have seen new technology which has diminished the need for oil – more fuel-efficient cars, hybrid cars, switch to renewable energy. This has moderated the demand for oil, though greater efficiency has been outweighed by the growing demand – especially from emerging economies in S.E Asia.

Inelastic Demand

With many goods, higher prices lead to lower demand as people switch to alternatives. However, demand for oil is notoriously inelastic because of the lack of available substitutes. Therefore, if the price rises, people are willing to pay the price.

In the long term, demand may become less inelastic because substitutes develop; but, at the moment alternatives are now widely available. This means as price rises, demand doesn’t drop off. People just pay the higher prices.

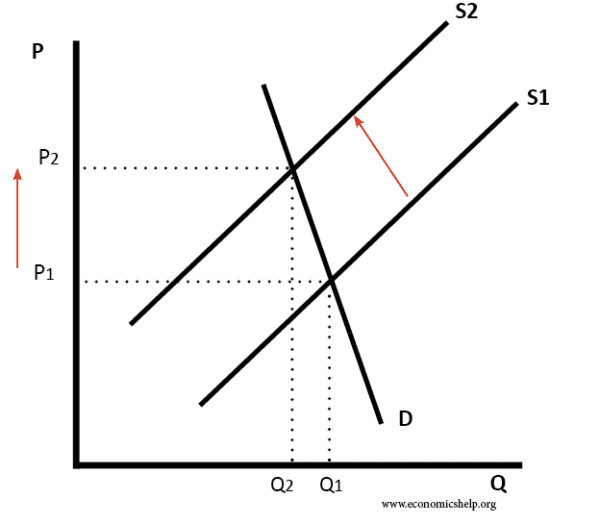

Disappointing yields from known suppliers

If countries face supply constraints, then the price of oil will rise. For example, if oil supplies become less accessible, countries will either not to want to produce from these areas or wait until prices rise to make it profitable. For example, oil from the Antarctic is much more expensive to extract than from the Middle East.

There can also be disruption to the supply of oil due to political instability or transport strikes.

OPEC Quotas

Sometimes, OPEC countries can attempt to raise the price of oil by restricting supply. In particular, the world’s largest producer of oil – Saudi Arabia has the capacity to influence the price of oil through cutting back supply. If other member countries also follow suit, the restriction in supply can cause a significant rise in price.

In 1974, OPEC controlled a higher share of the total oil market. In response to events in the Middle East, they severely restricted oil supplies, causing the price to triple in a short period. This was the most dramatic period of rising oil prices.

Speculation

The price of oil does not just depend on economic fundamentals. There is also an element of speculation. If investors predict oil prices will keep rising, they will buy oil futures to keep pushing prices up.

Empirical example

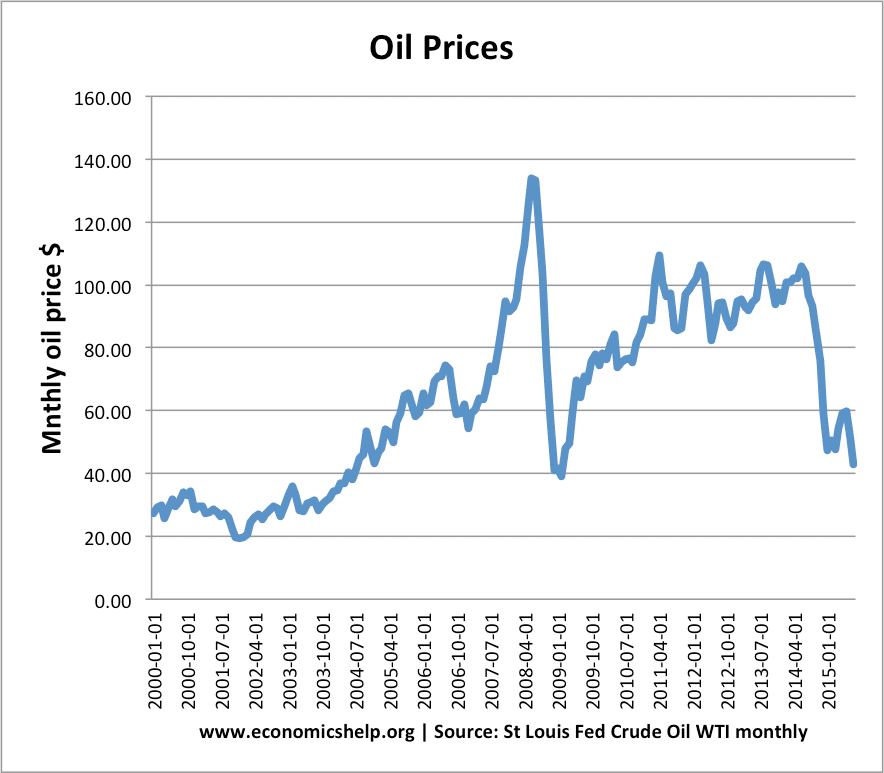

Between 2000 and 2008, there was a sustained period of global economic growth, which contributed to rising oil prices.

The collapse in price in 2008, reflected the pessimism of the credit crunch and start of the global recession. The rise in the price of 2009/2010 is unusual; the price of oil rarely rises during a recession. But, in 2010, China and India were less affected by the global recession – demand from China kept rising. But, also, there were supply constraints which caused the price to rise.

Related

Price of probably has increased because of the set number of oil wholesalers and access to oil. Unlike many other industries not everyone can be a seller of oil therefore as you rightly pointed out the burden increases on the set number of oil extractors, wholesalers and ditributors therefore passing the cost onto the end customer.

Also there is the element of what they can get away with charging since the demand for oil has not declined.