Readers Question:Do you really think the UK will keep the AAA credit rating for say the next 2 years?

The UK is one of the few countries to have a AAA credit rating. (list of countries with highest credit rating)

I’ve always felt that the UK should be able to maintain its AAA credit rating (with possible minor downgrade). However, there is a danger of downgrade due to two factors

The UK fail to recover, but get stuck in a persistent depression. Most analysts expect positive growth for the UK by the end of 2012, but this is far from guaranteed. In the past 4 years, forecasters have been persistently over-optimistic when it comes to UK growth. There are 3 factors which could cause the UK to endure persistent depression

- Government spending cuts are still to come into full force. If the government cuts spending, but the private sector continue to save and not invest, there could be a large fall in demand.

- The European economy could deteriorate much further. A deep European recession would reduce demand for UK exports (and AD) but, more significantly undermine confidence

- Further falls in Private sector spending and investment. For example, UK house prices are overvalued. If banks suffer substantial losses related to Eurozone debt default, mortgage availability could fall further, leading to lower house prices and a negative wealth effect on consumer spending. But, also households have been squeezed by rising living costs and stagnant wage growth. Consumer confidence is already very low, but could still deteriorate. (Confidence fairy)

Nevertheless, I still think (or perhaps hope is a better word) that this can be avoided. I would like to see a strong year of economic growth, that would be key to improve credit rating prospects.

Some Reasons to Hope UK will Keep its AAA credit rating.

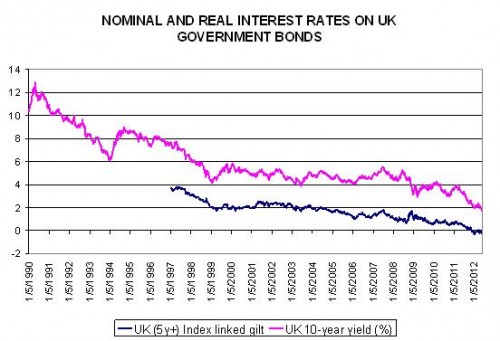

Bond Yields

IMF graph, source: FT