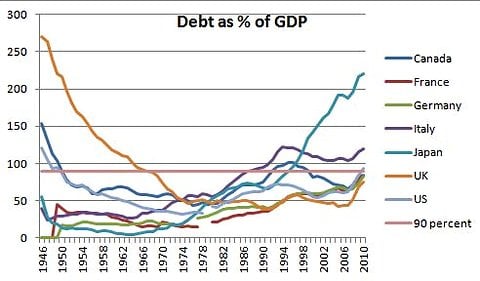

One of the most talked about issues in US politics is the US fiscal cliff.

The fiscal cliff refers to the situation at the end of 2012, where a series of tax increases and spending cuts (worth $600bn) are due to come into force automatically. This amounts to This will reduce the budget deficit, but cause lower growth. The alternative is to reject these planned budget cuts and allow the deficit to continue to grow. This will allow stronger economic growth, but leave the debt issue unchallenged.

A complicating factor for US politics is the debt ceiling. This is the legal amount by how much the government can borrow. The debt ceiling can be raised, but it has to go through the Senate to be voted on. This gives scope for political wrangling and efforts to push for some favoured spending cuts in return for allowing debt ceiling to be raised.

The debt ceiling was raised on January 30, 2012, to a new high of $16.394 trillion.