An economic downturn implies a fall in real GDP. A downturn also includes that period just before a recession – with a fall in the rate of economic growth and a widening output gap.

A downturn will also include a period of negative economic growth and recession.

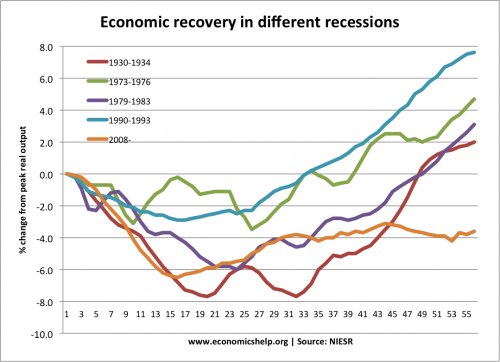

An economic downturn is part of the economic cycle (sometimes referred to as trade cycle or business cycle)

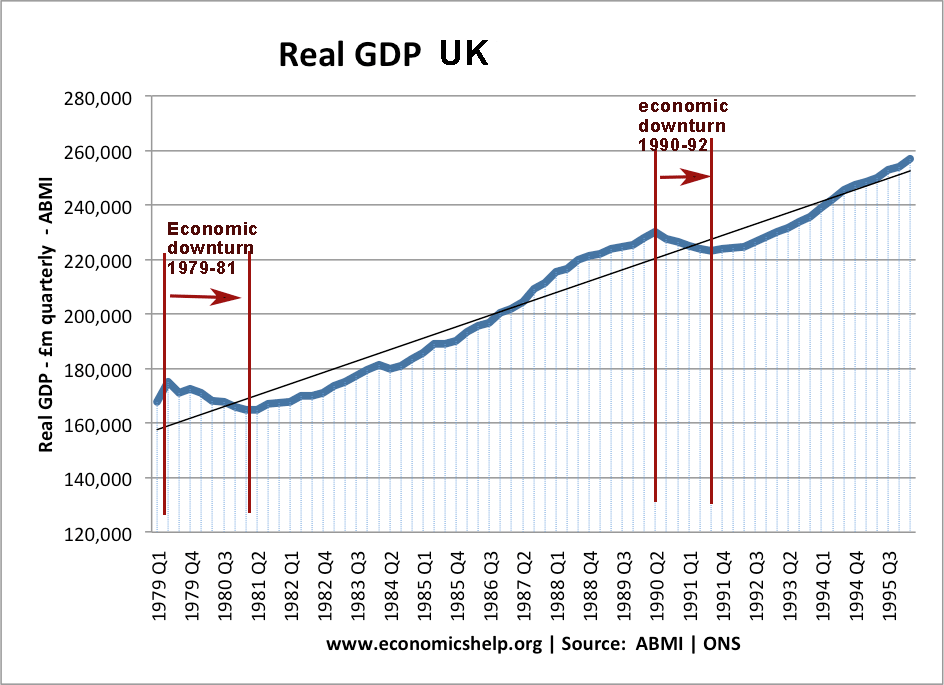

This shows two major economic downturns in the UK 1979-81 and 1990-91

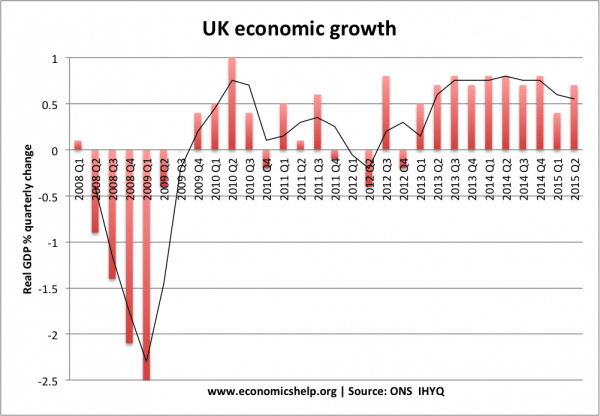

The UK definition of a recession is – negative economic growth for two consecutive quarters.

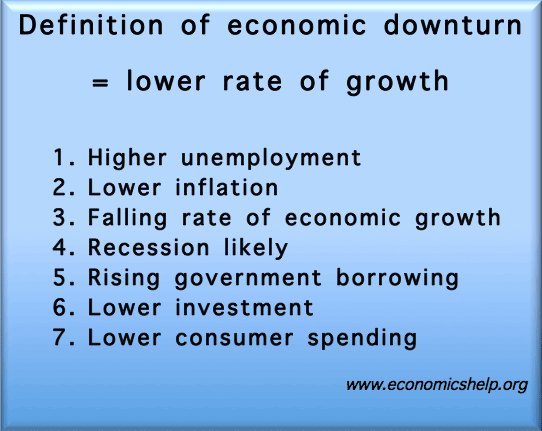

Features of economic downturns

The definition of an economic downturn is less strict than a recession. For example, there may be a consensus we are in an economic downturn even with a small rate of positive economic growth. With very low economic growth, there is likely to be a negative output gap and lower living standards. For example, during 2010 – 2012, the UK economy was stagnating with economic growth of around 0%. In addition, inflation was relatively high, meaning many saw a fall in their real wages. But, this was considered an economic downturn

The key features of an economic downturn include:

- Negative or very low economic growth

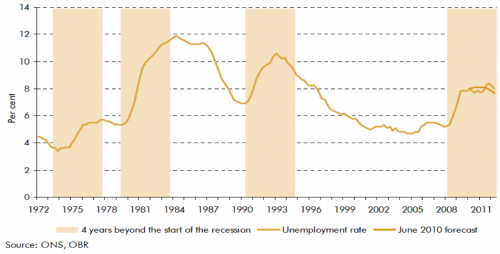

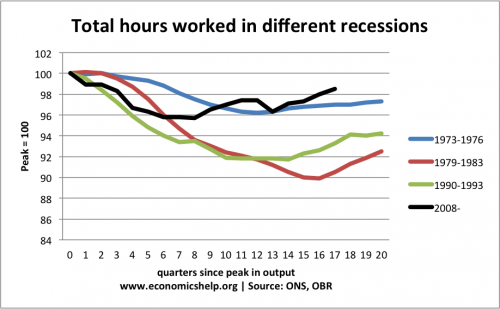

- Rising unemployment

- Falling asset prices – shares and house prices

- Low confidence and falling investment. (the accelerator theory suggests that a fall in the rate of economic growth is enough to lead to lower unemployment)

- Rising spare capacity (negative output gap)

- Increasing government borrowing (due to higher government spending on benefits and lower tax revenue.

Usually, economic downturns are temporary and part of the economic cycle.