A current account deficit means the value of imports of goods/services / investment incomes is greater than the value of exports. It is sometimes referred to as a trade deficit. Though a trade deficit (goods) is only part of the current account.

If there is a current account deficit, it means there is a surplus on the financial/capital account. See: Balance of payments for an explanation of the different components.

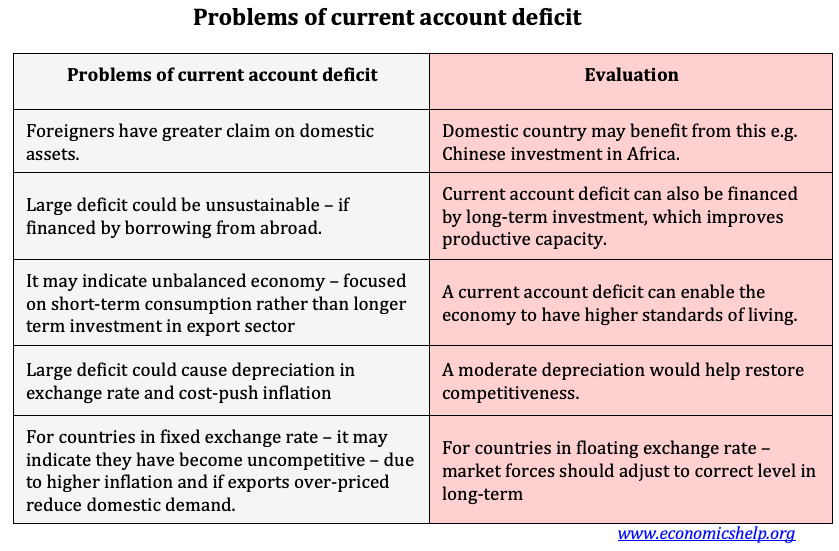

Why a current account can be harmful to the economy

- Unsustainable? If a current account deficit is financed through borrowing it is said to be more unsustainable. This is because borrowing is unsustainable in the long term and countries will be burdened with high-interest payments. E.g. Russia was unable to pay its foreign debt back in 1998. Other developing countries such as Brazil, African countries have experienced similar repayment problems. Countries with large interest payments have little left over to spend on investment.

- Risk of capital flight. A very high balance of payments deficit may, at some point, cause a loss of confidence by foreign investors. Therefore, there is always a risk, that investors will remove their investments causing a big fall in the value of your currency (devaluation). This can lead to a decline in living standards and lower confidence for investment.

- A factor behind the Asian crisis of 1997 was that countries had run up large current account deficits by attracting capital flows (hot money) to finance the deficit. But, when confidence fell, these hot money flows dried up, leading to a rapid devaluation and crisis of confidence. When confidence fell and the exchange rate fell, there was a degree of capital flight as foreign investors sought to return assets.

- Foreign ownership of assets. If you run a current account deficit, it means you need to run a surplus on the financial/capital account. This means foreigners have an increasing claim on your assets, which they could desire to be returned at any time. For example, if you run a current account deficit, it could be financed by foreign multinationals investing in your country or the purchase of assets. There is a risk that your best assets could be bought by foreigners, reducing long-term income.

- An indication of an unbalanced economy. A persistent current account deficit may imply that you are relying on consumer spending, and the economy is becoming unbalanced between different sectors and between short-term consumption and long-term investment.

- For example, the UK has had a high share of GDP focused on consumer spending and relatively low levels of investment – especially in the manufacturing sector. This focus on domestic consumption can have adverse effects in the long-term with less investment in productivity. The UK experience might be contrasted with Germany which has a current account surplus and generally considered to have better levels of investment in the economy.

- An indication of an uncompetitive economy. A current account deficit may imply the economy is becoming uncompetitive and the exchange rate relatively overvalued.

- For countries with floating exchange rate – e.g. Pound Sterling, this is not so serious because market forces will cause a depreciation to restore competitiveness.

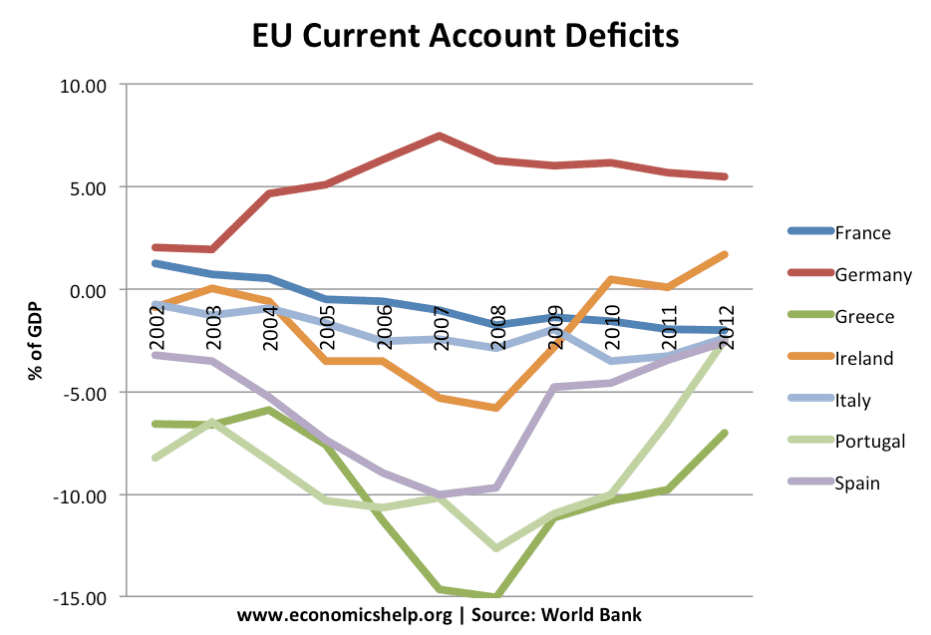

- However, a current account deficit can be a real problem for countries in the Euro – who cannot devalue to restore competitiveness. For example, 2000-2007, a divergence in inflation rates caused very large current account deficits in southern Eurozone economies. This lack of competitiveness and low level of export demand was a factor behind the weak domestic demand 2008-13 of Greece, Portugal, Spain during the Eurozone recession of 2008-13.

- Risk of depreciation. A country running large current account deficit is always at risk of seeing the value of the currency fall. If there is insufficient capital flows to finance the deficit, the exchange rate will fall to reflect the imbalance of foreign flows of funds. A depreciation in the exchange rate will cause imported inflation for consumers and firms who rely on imports of raw materials.

In 2008, some Eurozone economies had very large current account deficits (over 10% of GDP) – especially in Portugal, Greece and Spain – This was a sign of an unbalanced economy and a fundamental lack of competitiveness. This lack of competitiveness and their weak exports – was a factor in the slowdown in domestic demand for these Eurozone economies in the next few years.

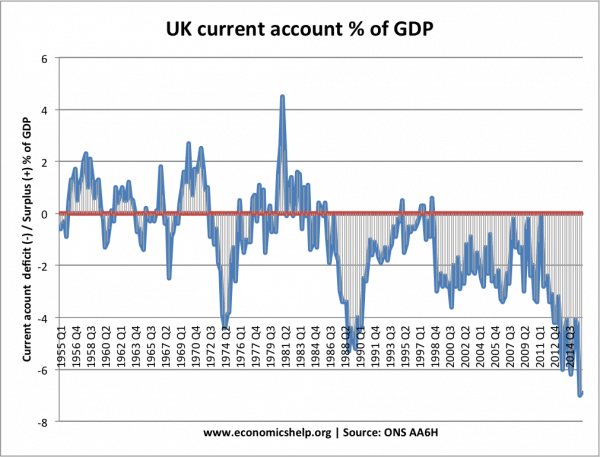

UK current account since 1955

UK current account deficit as a % of GDP since 1955.

- The large current account deficit (5% of GDP) in 1988 was indicative of an unbalanced economy – with economic boom, high inflation and demand greater than supply. This economic boom, led to the recession of 1991/92 where the UK deficit declined.

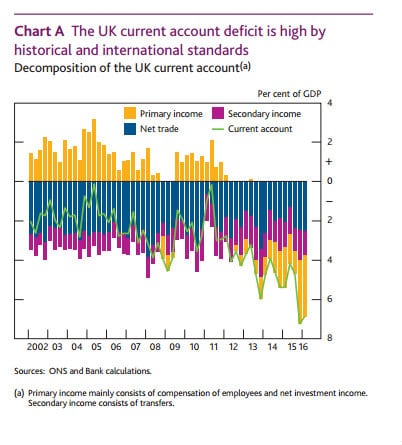

- In 2016, we see the UK current account deficit rise to nearly 7% of GDP – caused by deficit in goods, but also deficit on primary incomes (net investment incomes, wages) and secondary incomes (transfers) The size of this deficit was a factor behind the depreciation in the value of Sterling (exacerbated by Brexit)

A current account deficit is not necessarily harmful

- A current account deficit could occur during a period of inward investment (surplus on financial account). This inward investment can create jobs and investment. E.g. the US ran a current account deficit for a long time as it borrowed to invest in its economy. This enabled higher growth and so it was able to pay its debts back and countries had confidence in lending the US money. Japanese investment has been good for the UK economy – not only did the economy benefit from increased investment but the Japanese firms also helped bring new working practices in which increased labour productivity.

- With a floating exchange rate, a large current account deficit should cause a devaluation which will help automatically reduce the level of the deficit.

- A current account deficit may just indicate a strong economy, which is growing rapidly. For example, the rise in deficit on UK primary incomes (2015-16) is a reflection that investment in the UK was giving a good return to foreign investors.

Further Evaluation

- It depends on the size of the current account deficit as a % of GDP. For example, a deficit of over 5% would be cause for greater concern.

- It depends on how you are financing the current account deficit. If a country is borrowing from abroad to finance consumption, this is damaging in the long-term. If it is financing the current account deficit through attracting long-term capital investment, this could have positive benefits.

- It depends on the country in question. For example, the US probably has less reason to be concerned about a current account deficit. The US can attract a lot of capital flows to buy dollar securities. However, a developing economy may be more vulnerable to a current account deficit. This is because investors may be quicker to fear an economic downturn and remove their capital.

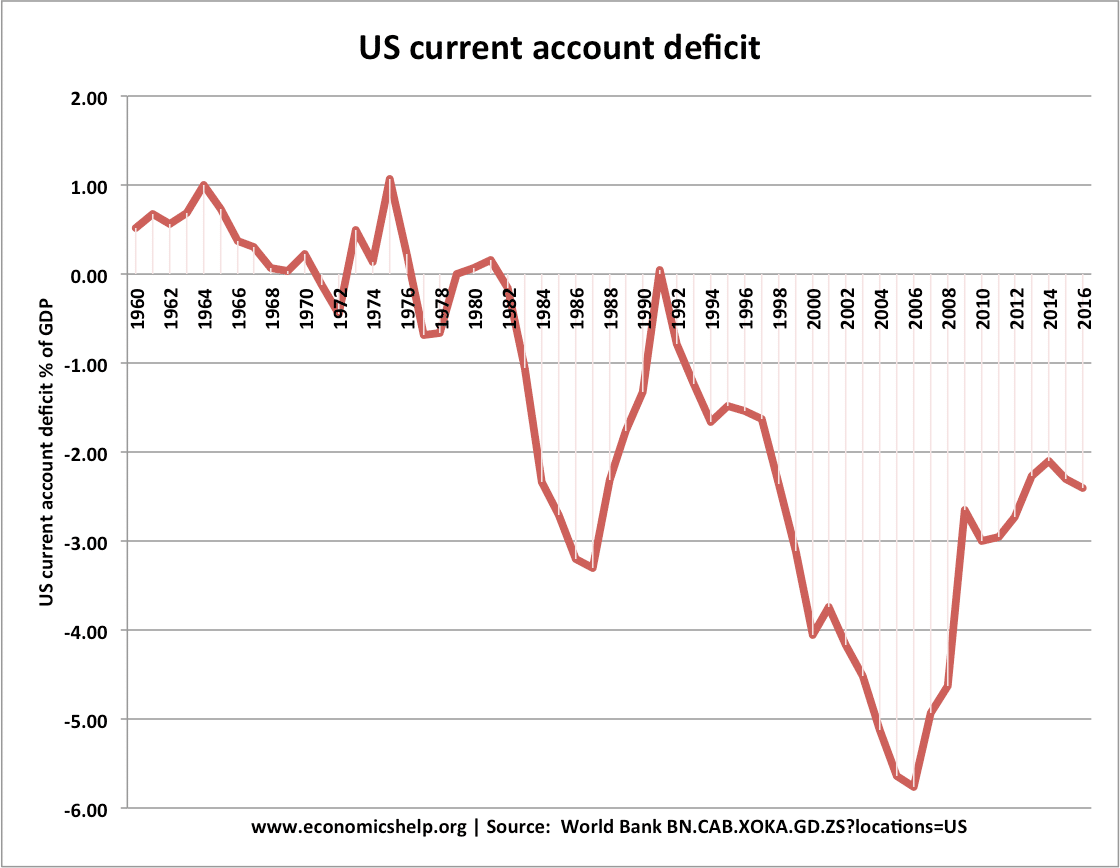

Persistent US current account deficit since 1980.

Current account deficit can reflect demographics. The current account position is driven by imbalance between saving and investment. A country with high percentage of 40-65 year olds, will tend to save more as these workers save for retirment. This tends to cause a current account surplus. If a country has a high percentage of retirees, who are running down their savings – this will tend to reduce the current account surplus. People upto the age of 35 tend to invest more than save, and this can contribute towards current account deficit. Demographics and capital flows.

Related